American Airlines 2001 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2001 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.11

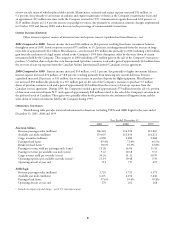

based upon the amount the net book value of the assets exceeds their fair market value. In making these determinations,

the Company utilizes certain assumptions, including, but not limited to: (i) estimated fair market value of the assets, and

(ii) estimated future cash flows expected to be generated by these assets, which are based on additional assumptions such as

asset utilization, length of service the asset will be used in the Company’s operations and estimated salvage values. During

2001, the Company determined its Fokker 100, Saab 340 and ATR 42 aircraft and related rotables were impaired under

SFAS 121 and recorded impairment charges of approximately $1.1 billion. In addition, during the fourth quarter of 2001,

the Company completed an impairment analysis of its long-lived assets, including aircraft fleets, route acquisition costs,

airport operating and gate lease rights, and goodwill. The impairment analysis did not result in any additional impairment

charges. See Notes 1 and 2 to the consolidated financial statements for additional information with respect to each of the

policies and assumptions utilized by the Company which affect the recorded values of long-lived assets.

Passenger revenue – Passenger ticket sales are initially recorded as a component of air traffic liability. Revenue derived from

ticket sales is recognized at the time service is provided. However, due to various factors, including the complex pricing

structure and interline agreements throughout the industry, certain amounts are recognized in revenue using estimates

regarding both the timing of the revenue recognition and the amount of revenue to be recognized. These estimates are

generally based upon the evaluation of historical trends, including the use of regression analysis and other methods to

model the outcome of future events based on the Company’s historical experience. Due to the uncertainties surrounding

the impact of the September 11, 2001 events on the Company’s business (see Note 2 to the consolidated financial

statements) and the acquisition of TWA in April 2001 (see Note 3 to the consolidated financial statements), historical

trends may not be representative of future results.

Frequent flyer accounting – The Company utilizes a number of estimates in accounting for its AAdvantage frequent flyer

program. Additional information regarding the Company’s AAdvantage frequent flyer program is included in Note 1 to

the consolidated financial statements. Changes to the percentage of the amount of revenue deferred, deferred recognition

period, cost per mile estimates or the minimum award level accrued could have a significant impact on the Company’s

revenues or incremental cost accrual in the year of the change as well as in future years. In addition, the Emerging Issues

Task Force of the Financial Accounting Standards Board is currently reviewing the accounting for both multiple-

deliverable revenue arrangements and volume-based sales incentive offers, but has not yet reached a consensus that would

apply to programs such as the AAdvantage program. The issuance of new accounting standards could have a significant

impact on the Company’s frequent flyer liability in the year of the change as well as in future years.

Pensions and other postretirement benefits – The Company’s pension and other postretirement benefit costs and liabilities are

calculated utilizing various actuarial assumptions and methodologies prescribed under Statements of Financial Accounting

Standards No. 87, “Employers’ Accounting for Pensions” and No. 106, “Employers’ Accounting for Postretirement Bene-

fits Other Than Pensions”. The Company utilizes certain assumptions including, but not limited to, the selection of the:

(i) discount rate, (ii) expected return on plan assets, and (iii) expected health care cost trend rate. The discount rate

assumption is based upon the review of high quality corporate bond rates and the change in these rates during the year.

The expected return on plan assets and health care cost trend rate are based upon an evaluation of the Company’s historical

trends and experience taking into account current and expected market conditions. In addition, the Company’s future

pension and other postretirement benefit costs and liabilities will be impacted by the acquisition of TWA and the new

labor agreements entered into during 2001. See Note 11 to the consolidated financial statements for additional

information regarding the Company’s pension and other postretirement benefits.

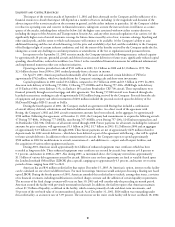

New Accounting Pronouncements In July 2001, the Financial Accounting Standards Board issued Statements of Finan-

cial Accounting Standards No. 141, “Business Combinations” (SFAS 141) and No. 142, “Goodwill and Other Intangible

Assets” (SFAS 142). SFAS 141 prohibits the use of the pooling-of-interests method for business combinations initiated after

June 30, 2001 and includes criteria for the recognition of intangible assets separately from goodwill. SFAS 142 includes the

requirement to test goodwill and indefinite lived intangible assets for impairment rather than amortize them. The Company

will adopt SFAS 142 in the first quarter of 2002, and currently estimates the impact to the Company’s results of operations of

discontinuing the amortization of goodwill and route authorities to be approximately $66 million on an annualized basis. The

Company is currently evaluating what additional impact these new accounting standards may have on the Company’s financial

position or results of operations. However, with the decline in the Company’s market capitalization, in part due to the terrorist

attacks on September 11, 2001, the adoption of SFAS 142 may result in the impairment of the Company’s goodwill.