American Airlines 2001 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2001 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26

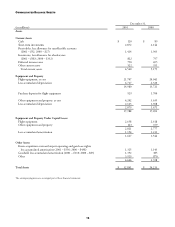

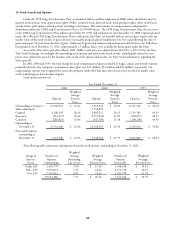

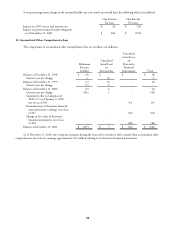

Maturities of long-term debt (including sinking fund requirements) for the next five years are: 2002 – $556 million;

2003 – $296 million; 2004 – $359 million; 2005 – $1.2 billion; 2006 – $886 million.

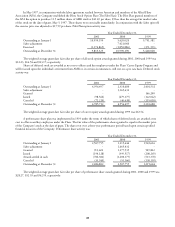

During 2001, American issued approximately $2.6 billion of enhanced equipment trust certificates and entered into

approximately $1.1 billion of various debt agreements. These financings are secured by aircraft. Effective rates on these financings

are fixed or variable (based upon the London Interbank Offered Rate [LIBOR] plus a spread).

In April 2001, the Board of Directors of American approved the guarantee by American of AMR’s existing debt

obligations. As of December 31, 2001, this guarantee covered approximately $676 million of unsecured debt and approximately

$573 million of secured debt. (American is a Securities and Exchange Commission registrant and has filed consolidated financial

statements included in its Form 10-K for the year ended December 31, 2001.)

During the third quarter of 2000, the Company repurchased prior to scheduled maturity approximately $167 million in

face value of long-term debt. Cash from operations provided the funding for the repurchases. These transactions resulted in an

extraordinary loss of $14 million.

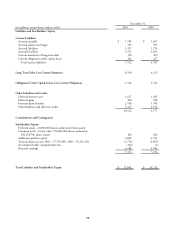

American has an $834 million credit facility that expires December 15, 2005. At American’s option, interest on this facility

can be calculated on one of several different bases. For most borrowings, American would anticipate choosing a floating rate based

upon LIBOR. During the fourth quarter of 2001, American amended this credit facility to include, among other items, a revision

of its financial covenants, including modifications to its fixed charge covenant and the addition of certain liquidity requirements.

The next test of the fixed charge covenant will occur on June 30, 2003 and will consider only the preceding six-month period.

American secured the facility with previously unencumbered aircraft. In addition, the facility requires that American maintain

at least $1.5 billion of liquidity, as defined in the facility, which consists primarily of cash and short-term investments, and

50 percent of the net book value of its unencumbered aircraft. The interest rate on the entire credit facility will be reset on

March 18, 2002.

In addition, American has available a $1 billion credit facility that expires September 30, 2002. Interest on this facility

is based upon LIBOR plus a spread. This facility is immediately available subject to the Company providing specified aircraft

collateral as security at the time of borrowing. At December 31, 2001, no borrowings were outstanding under this facility.

Certain debt is secured by aircraft, engines, equipment and other assets having a net book value of approximately

$8.5 billion. In addition, certain of American’s debt and letter of credit agreements contain restrictive covenants, including a

minimum net worth requirement, which could limit American’s ability to pay dividends. At December 31, 2001, under the most

restrictive provisions of those debt and credit facility agreements, approximately $400 million of the retained earnings of American

was available for payment of dividends to AMR.

Cash payments for interest, net of capitalized interest, were $343 million, $301 million and $237 million for 2001, 2000

and 1999, respectively.

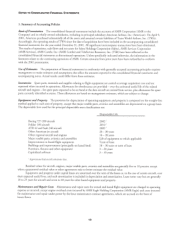

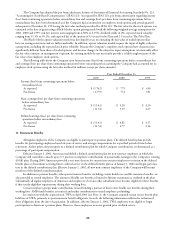

8. Financial Instruments and Risk Management

As part of the Company’s risk management program, AMR uses a variety of financial instruments, including fuel swap

and option contracts, interest rate swaps, and currency option contracts and exchange agreements. The Company does not hold

or issue derivative financial instruments for trading purposes.

The Company is exposed to credit losses in the event of non-performance by counterparties to these financial instruments,

but it does not expect any of the counterparties to fail to meet its obligations. The credit exposure related to these financial

instruments is represented by the fair value of contracts with a positive fair value at the reporting date, reduced by the effects of

master netting agreements. To manage credit risks, the Company selects counterparties based on credit ratings, limits its exposure

to a single counterparty under defined guidelines, and monitors the market position of the program and its relative market

position with each counterparty. The Company also maintains industry-standard security agreements with the majority of its

counterparties which may require the Company or the counterparty to post collateral if the value of these instruments falls below

certain mark-to-market thresholds. The Company’s outstanding collateral as of December 31, 2001 was not material.

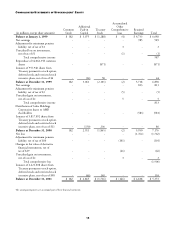

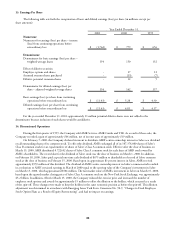

Effective January 1, 2001, the Company adopted Statement of Financial Accounting Standards No. 133, “Accounting

for Derivative Instruments and Hedging Activities”, as amended (SFAS 133). SFAS 133 requires the Company to recognize all

derivatives on the balance sheet at fair value. Derivatives that are not hedges must be adjusted to fair value through income. If the

derivative is a hedge, depending on the nature of the hedge, changes in the fair value of derivatives will either be offset against the

change in fair value of the hedged assets, liabilities or firm commitments through earnings or recognized in other comprehensive

income until the hedged item is recognized in earnings. The ineffective portion of a derivative’s change in fair value will be

immediately recognized in earnings. The adoption of SFAS 133 did not result in a cumulative effect adjustment being recorded to

net income for the change in accounting. However, the Company recorded a transition adjustment of approximately $64 million

in Accumulated other comprehensive loss in the first quarter of 2001. The amounts included in the following discussion are not

comparable in that the 2001 amounts reflect the January 1, 2001 adoption of SFAS 133 whereas the 2000 amounts do not.