Advance Auto Parts 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 1, 2011, January 2, 2010 and January 3, 2009

(in thousands, except per share data)

.

F-30

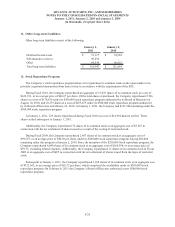

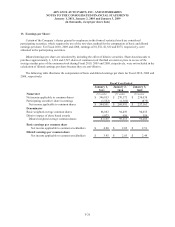

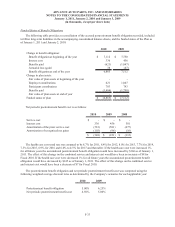

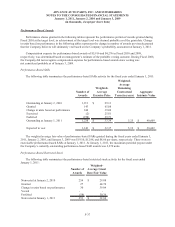

15. Lease Commitments:

At January 1, 2011, future minimum lease payments due under non-cancelable operating leases with lease terms

ranging from 1 year to 30 years through the year 2039 for all open stores are as follows:

Fiscal Year Amount

2011 297,315$

2012 265,680

2013 239,573

2014 210,722

2015 188,876

Thereafter 887,708

2,089,874$

The Company anticipates its future minimum lease payments will be partially off-set by future minimum sub-

lease income. At January 1, 2011 and January 2, 2010, future minimum sub-lease income to be received under non-

cancelable operating leases is $8,589 and $4,266, respectively.

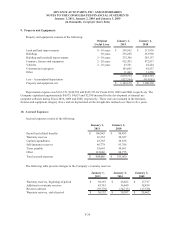

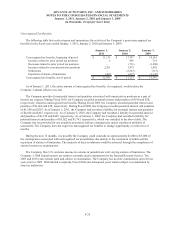

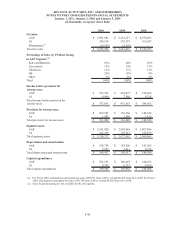

Net Rent Expense

Net rent expense for Fiscal 2010, 2009 and 2008 was as follows:

2010 2009 2008

Minimum facility rentals 279,099$ 272,686$ 261,315$

Contingent facility rentals 1,115 729 642

Equipment rentals 5,372 4,738 4,338

Vehicle rentals 19,903 21,403 17,202

305,489 299,556 283,497

Less: Sub-lease income (3,813) (3,652) (3,940)

301,676$ 295,904$ 279,557$

Rent expense associated with closed locations is included in SG&A.

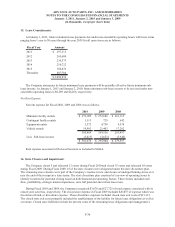

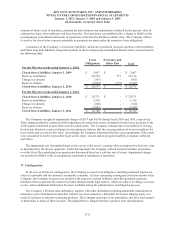

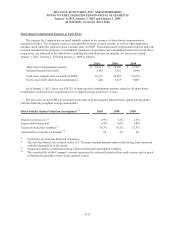

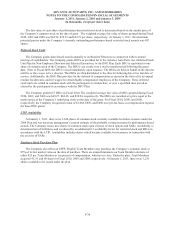

16. Store Closures and Impairment:

The Company closed 5 and relocated 12 stores during Fiscal 2010 and closed 55 stores and relocated 10 stores

during Fiscal 2009. During Fiscal 2009, 45 of the store closures were designated under the store divestiture plan.

The remaining store closures were part of the Company’s routine review and closure of underperforming stores at or

near the end of their respective lease terms. The store divestiture plan consisted of a review of operating stores to

identify locations for potential closing based on both financial and operating factors. These factors included cash

flow, profitability, strategic market importance, store full potential and current lease rates.

During Fiscal 2010 and 2009, the Company recognized $3,678 and $27,725 of total expense associated with its

closed store activities, respectively. The closed store expense in Fiscal 2009 included $26,057 of expense which was

divestiture related, or divestiture expense. These divestiture expenses included closed store exit costs of $21,121.

The closed store exit costs primarily included the establishment of the liability for future lease obligations as well as

severance. Closed store liabilities include the present value of the remaining lease obligations and management’s