Advance Auto Parts 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

sales. We believe that our focus on differentiating through our strategies of Service Leadership and Superior

Availability will allow us to continue to increase our share of the total automotive aftermarket with a higher growth

potential driven by the more fragmented Commercial market.

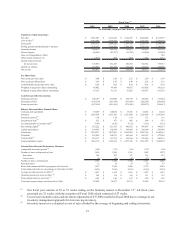

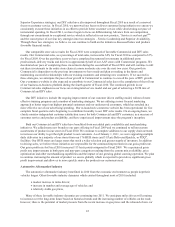

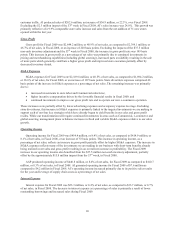

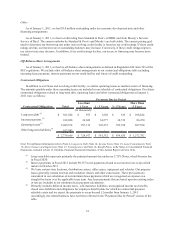

Store Development by Segment

The following table sets forth the total number of new, closed and relocated stores and stores with Commercial

delivery programs during Fiscal 2010, 2009 and 2008. We lease approximately 80% of our stores.

2010 2009 2008

Number of stores at beginning of year 3,264 3,243 3,153

New stores 110 75 109

Closed stores (5) (54) (19)

Number of stores, end of period 3,369 3,264 3,243

Relocated stores 9 6 10

Stores with commercial delivery programs 3,018 2,868 2,755

2010 2009 2008

Number of stores at beginning of year 156 125 108

New stores 38 32 18

Closed stores - (1) (1)

Number of stores, end of period 194 156 125

Relocated stores 3 4 -

Stores with commercial delivery programs 194 156 125

AAP

Fiscal Year

AI

Fiscal Year

During Fiscal 2011, we anticipate adding 110 to 120 AAP and 10 to 20 AI stores and closing approximately 10

total stores.

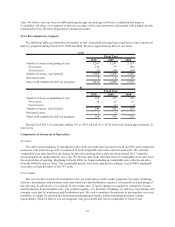

Components of Statement of Operations

Net Sales

Net sales consist primarily of merchandise sales from our retail store locations to both our DIY and Commercial

customers. Our total sales growth is comprised of both comparable store sales and new store sales. We calculate

comparable store sales based on the change in store sales starting once a store has been opened for 13 complete

accounting periods (approximately one year). We include sales from relocated stores in comparable store sales from

the original date of opening. Beginning in Fiscal 2008, we began including in comparable store sales the net sales

from the Offshore and AI stores. The comparable periods have been adjusted accordingly. Fiscal 2008 comparable

store sales exclude the effect of the 53rd week.

Cost of Sales

Our cost of sales consists of merchandise costs, net of incentives under vendor programs; inventory shrinkage,

defective merchandise and warranty costs; and warehouse and distribution expenses. Gross profit as a percentage of

net sales may be affected by (i) variations in our product mix, (ii) price changes in response to competitive factors

and fluctuations in merchandise costs, (iii) vendor programs, (iv) inventory shrinkage, (v) defective merchandise and

warranty costs and (v) warehouse and distribution costs. We seek to minimize fluctuations in merchandise costs and

instability of supply by entering into long-term purchasing agreements, without minimum purchase volume

requirements, when we believe it is advantageous. Our gross profit may not be comparable to those of our