3M 2009 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

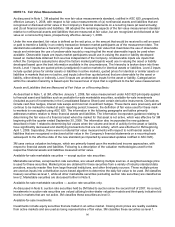

asset grouping’s carrying amount exceeded the remaining expected cash flows. As a result, associated assets were

written down to a fair value of $41 million in June 2009. 3M primarily uses a discounted cash flow model that uses

inputs other than quoted prices that are observable, such as interest rates and cost of capital, to determine the fair

value of such assets. 3M considers these level 2 inputs. Refer to Note 1 (“Property, plant and equipment” and

“Intangible Assets”) for further discussion of accounting policies related to long-lived asset impairments.

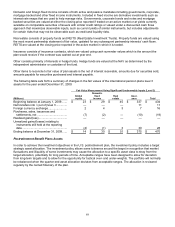

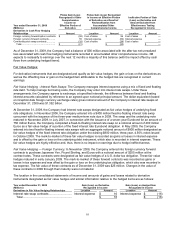

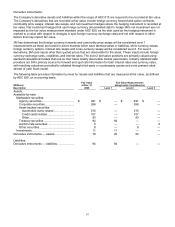

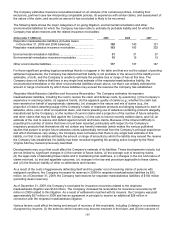

The following table provides information by level for nonfinancial assets and liabilities that were measured at fair

value during 2009, as defined by ASC 820, on a nonrecurring basis.

Twelve months ended December 31, 2009 Fair Value Measurements Using

Quoted Prices

Fair value in Active Significant

Twelve Markets Other Significant

months for Observable Unobservable

(Millions) ended Identical Assets Inputs Inputs Total Gains

Description Dec. 31, 2009 (Level 1) (Level 2) (Level 3) (Losses)

Long-lived assets held and used............. $ 41 $ — $ 41 $ — $ (32)

Business combinations ........................... 50 — 50 — —

Total ........................................................ $ (32)

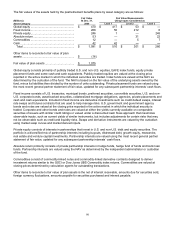

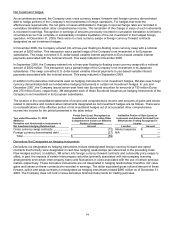

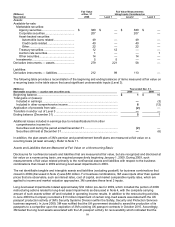

Fair value of financial instruments: At December 31, 2009 and 2008, the Company’s financial instruments included

cash and cash equivalents, marketable securities, accounts receivable, investments, accounts payable, borrowings,

and derivative contracts. The fair values of cash and cash equivalents, accounts receivable, accounts payable, and

short-term borrowings and current portion of long-term debt (except the $350 million Dealer Remarketable Securities

prior to 2009) approximated carrying values because of the short-term nature of these instruments. Available-for-sale

marketable securities and investments, in addition to certain derivative instruments, are recorded at fair values as

indicated in the preceding disclosures. Fair values for investments held at cost are not readily available, but are

estimated to approximate fair value. The Company utilized third-party quotes to estimate fair values for its Dealer

Remarketable Securities and long-term debt. Information with respect to the carrying amounts and estimated fair

values of these financial instruments follow:

2009 2008

(Millions)

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

Dealer Remarketable Securities ......................... $ 350 $ 350 $ 350 $ 364

Long-term debt .................................................... 5,097 5,355 5,166 5,375

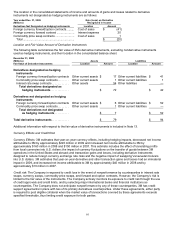

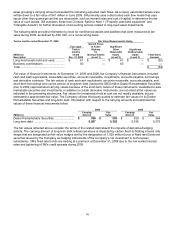

The fair values reflected above consider the terms of the related debt absent the impacts of derivative/hedging

activity. The carrying amount of long-term debt referenced above is impacted by certain fixed-to-floating interest rate

swaps that are designated as fair value hedges and by the designation of 1,025 million Euros of fixed rate Eurobond

securities issued by the Company as hedging instruments of the Company’s net investment in its European

subsidiaries. 3M’s fixed-rate bonds are trading at a premium at December 31, 2009 due to the low market interest

rates and tightening of 3M’s credit spreads during 2009.