American Airlines 2001 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2001 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

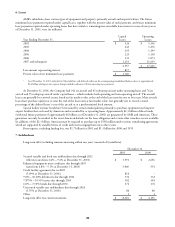

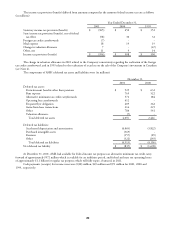

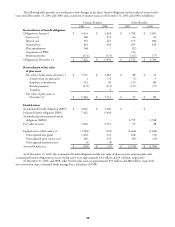

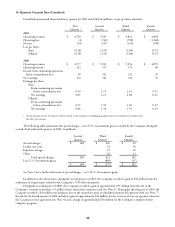

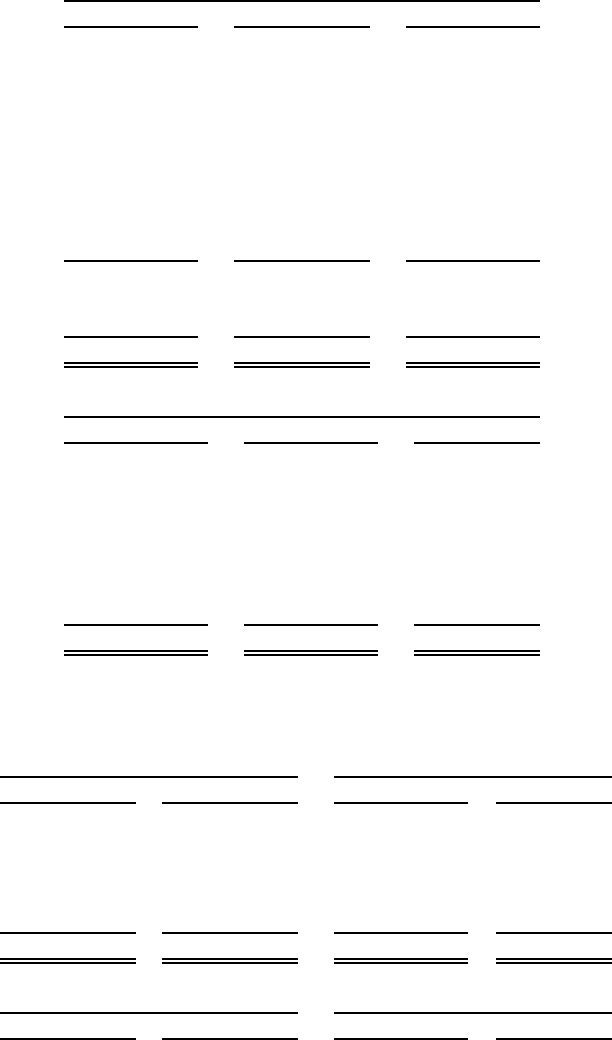

The following tables provide the components of net periodic benefit cost for the years ended December 31, 2001, 2000

and 1999 (in millions):

Pension Benefits

2001 2000 1999

Components of net periodic benefit cost

Defined benefit plans:

Service cost $ 260 $ 213 $ 236

Interest cost 515 467 433

Expected return on assets (539) (490) (514)

Amortization of:

Transition asset (1) (1) (4)

Prior service cost 11 10 5

Unrecognized net loss 22 17 21

Net periodic benefit cost for

defined benefit plans 268 216 177

Defined contribution plans 244 174 155

Total $ 512 $ 390 $ 332

Other Benefits

2001 2000 1999

Components of net periodic benefit cost

Service cost $ 66 $ 43 $ 56

Interest cost 175 108 108

Expected return on assets (9) (7) (6)

Amortization of:

Prior service cost (5) (5) (5)

Unrecognized net gain - (14) -

Net periodic benefit cost $ 227 $ 125 $ 153

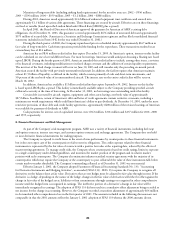

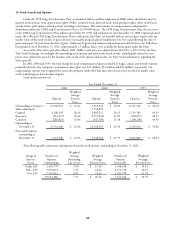

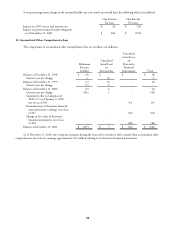

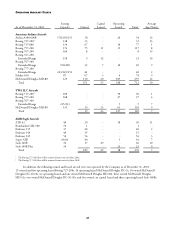

The following table provides the amounts recognized in the consolidated balance sheets as of December 31, 2001 and 2000

(in millions):

Pension Benefits Other Benefits

2001 2000 2001 2000

Prepaid benefit cost $ 123 $ 107 $ - $ -

Accrued benefit liability (328) (225) (2,538) (1,706)

Additional minimum liability (335) (21) - -

Intangible asset 163 72 - -

Accumulated other comprehensive income 172 10 - -

Net amount recognized $ (205) $ (57) $ (2,538) $ (1,706)

Pension Benefits Other Benefits

2001 2000 2001 2000

Weighted-average assumptions as of

December 31

Discount rate 7.50% 7.75% 7.50% 7.75%

Salary scale 4.26 4.26 - -

Expected return on plan assets 9.50 9.50 9.50 9.50

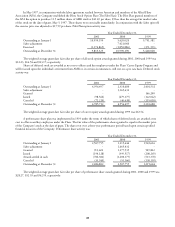

The assumed health care cost trend rate was six percent in 2001, decreasing gradually to an ultimate rate of 4.5 percent by

2004. The previously assumed health care cost trend rate was seven percent in 2000, decreasing gradually to an ultimate rate of

four percent by 2004.