Advance Auto Parts 2010 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2010 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

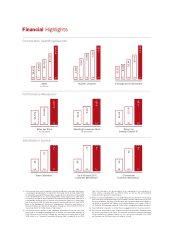

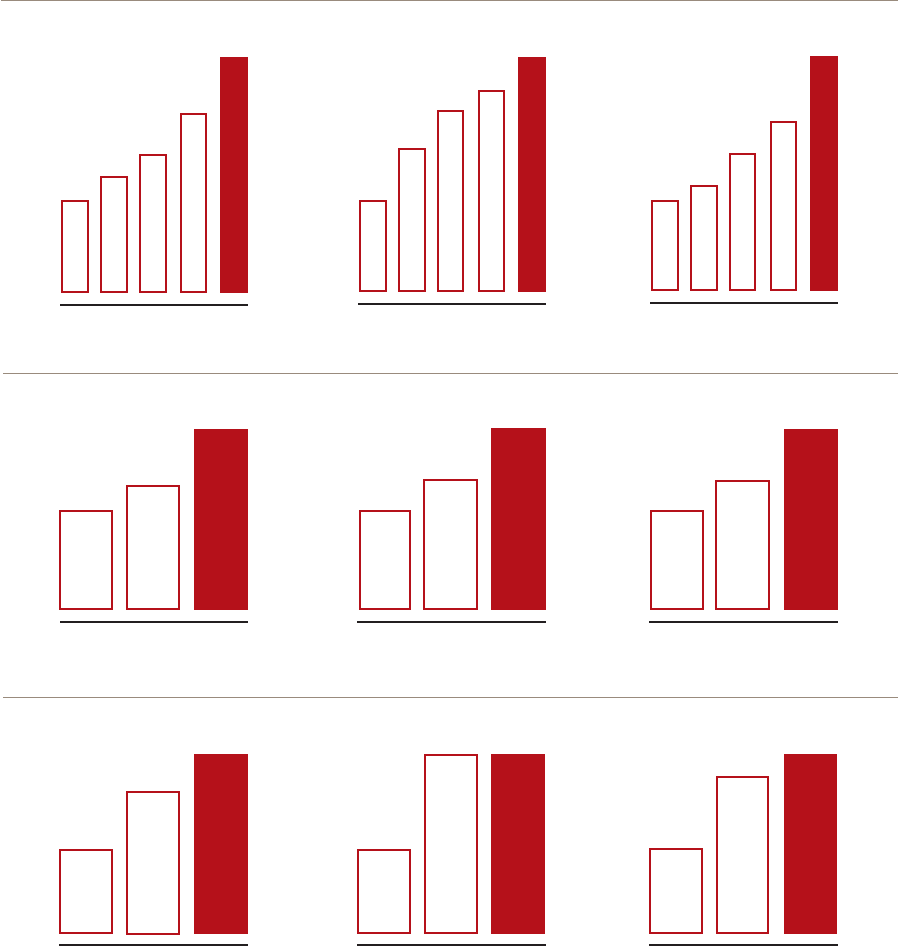

Financial Highlights

Comparable Operating Results(1)

06

$4,617

$4,844

$5,053

$5,413

$5,925

07 08 09 10

Sales

(in millions)

06

3,082

3,261

3,368

3,420

3,563

07 08 09 10

Number of Stores

06

$2.16

$2.28

$2.64

$3.00

$3.95

07 08 09 10

Earnings per Diluted Share

(1) Our scal year sales results reported in the referenced charts have been reported on

a comparable operating basis to exclude the 53rd week results in scal 2008. Refer

to “Selected Consolidated Financial Data” on page 18 of our 2010 Form 10-K included

in this Annual Report for the corresponding sales results reported on a GAAP basis.

Our earnings per diluted share reported in the referenced chart has been reported on

a comparable operating basis to exclude store divestiture expenses in scal 2009

and the results from the 53rd week and non-cash inventory adjustment in scal 2008.

Refer to the Management Overview of “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” on page 21 of our 2010 Form 10 -K in

this Annual Report for further details of these items.

(2) Our nancial results reported in the referenced performance measures have been

reported on a comparable operating basis to exclude store divestiture expenses in

scal 2009 and results from the 53rd week and non-cash inventory adjustment in scal

2008. Refer to the “Selected Consolidated Financial Data” on page 18 of our 2010

Form 10-K included in this Annual Report for an explanation of the calculation of

these metrics, excluding ROIC as de ned below, as well as the corresponding

nancial results reported on a GAAP basis.

(3) Return on invested capital (ROIC) is a non- GAAP measure and is de ned as net operating

pro t after taxes divided by average invested capital. Invested capital consists of total

assets and liabilities, excluding cash and debt, and estimated capital lease obligation

calculated as annualized rent expense for the applicable year times 6 years. Refer to

our 4th quarter 2010 earnings release for further details, including the detailed calculation.

(4) Team Calibration measures our overall Team’s engagement in our business direction.

(5) The Customer Satisfaction surveys measure the level of our customers’ satisfaction with

the service they receive in our stores. The Customer Satisfaction scores are calculated

using a twelve-month average. However, our rst survey was conducted in fall 2008

and therefore the 2008 score does not re ect a full year.

Satisfaction Scores

75

79

09 10

Team Calibration(4)

65

08

73

73

09 10

Do It Yourself (DIY)

Customer Satisfaction(5)

65

08

64

65

09 10

Commercial

Customer Satisfaction(5)

60

08

Performance Measures(2)

08

$1,524

$1,595

$1,697

09 10

Sales per Store

(in thousands)

$132

$142

$168

Operating Income per Store

(in thousands)

08 09 10

14.0%

15.1%

17.5%

Return on

Invested Capital %(3)

08 09 10