Advance Auto Parts 2010 Annual Report Download - page 67

Download and view the complete annual report

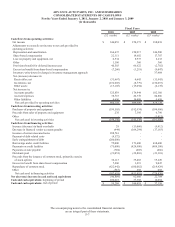

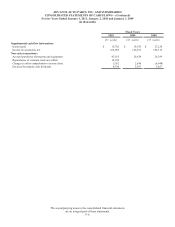

Please find page 67 of the 2010 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 1, 2011, January 2, 2010 and January 3, 2009

(in thousands, except per share data)

.

F-13

Testing for impairment is a two-step process. The first step is a review for potential impairment, while the

second step measures the amount of impairment, if any. Under the first step, the Company compares the fair value

of its reporting units with their respective carrying amounts, including goodwill. If the fair value of a reporting unit

exceeds its carrying amount, goodwill of the reporting unit is considered not impaired and the second step of the

impairment test is unnecessary. If the carrying amount of the reporting unit exceeds its fair value, the second step of

the impairment test must be performed to measure the amount of impairment loss to be recognized, if any. An

impairment loss is recognized when the fair value of goodwill or other intangible asset is below its carrying value.

Valuation of Long-Lived Assets

The Company evaluates the recoverability of its long-lived assets whenever events or changes in circumstances

indicate that the carrying amount of an asset might not be recoverable and exceeds its fair value.

Significant factors, which would trigger an impairment review, include the following:

• Significant decrease in the market price of a long-lived asset (asset group);

• Significant changes in how assets are used or are planned to be used;

• Significant adverse change in legal factors or business climate, including adverse regulatory action;

• Significant negative industry trends;

• An accumulation of costs significantly in excess of the amount originally expected for the acquisition or

construction of a long-lived asset (asset group);

• Significant changes in technology;

• A current-period operating or cash flow loss combined with a history of operating or cash flow losses, or a

projection or forecast that demonstrates continuing losses associated with the use of a long-lived asset

(asset group); or

• A current expectation that, more likely than not, a long-lived asset (asset group) will be sold or otherwise

disposed of significantly before the end of its previously estimated useful life.

When such an event occurs, the Company estimates the undiscounted future cash flows expected to result from the

use of the long-lived asset (asset group) and its eventual disposition. These impairment evaluations involve

estimates of asset useful lives and future cash flows. If the undiscounted expected future cash flows are less than the

carrying amount of the asset and the carrying amount of the asset exceeds its fair value, an impairment loss is

recognized. When an impairment loss is recognized, the carrying amount of the asset is reduced to its estimated fair

value based on quoted market prices or other valuation techniques (e.g., discounted cash flow analysis).

Financed Vendor Accounts Payable

The Company is party to a short-term financing program with a bank allowing it to extend its payment terms on

certain merchandise purchases. The substance of the program is for the Company to borrow money from the bank to

finance purchases from vendors. The Company records any discount given by the vendor to its inventory and

accretes this discount to the resulting short-term payable to the bank through interest expense over the extended

term. At January 1, 2011 and January 2, 2010, $31,648 and $32,092, respectively, was payable to the bank by the

Company under this program and is included in the accompanying consolidated balance sheets as Financed vendor

accounts payable.

Earnings per Share

The Company uses the two-class method to calculate earnings per share. Under the two-class method, unvested

share-based payment awards that contain non-forfeitable rights to dividends or dividend equivalents (whether paid

or unpaid) are considered participating securities and are included in the computation of earnings per share. Certain

of the Company’s shares granted to employees in the form of restricted stock are considered participating securities.

Accordingly, earnings per share is computed by dividing net income attributable to the Company’s common