3M 2009 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

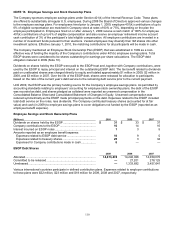

NOTE 15. Employee Savings and Stock Ownership Plans

The Company sponsors employee savings plans under Section 401(k) of the Internal Revenue Code. These plans

are offered to substantially all regular U.S. employees. During 2008 the Board of Directors approved various changes

to the employee savings plans. For employees hired prior to January 1, 2009, employee 401(k) contributions of up to

6% of eligible compensation are matched in Company stock at rates of 60% or 75%, depending on the plan the

employee participated in. Employees hired on or after January 1, 2009 receive a cash match of 100% for employee

401(k) contributions of up to 6% of eligible compensation and also receive an employer retirement income account

cash contribution of 3% of the participant’s total eligible compensation. All employee contributions are invested in a

number of investment funds pursuant to their elections. Vested employees may diversify their 3M shares into other

investment options. Effective January 1, 2010, the matching contributions for all participants will be made in cash.

The Company maintained an Employee Stock Ownership Plan (ESOP) that was established in 1989 as a cost-

effective way of funding the majority of the Company’s contributions under 401(k) employee savings plans. Total

ESOP shares were considered to be shares outstanding for earnings per share calculations. The ESOP debt

obligation matured in 2009 (Note 10).

Dividends on shares held by the ESOP were paid to the ESOP trust and, together with Company contributions, were

used by the ESOP to repay principal and interest on the outstanding ESOP debt. The tax benefit related to dividends

paid on unallocated shares was charged directly to equity and totaled approximately $1 million in 2009, $2 million in

2008, and $3 million in 2007. Over the life of the ESOP debt, shares were released for allocation to participants

based on the ratio of the current year’s debt service to the remaining debt service prior to the current payment.

Until 2009, the ESOP was the primary funding source for the Company’s employee savings plans. As permitted by

accounting standards relating to employers’ accounting for employee stock ownership plans, the debt of the ESOP

was recorded as debt, and shares pledged as collateral were reported as unearned compensation in the

Consolidated Balance Sheet and Consolidated Statement of Changes in Equity. Unearned compensation was

reduced symmetrically as the ESOP made principal payments on the debt. Expenses related to the ESOP included

total debt service on the notes, less dividends. The Company contributed treasury shares (accounted for at fair

value) and cash (in 2009) to employee savings plans to cover obligations not funded by the ESOP (reported as an

employee benefit expense).

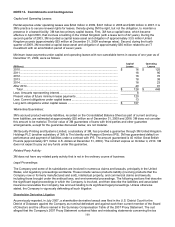

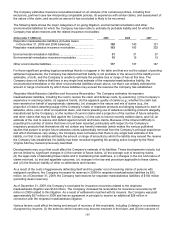

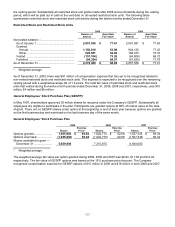

Employee Savings and Stock Ownership Plans

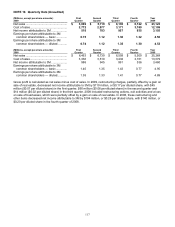

(Millions) 2009 2008 2007

Dividends on shares held by the ESOP ......................................... $31

$ 33 $ 37

Company contributions to the ESOP ............................................. 16 14 10

Interest incurred on ESOP notes ................................................... 1

3 5

Amounts reported as an employee benefit expense:

Expenses related to ESOP debt service .................................... 10 9 5

Expenses related to treasury shares.......................................... 25 3 34

Expenses for Company contributions made in cash .................. 6

—

—

ESOP Debt Shares

2009 2008 2007

Allocated......................................................................................... 14,473,474 14,240,026 14,039,070

Committed to be released ..............................................................

—

27,201 278,125

Unreleased .....................................................................................

—

1,333,692 2,457,641

Various international countries participate in defined contribution plans. Expenses related to employer contributions

to these plans were $22 million, $23 million and $18 million for 2009, 2008 and 2007, respectively.