Advance Auto Parts 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 1, 2011, January 2, 2010 and January 3, 2009

(in thousands, except per share data)

.

F-15

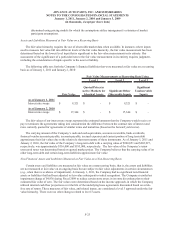

From time to time closed store liability estimates require revisions, primarily due to changes in assumptions

associated with revenue from subleases. The effect of changes in estimates for our closed store liabilities impact

both our income statement and balance sheet: (i) they are included in SG&A in the accompanying consolidated

statements of operations, and (ii) they are recorded in Accrued expenses (current portion) and Other long-term

liabilities (long-term portion) in the accompanying consolidated balance sheets.

The Company also evaluates and determines if the results from the closure of store locations should be reported

as discontinued operations based on the elimination of the operations and associated cash flows from the Company’s

ongoing operations. The Company does not include in its evaluation of discontinued operations those operations and

associated cash flows transferred to another store in the local market.

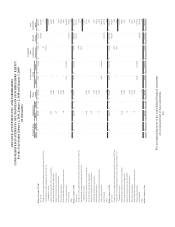

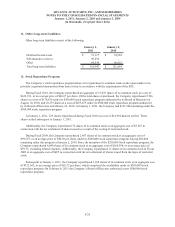

Cost of Sales and Selling, General and Administrative Expenses

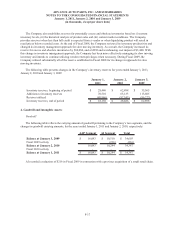

The following table illustrates the primary costs classified in each major expense category:

ƔTotal cost of merchandise sold including: ƔPayroll and benefit costs for retail and corporate

–Freight expenses associated with moving team members;

merchandise inventories from our vendors to ƔOccupancy costs of retail and corporate facilities;

our distribution center, ƔDepreciation related to retail and corporate assets;

–Vendor incentives, and ƔAdvertising;

–Cash discounts on payments to vendors; ƔCosts associated with our commercial delivery

ƔInventory shrinkage; program, including payroll and benefit costs,

ƔDefective merchandise and warranty costs; and transportation expenses associated with moving

ƔCosts associated with operating our distribution merchandise inventories from our retail stores to

network, including payroll and benefit costs, our customer locations;

occupancy costs and depreciation; and ƔSelf-insurance costs;

ƔFreight and other handling costs associated with ƔProfessional services;

moving merchandise inventories through our ƔOther administrative costs, such as credit card

supply chain service fees, supplies, travel and lodging;

–From our distribution centers to our retail ƔClosed store expenses; and

store locations, and ƔImpairment charges, if any.

–From certain of our larger stores which stock a

wider variety and greater supply of inventory, or

HUB stores, and Parts Delivered Quickly warehouses,

or PDQ

®

s, to our retail stores after the customer

has special-ordered the merchandise.

Cost of Sales SG&A

New Accounting Pronouncements

In January 2010, the Financial Accounting Standards Board, or FASB, issued ASU No. 2010-06 “Fair Value

Measurements and Disclosures – Improving Disclosures about Fair Value Measurements.” ASU 2010-06 requires

new disclosures for significant transfers in and out of Level 1 and 2 of the fair value hierarchy and the activity

within Level 3 of the fair value hierarchy. The updated guidance also clarifies existing disclosures regarding the

level of disaggregation of assets or liabilities and the valuation techniques and inputs used to measure fair value. The

updated guidance is effective for interim and annual reporting periods beginning after December 15, 2009, with the

exception of the new Level 3 activity disclosures, which are effective for interim and annual reporting periods

beginning after December 15, 2010. The adoption of the new Level 1 and 2 guidance had no impact on the

Company’s consolidated financial statements. The adoption of the new Level 3 guidance is not expected to have a

material impact on the Company’s consolidated financial statements.