Advance Auto Parts 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

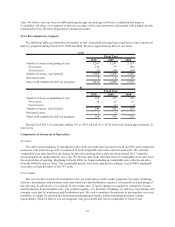

Capital Expenditures

Our primary capital requirements have been the funding of our continued new store openings, store relocations,

maintenance of existing stores, the construction and upgrading of distribution centers, and the development of both

proprietary and purchased information systems. Our capital expenditures were $199.6 million in Fiscal 2010, or $6.7

million more than Fiscal 2009. During Fiscal 2010, we opened 110 AAP stores and 38 AI stores, remodeled 9 AAP

stores and relocated 9 AAP and 3 AI stores.

Our future capital requirements will depend in large part on the number of and timing for new stores we open

within a given year and the investments we make in information technology and supply chain networks. We

anticipate adding approximately 110 to 120 AAP and 10 to 20 AI stores and closing approximately 10 total stores

during Fiscal 2011. We expect to relocate and remodel existing stores only in the normal course of business.

We also plan to make continued investments in the maintenance of our existing stores and supply chain network

and to invest in new information systems to support our key strategies. In Fiscal 2011, we anticipate that our capital

expenditures will be approximately $275.0 million to $300.0 million. The increase in capital expenditures over

Fiscal 2010 will be primarily driven by supply chain investments as part of our Superior Availability strategy. These

expenditures include a new warehouse management system and costs associated with the completion of our

Remington, IN distribution center scheduled to open in late 2011.

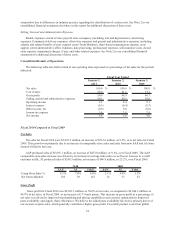

Stock Repurchase Program

Our stock repurchase program allows us to repurchase our common stock on the open market or in privately

negotiated transactions from time to time in accordance with the requirements of the SEC.

During Fiscal 2010, we repurchased an aggregate of 13.0 million shares of our common stock at a cost of

$633.9 million, or an average price of $48.67 per share. Of these, we repurchased 2.7 million shares at a cost of

$178.4 million under our $300 million stock repurchase program authorized by our Board of Directors on August

10, 2010, and 10.3 million shares at a cost of $455.5 million under our $500 million stock repurchase program

authorized by our Board of Directors on February 16, 2010. At January 1, 2011, we had $121.6 million remaining

under the $300 million stock repurchase program.

At January 1, 2011, 0.2 million shares repurchased during Fiscal 2010 at a cost of $15.0 million had not settled.

These shares settled subsequent to January 1, 2011.

Additionally, we repurchased 0.1 million shares of our common stock at an aggregate cost of $3.5 million in

connection with the net settlement of shares issued as a result of the vesting of restricted stock.

Subsequent to January 1, 2011, we repurchased 1.9 million shares of our common stock at an aggregate cost of

$121.6 million, or an average price of $62.72 per share, which completed the availability under our $300 million

stock repurchase program. On February 8, 2011 our Board of Directors authorized a new $500 million stock

repurchase program.

Dividend

Our Board of Directors has approved the payment of quarterly dividends of $0.06 per share to stockholders of

record since Fiscal 2006. Subsequent to January 1, 2011, our Board of Directors declared a quarterly dividend of

$0.06 per share to be paid on April 8, 2011 to all common stockholders of record as of March 25, 2011.

Other Liquidity

During the last two years, we have transitioned certain of our merchandise vendors from a vendor financing

program to a customer-managed services arrangement, or vendor program. Under this vendor program, a third party

provides an accounts payable tracking system which facilitates the participating suppliers’ ability to finance our

payment obligations with designated third-party financial institutions. Participating suppliers may, at their sole

discretion, make offers to participating financial institutions to finance one or more of our payment obligations prior