3M 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 71

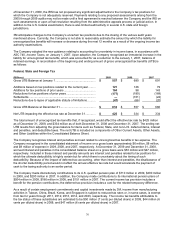

Business-specific asset impairment charges for 2007 totaled $35 million. This included charges of $24 million related

to property, plant and equipment associated with the Company’s decision to phaseout operations at a New Jersey

roofing granule facility (Safety, Security and Protection Services segment) and charges of $11 million ($10 million

related to property, plant and equipment and $1 million related to intangible assets) related to the Company’s

decision to close an Electro and Communications facility in Wisconsin.

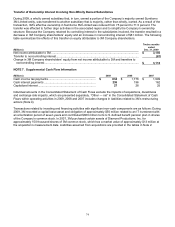

Exit Activities:

During the second and third quarters of 2008, management approved and committed to undertake certain exit

activities, which resulted in a pre-tax charge of $68 million. These charges primarily related to employee-related

liabilities and fixed asset impairments. During the fourth quarter 2008, a pre-tax benefit of $10 million was recorded,

which primarily related to adjustments to employee-related liabilities for second and third-quarter 2008 exit activities.

In total for 2008, these actions resulted in pre-tax charges for Industrial and Transportation ($26 million); Display and

Graphics ($18 million); Health Care ($9 million); Safety, Security and Protection Services ($3 million); and Corporate

and Unallocated ($2 million). These charges were recorded in cost of sales ($38 million), selling, general and

administrative expenses ($17 million), and research, development and related expenses ($3 million).

During the second half of 2007, the Company recorded net pre-tax charges of $45 million related to exit activities.

These charges related to employee reductions and fixed asset impairments, including the consolidation of certain

flexible circuit manufacturing operations ($23 million recorded in the Electro and Communications segment) and

other actions, primarily in the Display and Graphics segment and Industrial and Transportation segment. These

charges were recorded in cost of sales and selling, general and administrative expenses and research, development

and related expenses.