3M 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

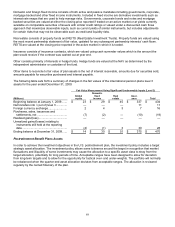

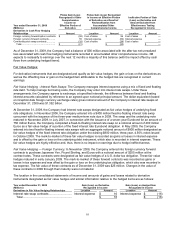

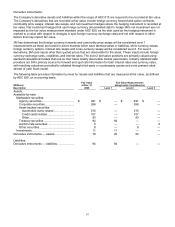

The location in the consolidated statements of income and amounts of gains and losses related to derivative

instruments not designated as hedging instruments are as follows:

Year ended Dec. 31, 2009

(Millions)

Gain (Loss) on Derivative

Recognized in Income

Derivatives Not Designated as Hedging Instruments Location Amount

Foreign currency forward/option contracts.......... Cost of sales $ (41)

Foreign currency forward contract ...................... Interest expense 20

Commodity price swap contracts ........................ Cost of sales 1

Total................................................................. $ (20)

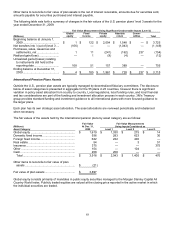

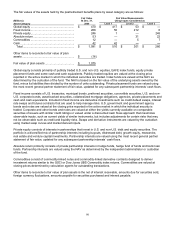

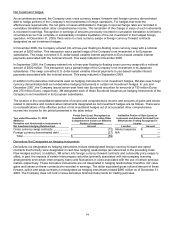

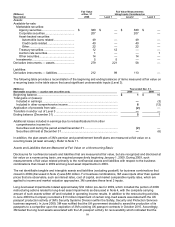

Location and Fair Value Amount of Derivative Instruments

The following table summarizes the fair value of 3M’s derivative instruments, excluding nonderivative instruments

used as hedging instruments, and their location in the consolidated balance sheet.

December 31, 2009

(Millions) Assets Liabilities

Fair Value of Derivative Instruments Location Amount Location Amount

Derivatives designated as hedging

instruments

Foreign currency forward/option contracts Other current assets $ 17 Other current liabilities $ 41

Commodity price swap contracts........ Other current assets 1 Other current liabilities 1

Interest rate swap contracts............ Other assets 54 Other liabilities —

Total derivatives designated as

hedging instruments.............

$ 72 $ 42

Derivatives not designated as hedging

instruments

Foreign currency forward/option contracts Other current assets $ 6 Other current liabilities $ 52

Commodity price swap contracts........ Other current assets 1 Other current liabilities —

Total derivatives not designated

as hedging instruments ..........

$7 $52

Total derivative instruments............

$ 79 $ 94

Additional information with respect to the fair value of derivative instruments is included in Note 13.

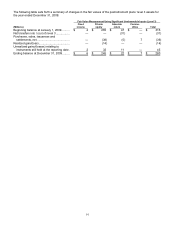

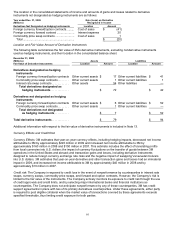

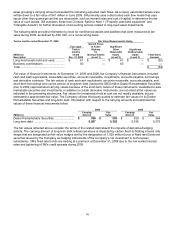

Currency Effects and Credit Risk

Currency Effects: 3M estimates that year-on-year currency effects, including hedging impacts, decreased net income

attributable to 3M by approximately $220 million in 2009 and increased net income attributable to 3M by

approximately $160 million in 2008 and $150 million in 2007. This estimate includes the effect of translating profits

from local currencies into U.S. dollars; the impact of currency fluctuations on the transfer of goods between 3M

operations in the United States and abroad; and transaction gains and losses, including derivative instruments

designed to reduce foreign currency exchange rate risks and the negative impact of swapping Venezuelan bolivars

into U.S. dollars. 3M estimates that year-on-year derivative and other transaction gains and losses had an immaterial

impact in 2009, and increased net income attributable to 3M by approximately $40 million in 2008 and by

approximately $10 million in 2007.

Credit risk: The Company is exposed to credit loss in the event of nonperformance by counterparties in interest rate

swaps, currency swaps, commodity price swaps, and forward and option contracts. However, the Company’s risk is

limited to the fair value of the instruments. The Company actively monitors its exposure to credit risk through the use

of credit approvals and credit limits, and by selecting major international banks and financial institutions as

counterparties. The Company does not anticipate nonperformance by any of these counterparties. 3M has credit

support agreements in place with two of its primary derivatives counterparties. Under these agreements, either party

is required to post eligible collateral when the market value of transactions covered by these agreements exceeds

specified thresholds, thus limiting credit exposure for both parties.