3M 2009 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

the vesting period. Substantially all restricted stock unit grants made after 2008 accrue dividends during the vesting

period, which will be paid out in cash at the vest date on all vested restricted stock units. The following table

summarizes restricted stock and restricted stock unit activity during the twelve months ended December 31:

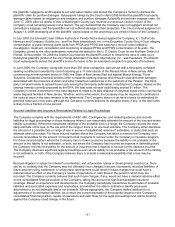

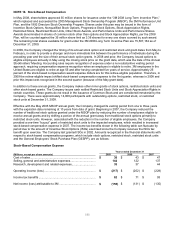

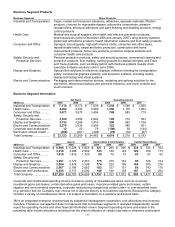

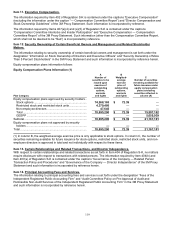

Restricted Stock and Restricted Stock Units

2009 2008

Number of

Awards

Grant Date

Fair Value*

Number of

Awards

Grant Date

Fair Value*

Nonvested balance —.........................................

As of January 1................................................ 2,957,538 $ 77.41 2,001,581 $ 77.63

Granted:

Annual .......................................................... 1,150,819 53.89 924,120 77.23

Other ............................................................ 522,581 54.82 188,473 73.16

Vested.............................................................. (157,104) 73.26 (64,806) 68.72

Forfeited........................................................... (94,354) 69.57 (91,830) 77.76

As of December 31.............................................. 4,379,480 $ 68.85 2,957,538 $ 77.41

* Weighted average

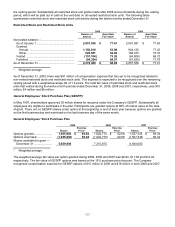

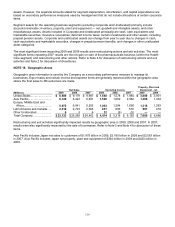

As of December 31, 2009, there was $91 million of compensation expense that has yet to be recognized related to

non-vested restricted stock and restricted stock units. This expense is expected to be recognized over the remaining

vesting period with a weighted-average life of 1.9 years. The total fair value of restricted stock and restricted stock

units that vested during the twelve-month periods ended December 31, 2009, 2008 and 2007, respectively, was $10

million, $4 million and $6 million.

General Employees’ Stock Purchase Plan (GESPP):

In May 1997, shareholders approved 30 million shares for issuance under the Company’s GESPP. Substantially all

employees are eligible to participate in the plan. Participants are granted options at 85% of market value at the date

of grant. There are no GESPP shares under option at the beginning or end of each year because options are granted

on the first business day and exercised on the last business day of the same month.

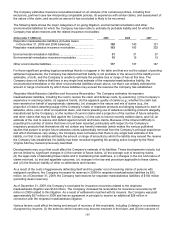

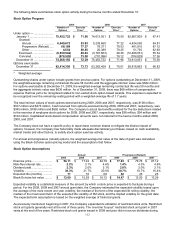

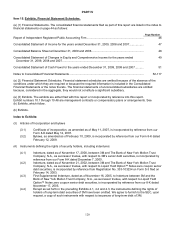

General Employees’ Stock Purchase Plan

2009 2008 2007

Exercise Exercise Exercise

Shares Price* Shares Price* Shares Price*

Options granted....................... 1,655,936 $ 50.58 1,624,775 $ 62.68 1,507,335 $ 69.34

Options exercised.................... (1,655,936) 50.58 (1,624,775) 62.68 (1,507,335) 69.34

Shares available for grant —

December 31 ....................... 5,659,939 7,315,875 8,940,650

* Weighted average

The weighted-average fair value per option granted during 2009, 2008 and 2007 was $8.93, $11.06 and $12.24,

respectively. The fair value of GESPP options was based on the 15% purchase price discount. The Company

recognized compensation expense for GESSP options of $15 million in 2009 and $18 million in both 2008 and 2007.