Advance Auto Parts 2010 Annual Report Download - page 101

Download and view the complete annual report

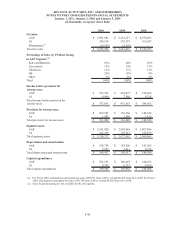

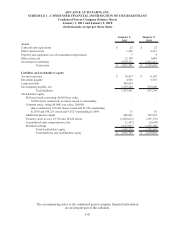

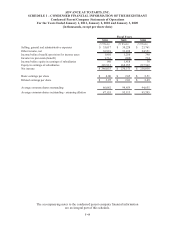

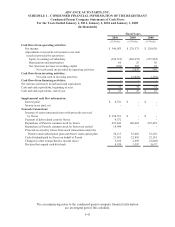

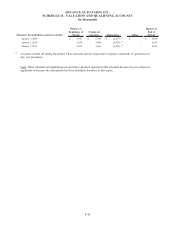

Please find page 101 of the 2010 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC.

SCHEDULE I – CONDENSED FINANCIAL INFORMATION OF THE REGISTRANT

Notes to the Condensed Parent Company Statements

January 1, 2011 and January 2, 2010

(in thousands, except per share data)

See Notes to the Consolidated Financial Statements for Additional Disclosures.

F-47

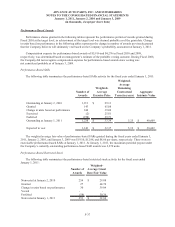

Earnings per Share

The Company uses the two-class method to calculate earnings per share. Under the two-class method, unvested

share-based payment awards that contain non-forfeitable rights to dividends or dividend equivalents (whether paid

or unpaid) are considered participating securities and are included in the computation of earnings per share. Certain

of the Company’s shares granted to employees in the form of restricted stock are considered participating securities.

Accordingly, earnings per share is computed by dividing net income attributable to the Company’s common

shareholders by the weighted-average common shares outstanding during the period. The two-class method is an

earnings allocation formula that determines income per share for each class of common stock and participating

security according to dividends declared and participation rights in undistributed earnings. Diluted income per

common share reflects the more dilutive earnings per share amount calculated using the treasury stock method or the

two-class method.

Basic earnings per share of common stock has been computed based on the weighted-average number of

common shares outstanding during the period, which is reduced by stock held in treasury and shares of nonvested

restricted stock. Diluted earnings per share of common stock reflects the weighted-average number of shares of

common stock outstanding, outstanding deferred stock units and the impact of outstanding stock options, and stock

appreciation rights (collectively “share-based awards”). Share-based awards containing performance conditions are

included in the dilution impact as those conditions are met. Diluted earnings per share are calculated by including

the effect of dilutive securities.

New Accounting Pronouncements

In January 2010, the Financial Accounting Standards Board, or FASB, issued ASU No. 2010-06 “Fair Value

Measurements and Disclosures – Improving Disclosures about Fair Value Measurements”. ASU 2010-06 requires

new disclosures for significant transfers in and out of Level 1 and 2 of the fair value hierarchy and the activity

within Level 3 of the fair value hierarchy. The updated guidance also clarifies existing disclosures regarding the

level of disaggregation of assets or liabilities and the valuation techniques and inputs used to measure fair value. The

updated guidance is effective for interim and annual reporting periods beginning after December 15, 2009, with the

exception of the new Level 3 activity disclosures, which are effective for interim and annual reporting periods

beginning after December 15, 2010. The adoption of the new Level 1 and 2 guidance had no impact on the

Company’s condensed consolidated financial statements. The adoption of the new Level 3 guidance is not expected

to have a material impact on the Company’s condensed consolidated financial statements.

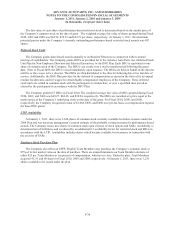

3. Long-Term Debt

Senior Unsecured Notes

On April 29, 2010, the Company sold $300,000 aggregate principal amount of 5.75% senior unsecured notes

due May 1, 2020, or the Notes, at a public offering price of 99.587% of the principal amount per note. The

Company, or Advance, served as the issuer of the Notes with each of Advance’s domestic subsidiaries serving as a

subsidiary guarantor. The terms of the Notes are governed by an indenture and supplemental indenture (collectively

the “Indenture”), dated as of April 29, 2010, among the Company, the subsidiary guarantors and Wells Fargo Bank,

National Association, as Trustee.

The net proceeds from the offering of the Notes were $294,189, after deducting underwriting discounts and

commissions and offering expenses of $4,572 (collectively “deferred financing costs”) payable by the Company.

The Company is amortizing the deferred financing costs over the term of the Notes. The Company used the net

proceeds from this offering to repay indebtedness outstanding under its revolving credit facility and term loan.

Amounts repaid under the Company’s revolving credit facility may be reborrowed from time to time for operational

purposes, working capital needs, capital expenditures and other general corporate purposes.