Advance Auto Parts 2010 Annual Report Download - page 63

Download and view the complete annual report

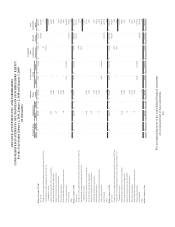

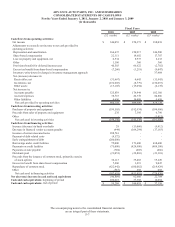

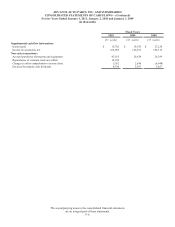

Please find page 63 of the 2010 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

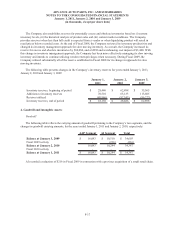

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 1, 2011, January 2, 2010 and January 3, 2009

(in thousands, except per share data)

.

F-9

1. Organization and Description of Business:

Advance Auto Parts, Inc. (“Advance”) conducts all of its operations through its wholly owned subsidiary,

Advance Stores Company, Incorporated (“Stores”) and its subsidiaries (collectively, the “Company”). The

Company operates 3,563 stores within the United States, Puerto Rico and the Virgin Islands. The Company operates

3,343 stores throughout 39 states in the Northeastern, Southeastern and Midwestern regions of the United States

under the “Advance Auto Parts” trade name except for certain stores in the State of Florida which operate under the

“Advance Discount Auto Parts” trade name. These stores offer a broad selection of brand name and proprietary

automotive replacement parts, accessories and maintenance items for domestic and imported cars and light trucks to

do-it-yourself, or DIY, and do-it-for-me, or Commercial, customers. The Company’s Commercial customers consist

primarily of delivery customers as well as walk-in customers. For Commercial sales to delivery customers, the

Company utilizes a fleet of vehicles to deliver product from its 3,018 store locations with delivery service to

Commercial customers’ places of business, including independent garages, service stations and auto dealers. In

addition, the Company operates 26 stores located in Puerto Rico and the Virgin Islands under the “Advance Auto

Parts” and “Western Auto” trade names. Autopart International (“AI”) is a subsidiary of Stores and operates 194

stores under the “Autopart International” trade name located throughout the Northeastern and Mid-Atlantic regions

of the United States and Florida.

2. Summary of Significant Accounting Policies:

Accounting Period

The Company's fiscal year ends on the Saturday nearest the end of December, which results in an extra week

every several years. Accordingly, our fiscal year ended January 3, 2009, or Fiscal 2008, included 53 weeks of

operations. All other fiscal years presented included 52 weeks of operations.

Principles of Consolidation

The consolidated financial statements include the accounts of Advance and its wholly owned subsidiaries. All

intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and

liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the

reporting period. Actual results could differ materially from those estimates.

Cash, Cash Equivalents and Bank Overdrafts

Cash and cash equivalents consist of cash in banks and money market funds with original maturities of three

months or less. Included in cash equivalents are credit card and debit card receivables from banks, which generally

settle within two to four business days. Credit and debit card receivables included in Cash and cash equivalents at

January 1, 2011 and January 2, 2010 were $21,149 and $24,308, respectively. Bank overdrafts consist of

outstanding checks not yet presented to a bank for settlement, net of cash held in accounts with right of offset. Bank

overdrafts of $9,556 and $9,528 are included in Other current liabilities at January 1, 2011 and January 2, 2010,

respectively.

Receivables

Receivables, net consist primarily of accounts receivables from vendors and commercial customers. Vendor

receivables are recorded based on amounts owed by the Company’s suppliers as provided in incentive agreements

and other overall terms of the Company’s purchase agreements. The Company provides an allowance for doubtful