Advance Auto Parts 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 1, 2011, January 2, 2010 and January 3, 2009

(in thousands, except per share data)

.

F-25

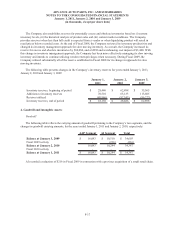

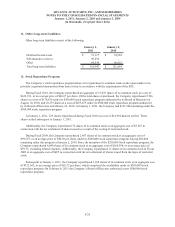

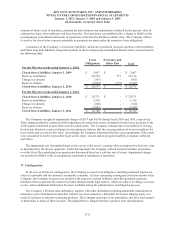

11. Other Long-term Liabilities:

Other long-term liabilities consist of the following:

January 1, January 2,

2011 2010

Deferred income taxes 51,117$ 54,982$

Self-insurance reserves 50,292 -

Other 64,534 66,662

Total long-term liabilities 165,943$ 121,644$

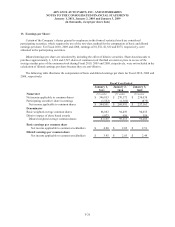

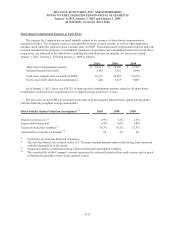

12. Stock Repurchase Program:

The Company’s stock repurchase program allows it to repurchase its common stock on the open market or in

privately negotiated transactions from time to time in accordance with the requirements of the SEC.

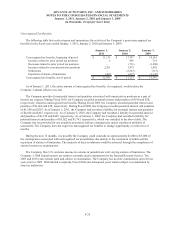

During Fiscal 2010, the Company repurchased an aggregate of 13,025 shares of its common stock at a cost of

$633,911, or an average price of $48.67 per share. Of the total shares repurchased, the Company repurchased 2,746

shares at a cost of $178,436 under its $300,000 stock repurchase program authorized by its Board of Directors on

August 10, 2010, and 10,279 shares at a cost of $455,475 under its $500,000 stock repurchase program authorized

by its Board of Directors on February 16, 2010. At January 1, 2011, the Company had $121,564 remaining under the

$300,000 stock repurchase program.

At January 1, 2011, 225 shares repurchased during Fiscal 2010 at a cost of $14,994 had not settled. These

shares settled subsequent to January 1, 2011.

Additionally, the Company repurchased 72 shares of its common stock at an aggregate cost of $3,525 in

connection with the net settlement of shares issued as a result of the vesting of restricted stock.

During Fiscal 2009, the Company repurchased 2,467 shares of its common stock at an aggregate cost of

$99,567, or an average price of $40.36 per share, under its $250,000 stock repurchase program leaving $89,406

remaining under this program at January 2, 2010. Since the inception of the $250,000 stock repurchase program, the

Company repurchased 4,040 shares of its common stock at an aggregate cost of $160,594, or an average price of

$39.75, excluding related expenses. Additionally, the Company repurchased 12 shares of its common stock in Fiscal

2009 at an aggregate cost of $495 in connection with the net settlement of shares issued from the lapse of restricted

stock.

Subsequent to January 1, 2011, the Company repurchased 1,938 shares of its common stock at an aggregate cost

of $121,562, or an average price of $62.72 per share, which completed the availability under its $300,000 stock

repurchase program. On February 8, 2011 the Company’s Board of Directors authorized a new $500,000 stock

repurchase program.