American Airlines 2001 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2001 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

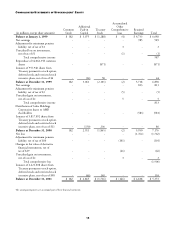

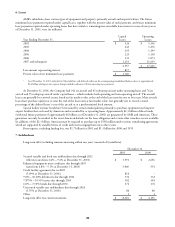

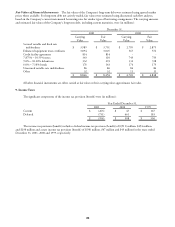

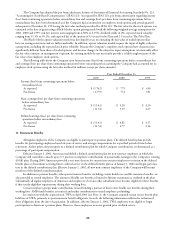

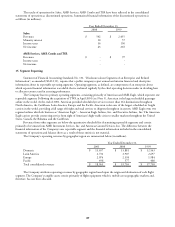

Fair Values of Financial Instruments The fair values of the Company’s long-term debt were estimated using quoted market

prices where available. For long-term debt not actively traded, fair values were estimated using discounted cash flow analyses,

based on the Company’s current incremental borrowing rates for similar types of borrowing arrangements. The carrying amounts

and estimated fair values of the Company’s long-term debt, including current maturities, were (in millions):

December 31,

2001 2000

Carrying

Value

Fair

Value

Carrying

Value

Fair

Value

Secured variable and fixed rate

indebtedness $ 3,989 $ 3,751 $ 2,799 $ 2,879

Enhanced equipment trust certificates 3,094 3,025 567 576

Credit facility agreement 814 814 - -

7.875% – 10.55% notes 343 310 749 759

9.0% – 10.20% debentures 332 293 332 358

6.0% – 7.10% bonds 176 143 176 179

Unsecured variable rate indebtedness 86 86 86 86

Other 32 32 11 11

$ 8,866 $ 8,454 $ 4,720 $ 4,848

All other financial instruments are either carried at fair value or their carrying value approximates fair value.

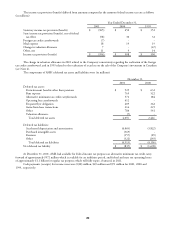

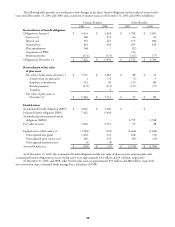

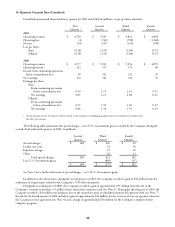

9. Income Taxes

The significant components of the income tax provision (benefit) were (in millions):

Year Ended December 31,

2001 2000 1999

Current $ (263) $ 47 $ 167

Deferred (731) 461 183

$ (994) $ 508 $ 350

The income tax provision (benefit) includes a federal income tax provision (benefit) of $(911) million, $454 million

and $290 million and a state income tax provision (benefit) of $(90) million, $47 million and $49 million for the years ended

December 31, 2001, 2000 and 1999, respectively.