Advance Auto Parts 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 1, 2011, January 2, 2010 and January 3, 2009

(in thousands, except per share data)

.

F-34

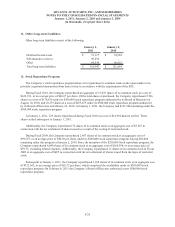

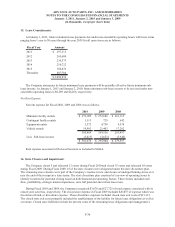

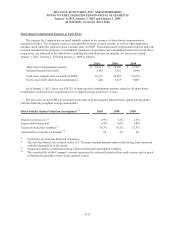

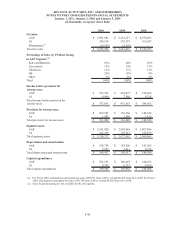

The Company expects plan contributions to completely offset benefits paid. The following table summarizes the

Company's expected benefit payments (net of retiree contributions) to be paid for each of the following fiscal years:

Amount

2011 811$

2012 816

2013 806

2014 819

2015 799

2016-2020 1,956

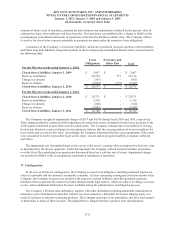

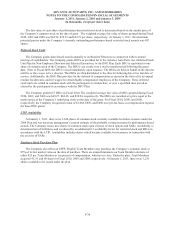

At January 1, 2011, the net unrealized gain on the Plan consists of an unrealized gain of $3,532 related to prior

service cost and an unrealized net gain of $1,659 related to actuarial gains. Approximately $581 of the unrealized

gain related to prior service cost and $92 related to the actuarial loss are expected to be recognized as a component

of Net periodic postretirement benefit cost in Fiscal 2011. The Company reserves the right to change or terminate

the employee benefits or Plan contributions at any time.

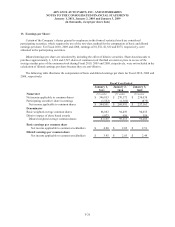

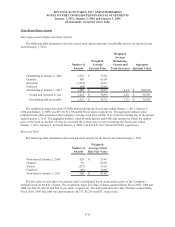

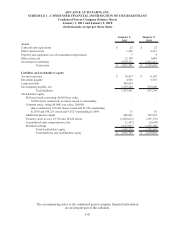

19. Share-Based Compensation:

Overview

The Company grants share-based compensation awards to its employees and members of its Board of Directors

as provided for under the Company’s 2004 Long-Term Incentive Plan, or LTIP. The Company currently grants

share-based compensation in the form of stock appreciation rights, or SARs, restricted stock (considered nonvested

stock under ASC Topic 718) and deferred stock units, or DSUs. The Company also has outstanding stock options

granted prior to Fiscal 2007.

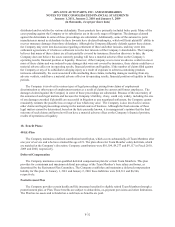

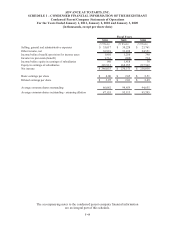

General Terms of Awards

Time Vested Awards

The SARs generally vest over a three-year period in equal annual installments beginning on the first anniversary

of the grant date. All SARs granted are non-qualified, terminate on the seventh anniversary of the grant date and

contain no post-vesting restrictions other than normal trading black-out periods prescribed by the Company’s

corporate governance policies.

During the vesting period, holders of restricted stock are entitled to receive dividends and voting rights. The

shares are restricted until they vest and cannot be sold by the recipient until the restriction has lapsed at the end of

the three-year period. All restricted stock granted generally vests over a three-year period in equal annual

installments beginning on the first anniversary of the grant date.

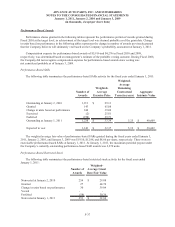

Performance-Based Awards

Beginning in Fiscal 2008, each grant of share-based compensation is comprised of SARs and restricted stock,

including a 75% time-service portion and 25% performance-based portion which collectively represent the target

award. Each performance award may vest following a three-year period subject to the Company’s achievement of

certain financial goals. The performance restricted stock awards do not have dividend equivalent rights and do not

have voting rights until earned and issued following the end of the applicable performance period. Depending on the

Company’s results during the three-year performance period, the actual number of shares vesting at the end of the

period may range from 0% to 200% of the target shares.