3M 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 58

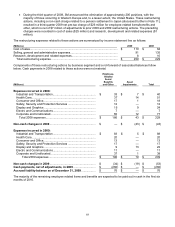

standard impacted the Company’s “Convertible Notes” (refer to Note 10 to the Consolidated Financial Statements

for more detail), and required that additional interest expense essentially equivalent to the portion of issuance

proceeds be retroactively allocated to the instrument’s equity component and be recognized over the period from the

Convertible Notes’ issuance on November 15, 2002 through November 15, 2005 (the first date holders of these

Notes had the ability to put them back to 3M). 3M adopted this standard in January 2009. Its retrospective application

had no impact on results of operations for periods following 2005, but on post-2005 consolidated balance sheets, it

resulted in an increase of approximately $22 million in previously reported opening additional paid in capital and a

corresponding decrease in previously reported opening retained earnings.

In early October 2008, the FASB issued an accounting standard codified in ASC 820, Fair Value Measurements and

Disclosures, which illustrated key considerations in determining the fair value of a financial asset in an inactive

market. This standard was effective for 3M beginning with the quarter ended September 30, 2008. Its additional

guidance was incorporated in the measurements of fair value of applicable financial assets disclosed in Note 13 and

did not have a material impact on 3M’s consolidated results of operations or financial condition.

In November 2008, the FASB ratified a standard related to certain equity method investment accounting

considerations. The standard indicates, among other things, that transaction costs for an investment should be

included in the cost of the equity-method investment (and not expensed) and shares subsequently issued by the

equity-method investee that reduce the investor’s ownership percentage should be accounted for as if the investor

had sold a proportionate share of its investment, with gains or losses recorded through earnings. For 3M, the

standard was effective for transactions occurring after December 31, 2008. The adoption of this standard did not

have a material impact on 3M’s consolidated results of operations or financial condition.

In November 2008, the FASB ratified an accounting standard related to intangible assets acquired in a business

combination or asset acquisition that an entity does not intend to use or intends to hold to prevent others from

obtaining access (a defensive intangible asset). Under the standard a defensive intangible asset needs to be

accounted for as a separate unit of accounting and would be assigned a useful life based on the period over which

the asset diminishes in value. For 3M, the standard was effective for transactions occurring after December 31, 2008.

The Company considered this standard in terms of intangible assets acquired in business combinations or asset

acquisitions that closed after December 31, 2008.

In December 2008, the FASB issued an accounting standard regarding a company’s disclosures about

postretirement benefit plan assets. This standard requires additional disclosures about plan assets for sponsors of

defined benefit pension and postretirement plans including expanded information regarding investment strategies,

major categories of plan assets, and concentrations of risk within plan assets. Additionally, this standard requires

disclosures similar to those required for fair value measurements and disclosures under ASC 820 with respect to the

fair value of plan assets such as the inputs and valuation techniques used to measure fair value and information with

respect to classification of plan assets in terms of the hierarchy of the source of information used to determine their

value. For 3M, the disclosures under this standard are required beginning with the annual period ended

December 31, 2009. The additional disclosures are included in Note 11.

In April 2009, the FASB issued an accounting standard which provides guidance on (1) estimating the fair value of an

asset or liability when the volume and level of activity for the asset or liability have significantly declined and

(2) identifying transactions that are not orderly. The standard also amended certain disclosure provisions for fair

value measurements and disclosures in ASC 820 to require, among other things, disclosures in interim periods of the

inputs and valuation techniques used to measure fair value as well as disclosure of the hierarchy of the source of

underlying fair value information on a disaggregated basis by specific major category of investment. For 3M, this

standard was effective prospectively beginning April 1, 2009. The adoption of this standard did not have a material

impact on 3M’s consolidated results of operations or financial condition.

In April 2009, the FASB issued an accounting standard which modifies the requirements for recognizing other-than-

temporarily impaired debt securities and changes the existing impairment model for such securities. The standard

also requires additional disclosures for both annual and interim periods with respect to both debt and equity

securities. Under the standard, impairment of debt securities is considered other-than-temporary if an entity

(1) intends to sell the security, (2) more likely than not will be required to sell the security before recovering its cost,

or (3) does not expect to recover the security’s entire amortized cost basis (even if the entity does not intend to sell).

The standard further indicates that, depending on which of the above factor(s) causes the impairment to be

considered other-than-temporary, (1) the entire shortfall of the security’s fair value versus its amortized cost basis or

(2) only the credit loss portion would be recognized in earnings while the remaining shortfall (if any) would be

recorded in other comprehensive income. The standard requires entities to initially apply its provisions to previously

other-than-temporarily impaired debt securities existing as of the date of initial adoption by making a cumulative-