Advance Auto Parts 2010 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2010 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

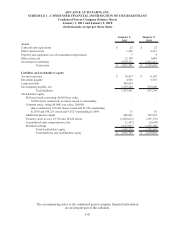

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 1, 2011, January 2, 2010 and January 3, 2009

(in thousands, except per share data)

.

F-35

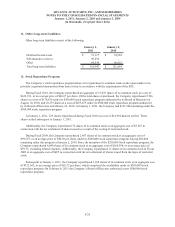

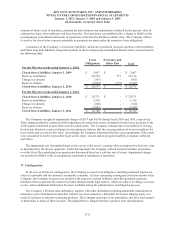

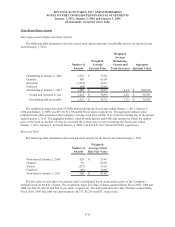

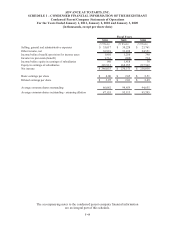

Share-Based Compensation Expense & Cash Flows

The expense the Company has incurred annually related to the issuance of share-based compensation is

included in SG&A. The Company receives cash upon the exercise of stock options, as well as when employees

purchase stock under the employee stock purchase plan, or ESPP. Total share-based compensation expense and cash

received included in the Company’s consolidated statements of operations and consolidated statement of cash flows,

respectively, are reflected in the table below, including the related income tax benefits, for fiscal years ended

January 1, 2011, January 2, 2010 and January 3, 2009 as follows:

2010 2009 2008

Share-based compensation expense 22,311$ 19,682$ 17,707$

Deferred income tax benefit 8,456 7,361 6,640

Cash received upon exercise and from ESPP 36,113 35,402 35,220

Excess tax benefit share-based compensation 7,260 3,219 9,047

As of January 1, 2011, there was $29,521 of unrecognized compensation expense related to all share-based

awards that is expected to be recognized over a weighted average period of 1.2 years.

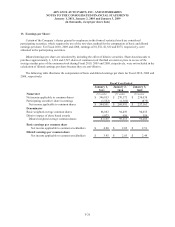

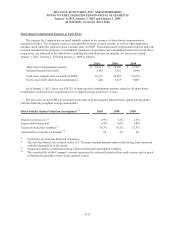

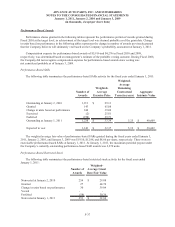

The fair value of each SAR was estimated on the date of grant using the Black-Scholes option-pricing model

with the following weighted average assumptions:

Black-Scholes Option Valuation Assumptions

(1)

2010 2009 2008

Risk-free interest rate

(2)

0.9% 1.6% 2.5%

Expected dividend yield 0.4% 0.6% 0.8%

Expected stock price volatility

(3)

36.3% 39.2% 32.3%

Expected life of awards (in months)

(4)

50 50 50

(1) Forfeitures are based on historical experience.

(2) The risk-free interest rate is based on the U.S. Treasury constant maturity interest rate having term consistent

with the expected life of the award.

(3) Expected volatility is determined using a blend of historical and implied volatility.

(4) The expected life of the Company’s awards represents the estimated period of time until exercise and is based

on historical experience of previously granted awards.