3M 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

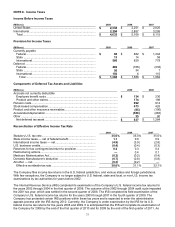

The Company has not provided deferred taxes on unremitted earnings attributable to international companies that

have been considered to be reinvested indefinitely. These earnings relate to ongoing operations and were

approximately $5.6 billion as of December 31, 2009. Because of the availability of U.S. foreign tax credits, it is not

practicable to determine the income tax liability that would be payable if such earnings were not indefinitely

reinvested.

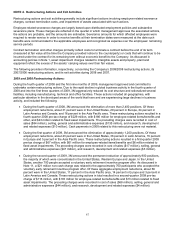

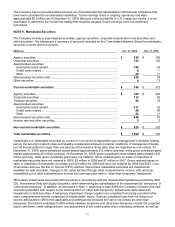

NOTE 9. Marketable Securities

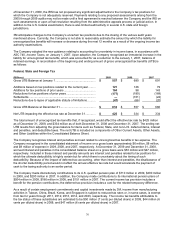

The Company invests in asset-backed securities, agency securities, corporate medium-term note securities and

other securities. The following is a summary of amounts recorded on the Consolidated Balance Sheet for marketable

securities (current and non-current).

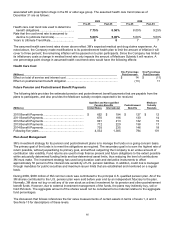

(Millions) Dec. 31, 2009 Dec. 31, 2008

Agency securities ......................................................................................................

.

$ 326 $ 180

Corporate securities ..................................................................................................

.

154 145

Asset-backed securities:

Automobile loans related .......................................................................................

.

198 24

Credit cards related ...............................................................................................

.

9

—

Other......................................................................................................................

.

49 11

Asset-backed securities total ....................................................................................

.

256 35

Other securities .........................................................................................................

.

8

13

Current marketable securities ...............................................................................

.

$ 744 $ 373

Agency securities ......................................................................................................

.

$ 165 $ 200

Corporate securities ..................................................................................................

.

112 62

Treasury securities....................................................................................................

.

94 12

Asset-backed securities:

Automobile loans related .......................................................................................

.

317 25

Credit cards related ...............................................................................................

.

98 40

Other......................................................................................................................

.

34 11

Asset-backed securities total ....................................................................................

.

449 76

Auction rate and other securities...............................................................................

.

5

2

Non-current marketable securities........................................................................

.

$ 825 $ 352

Total marketable securities....................................................................................

.

$ 1,569 $ 725

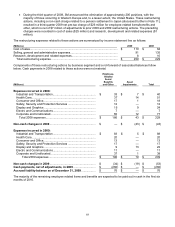

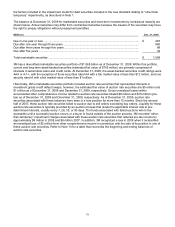

Classification of marketable securities as current or non-current is dependent upon management’s intended holding

period, the security’s maturity date and liquidity considerations based on market conditions. If management intends

to hold the securities for longer than one year as of the balance sheet date, they are classified as non-current. At

December 31, 2009, gross unrealized losses totaled approximately $12 million (pre-tax), while gross unrealized gains

totaled approximately $3 million (pre-tax). At December 31, 2008, gross unrealized losses totaled approximately $30

million (pre-tax), while gross unrealized gains were not material. Gross realized gains on sales or maturities of

marketable securities were not material in 2009, $5 million in 2008 and $7 million in 2007. Gross realized losses on

sales or maturities of marketable securities were $3 million for 2009 and were not material for 2008 and 2007. Cost

of securities sold use the first in, first out (FIFO) method. Since these marketable securities are classified as

available-for-sale securities, changes in fair value will flow through other comprehensive income, with amounts

reclassified out of other comprehensive income into earnings upon sale or “other-than-temporary” impairment.

3M reviews impairments associated with the above in accordance with the measurement guidance provided by ASC

320, Investments-Debt and Equity Securities, when determining the classification of the impairment as “temporary” or

“other-than-temporary”. In addition, as discussed in Note 1, beginning in April 2009, the Company considers the new

accounting standard with respect to the determination of “other-than-temporary” impairments associated with

investments in debt securities. A temporary impairment charge results in an unrealized loss being recorded in the

other comprehensive income component of shareholders’ equity. Such an unrealized loss does not reduce net

income attributable to 3M for the applicable accounting period because the loss is not viewed as other-than-

temporary. The factors evaluated to differentiate between temporary and other-than-temporary include the projected

future cash flows, credit ratings actions, and assessment of the credit quality of the underlying collateral, as well as