Advance Auto Parts 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

Other

As of January 1, 2011, we had $3.0 million outstanding under an economic development note and other

financing arrangements.

As of January 1, 2011, we had a credit rating from Standard & Poor’s of BBB- and from Moody’s Investor

Service of Baa3. The current outlooks by Standard & Poor’s and Moody’s are both stable. The current pricing grid

used to determine our borrowing rate under our revolving credit facility is based on our credit ratings. If these credit

ratings decline, our interest rate on outstanding balances may increase. Conversely, if these credit ratings improve,

our interest rate may decrease. In addition, if our credit ratings decline, our access to financing may become more

limited.

Off-Balance-Sheet Arrangements

As of January 1, 2011, we had no off-balance-sheet arrangements as defined in Regulation S-K Item 303 of the

SEC regulations. We include other off-balance-sheet arrangements in our contractual obligations table including

operating lease payments, interest payments on our credit facility and letters of credit outstanding.

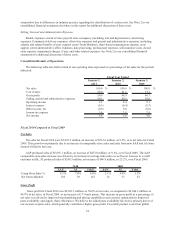

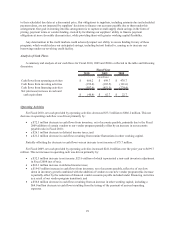

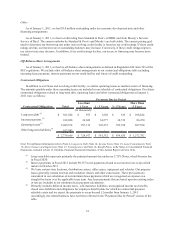

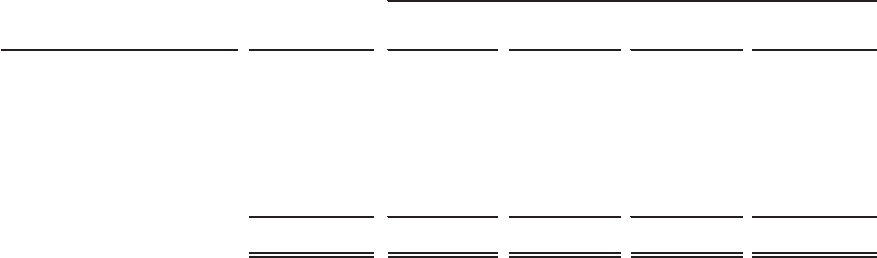

Contractual Obligations

In addition to our Notes and revolving credit facility, we utilize operating leases as another source of financing.

The amounts payable under these operating leases are included in our schedule of contractual obligations. Our future

contractual obligations related to long-term debt, operating leases and other contractual obligations at January 1,

2011 were as follows:

Less than More Than

Contractual Obligations Total 1 Year 1 - 3 Years 3 - 5 Years 5 Years

Long-term debt

(1)

301,824$ 973$ 1,502$ 525$ 298,824$

Interest payments

(2)

182,028 26,689 34,577 34,512 86,250

Operating leases

(3)

2,089,874 297,315 505,253 399,598 887,708

Other long-term liabilities

(4)

165,943 - - - -

2,739,669$ 324,977$ 541,332$ 434,635$ 1,272,782$

(in thousands)

Payments Due by Period

Note: For additional information refer to Note 6, Long-term Debt; Note 14, Income Taxes; Note 15, Lease Commitments; Note

16, Store Closures and Impairment; Note 17, Contingencies; and Note 18, Benefit Plans, in the Notes to Consolidated Financial

Statements, included in Item 15, Exhibits, Financial Statement Schedules, of this Annual Report on Form 10-K.

(1) Long-term debt represents primarily the principal amount due under our 5.75% Notes, which become due

in Fiscal 2020.

(2) Interest payments in Fiscal 2011 include $9,357 in net payments related to our interest rate swaps which

mature in October 2011.

(3) We lease certain store locations, distribution centers, office space, equipment and vehicles. Our property

leases generally contain renewal and escalation clauses and other concessions. These provisions are

considered in our calculation of our minimum lease payments which are recognized as expense on a

straight-line basis over the applicable lease term. Any lease payments that are based upon an existing index

or rate are included in our minimum lease payment calculations.

(4) Primarily includes deferred income taxes, self-insurance liabilities, unrecognized income tax benefits,

closed store liabilities and obligations for employee benefit plans for which no contractual payment

schedule exists and we expect the payments to occur beyond 12 months from January 1, 2011.

Accordingly, the related balances have not been reflected in the "Payments Due by Period" section of the

table.