3M 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

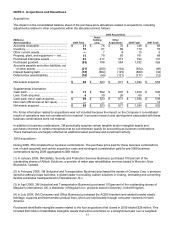

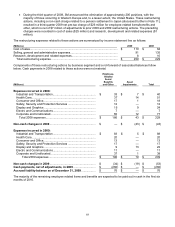

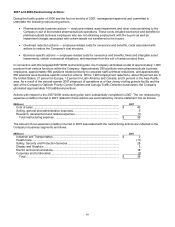

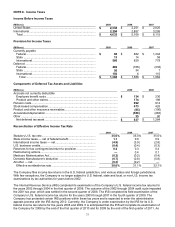

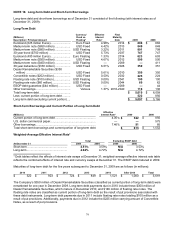

Components of these restructuring actions, beginning with accrued liability balances as of December 31, 2006,

include:

(Millions)

Employee-

Related

Items and

Benefits

Contract

Terminations

and Other

Asset

Impairments Total

Accrued liability balances as of Dec. 31,

2006:

Pharmaceuticals business actions .................. $ 78 $ 6 $ — $ 84

Overhead reduction actions............................. 100

—

— 100

Business-specific actions ................................ 30 8 — 38

Total accrued liability balance...................... $ 208 $ 14 $ — $ 222

Expenses (credits) incurred in 2007:

Pharmaceuticals business actions .................. $ (12) $ (4) $ — $ (16)

Overhead reduction actions............................. 2

—

— 2

Business-specific actions ................................ 13 4 35 52

2007 expense ........................................... $ 3 $ — $ 35 $ 38

Non-cash changes in 2007:

Pharmaceuticals business actions .................. $ (21) $ 4 $ — $ (17)

Overhead reduction actions............................. (5)

—

— (5)

Business-specific actions ................................ (12) (4) (35) (51)

2007 non-cash.......................................... $ (38) $ — $ (35) $ (73)

Cash payments in 2007:

Pharmaceuticals business actions .................. $ (40) $ (6) $ — $ (46)

Overhead reduction actions............................. (87)

—

— (87)

Business-specific actions ................................ (26) (8) — (34)

2007 cash payments ................................ $ (153) $ (14) $ — $ (167)

Accrued liability balances as of Dec. 31,

2007:

Pharmaceuticals business actions .................. $ 5 $ — $ — $ 5

Overhead reduction actions............................. 10

—

— 10

Business-specific actions ................................ 5

—

— 5

Total accrued liability balance .................. $ 20 $ — $ — $ 20

Cash payments in 2008:

Pharmaceuticals business actions .................. $ (5) $ — $ — $ (5)

Overhead reduction actions............................. (10)

—

— (10)

Business-specific actions ................................ (4)

—

— (4)

2008 cash payments ................................ $ (19) $ — $ — $ (19)

Accrued liability balances as of Dec. 31,

2008:

Pharmaceuticals business actions .................. $ — $ — $ — $ —

Overhead reduction actions............................. —

—

—

—

Business-specific actions ................................ 1

—

— 1

Total accrued liability balance .................. $ 1 $ — $ — $ 1

Cash payments in 2009 .................................... $(1) $— $— (1)

Accrued liability balances as of Dec. 31,

2009................................................................. $ — $ — $ — $ —

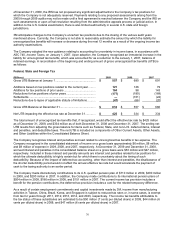

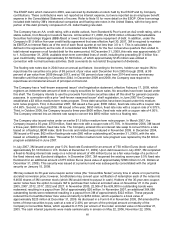

Non-cash employee-related changes in 2007 primarily relate to special termination pension and medical benefits

granted to certain U.S. eligible employees. These pension and medical benefits were reflected as a component of the

benefit obligation of the Company’s pension and medical plans as of December 31, 2007. In addition, these changes

also reflect non-cash stock option expense due to the reclassification of certain employees age 50 and older to

retiree status, resulting in a modification of their original stock option awards for accounting purposes.