3M 2009 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

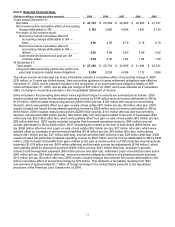

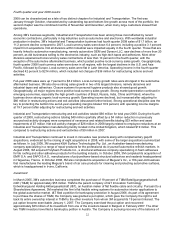

Sales in 2009 totaled $23.1 billion, a decrease of 8.5 percent from 2008. Including the preceding special items, net

income attributable to 3M was $3.193 billion, or $4.52 per diluted share, in 2009, versus $3.460 billion, or $4.89 per

diluted share, in 2008. In 2009, the global economic slowdown dramatically affected year-on-year comparisons for

3M’s businesses. Substantial end-market declines and inventory takedowns in major industries, including

automotive, consumer electronics and general industrial manufacturing, resulted in significantly lower sales and

income. Accordingly, 3M reduced its cost structure, lowered manufacturing output and intensified its attention to

operational improvement. The combination of these actions drove operating income margins of 20.8 percent in 2009,

compared to 20.6 percent in 2008. Restructuring charges and other special items reduced this operating income

margin by approximately one percentage point in both 2009 and 2008.

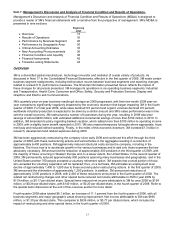

In January 2007, 3M completed the sale of its branded pharmaceuticals business, resulting in a gain in the first

quarter of 2007. In addition, 3M recorded a gain related to the sale of its Opticom Priority Control Systems and

Canoga Traffic Detection businesses in the second quarter of 2007. In 2007, these gains on sale of businesses were

partially offset by restructuring and the net impact of other special items. Refer to “Special Items” at the end of this

overview section for additional details. Including these special items, in 2007, 3M reported net sales of $24.462 billion

and net income attributable to 3M of $4.096 billion, or $5.60 per diluted share.

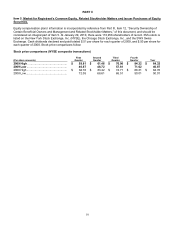

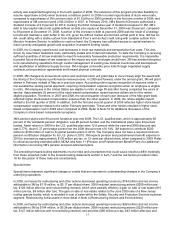

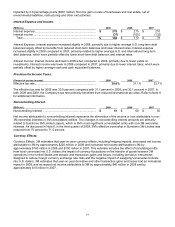

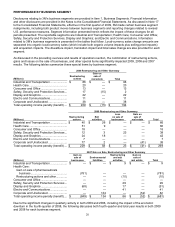

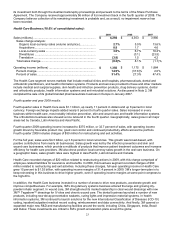

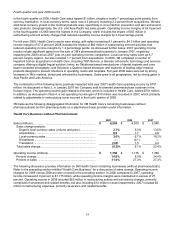

The following table contains sales and operating income results by business segment for the years ended

December 31, 2009 and 2008. Refer to the section entitled “Performance by Business Segment” later in MD&A for

discussion by business segment of restructuring and other items that impacted reported operating income. Refer to

Note 17 for discussion of Corporate and Unallocated and Elimination of Dual Credit.

2009 2008

2009 vs. 2008

% change

(Dollars in millions)

Net

Sales

% of

Total

Oper.

Income

Net

Sales

% of

Total

Oper.

Income

Net

Sales

Oper.

Income

Business Segments

Industrial and

Transportation.......... $ 7,116 30.8% $ 1,238 $ 8,173 32.3% $ 1,548 (12.9)% (20.0)%

Health Care ................. 4,294 18.6% 1,350 4,303 17.0% 1,175 (0.2)% 14.9%

Consumer and Office .. 3,471 15.0% 748 3,578 14.2% 683 (3.0)% 9.5%

Safety, Security and

Protection Services.. 3,180 13.8% 745 3,450 13.7% 710 (7.8)% 5.0%

Display and Graphics .. 3,132 13.5% 590 3,268 12.9% 583 (4.2)% 1.3%

Electro and

Communications ...... 2,276 9.8% 322 2,835 11.2% 540 (19.7)% (40.4)%

Corporate and

Unallocated.............. 12 0.1% (100) 23 0.1% 58

Elimination of Dual

Credit ....................... (358) (1.6)% (79) (361) (1.4)% (79)

Total Company ............ $ 23,123 100.0% $ 4,814 $ 25,269 100.0% $ 5,218 (8.5)% (7.7)%

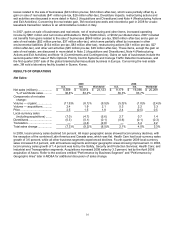

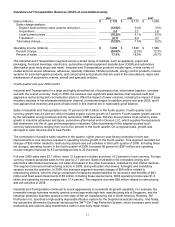

In 2009, while sales declined 8.5 percent for the total year, this was similar to the overall economy and close to the

estimated decline in worldwide industrial production. Quarterly year-on-year comparisons improved throughout 2009.

Sales declined 21.3 percent in the first quarter, 15.1 percent in the second quarter and 5.6 percent in the third

quarter, but improved 11.1 percent in the fourth quarter. Refer to the sections entitled “Performance by Business

Segment” and “Performance by Geographic Area” later in MD&A for additional discussion of sales change.

In 2008, worldwide sales growth was 3.3 percent. Local-currency sales growth was 1.4 percent for 2008, including a

3.3 percentage point benefit from acquisitions. Local-currency sales increased 17.1 percent in Safety, Security and

Protection Services (including 13.0 percentage points from acquisitions), 6.7 percent in Health Care (including 1.7

percentage points from acquisitions), 4.1 percent in Industrial and Transportation (including 3.7 percentage points

from acquisitions), and 1.0 percent in Consumer and Office (including 1.8 percentage points from acquisitions).

Local-currency sales declined 1.6 percent in Electro and Communications and 17.9 percent in Display and Graphics.

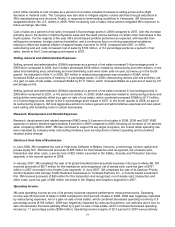

3M generated $4.9 billion of operating cash flows in 2009, an increase of $408 million when compared to 2008. This

followed an increase of $287 million when comparing 2008 to 2007. In 2009, 2008 and 2007, the Company utilized

approximately $1.4 billion of cash each year to pay dividends. In February 2007, 3M’s Board of Directors authorized

a two-year share repurchase of up to $7.0 billion for the period from February 12, 2007 to February 28, 2009. In

February 2009, 3M’s Board of Directors extended this share repurchase authorization until the remaining amount is

fully utilized. As of December 31, 2009, approximately $2.6 billion remained available for repurchase. With the

Company’s emphasis on maintaining ample liquidity and enhancing balance sheet strength, share repurchase