American Airlines 2001 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2001 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

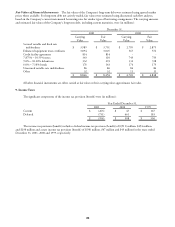

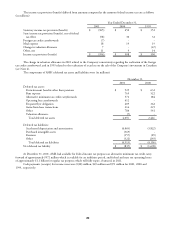

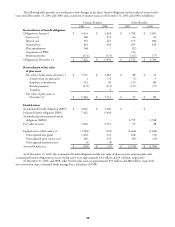

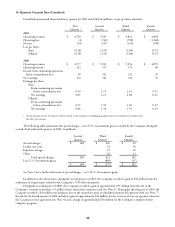

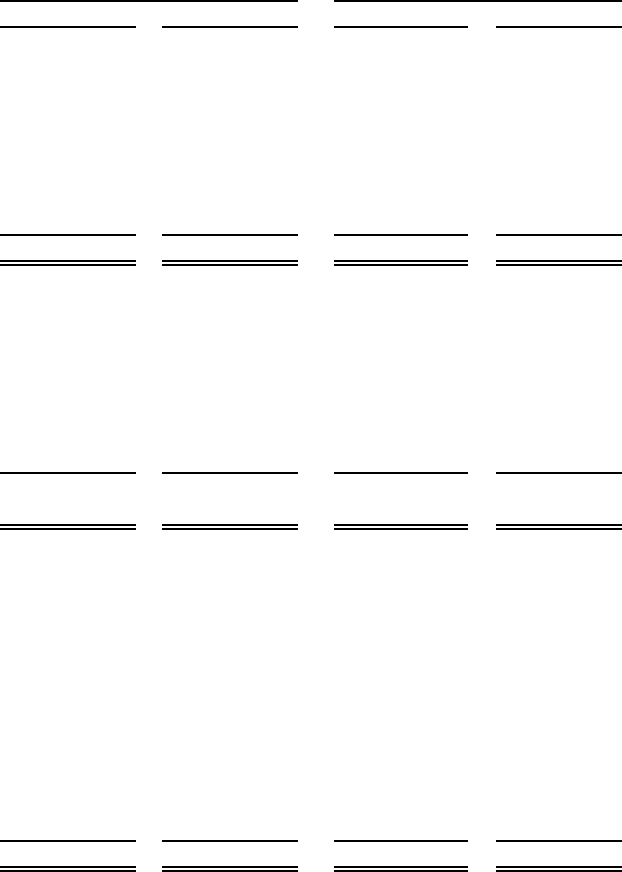

The following table provides a reconciliation of the changes in the plans’ benefit obligations and fair value of assets for the

years ended December 31, 2001 and 2000, and a statement of funded status as of December 31, 2001 and 2000 (in millions):

Pension Benefits Other Benefits

2001 2000 2001 2000

Reconciliation of benefit obligation

Obligation at January 1 $ 6,434 $ 5,628 $ 1,708 $ 1,306

Service cost 260 213 66 43

Interest cost 515 467 175 108

Actuarial loss 416 499 205 328

Plan amendments 168 - (12) -

Acquisition of TWA - - 734 -

Benefit payments (371) (373) (117) (77)

Obligation at December 31 $ 7,422 $ 6,434 $ 2,759 $ 1,708

Reconciliation of fair value

of plan assets

Fair value of plan assets at January 1 $ 5,731 $ 5,282 $ 88 $ 72

Actual return on plan assets 1 735 (5) 5

Employer contributions 121 85 129 88

Benefit payments (371) (373) (117) (77)

Transfers - 2 - -

Fair value of plan assets at

December 31 $ 5,482 $ 5,731 $ 95 $ 88

Funded status

Accumulated benefit obligation (ABO) $ 6,041 $ 5,306 $ - $ -

Projected benefit obligation (PBO) 7,422 6,434 - -

Accumulated postretirement benefit

obligation (APBO) - - 2,759 1,708

Fair value of assets 5,482 5,731 95 88

Funded status at December 31 (1,940) (703) (2,664) (1,620)

Unrecognized loss (gain) 1,454 523 168 (51)

Unrecognized prior service cost 286 129 (42) (35)

Unrecognized transition asset (5) (6) - -

Accrued benefit cost $ (205) $ (57) $ (2,538) $ (1,706)

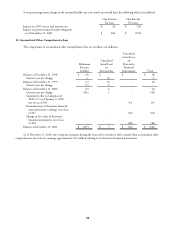

As of December 31, 2001, the accumulated benefit obligation and the fair value of plan assets for pension plans with

accumulated benefit obligations in excess of plan assets were approximately $4.2 billion and $3.6 billion, respectively.

At December 31, 2001 and 2000, other benefits plan assets of approximately $93 million and $88 million, respectively,

were invested in shares of mutual funds managed by a subsidiary of AMR.