3M 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

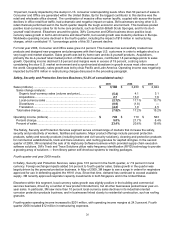

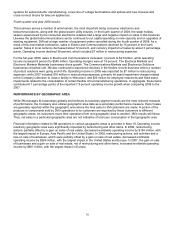

10 percent, heavily impacted by the slump in U.S. consumer retail spending levels. More than 50 percent of sales in

Consumer and Office are generated within the United States. By far the biggest contributor to this decline was the

retail and wholesale office channel. The combination of massive office worker layoffs, coupled with across-the-board

declines in office retail foot traffic, had a dramatic and negative impact on sales. 3M businesses serving other U.S.

retail channels performed well in the fourth quarter despite the tough economic environment. This business posted

positive local-currency sales for its home care products, such as Scotch-Brite® Scrub Sponges, and for its do-it-

yourself retail channel. Elsewhere around the globe, 3M’s Consumer and Office business drove positive local-

currency sales growth in both Latin America and Asia Pacific, but overall growth was muted by declines in Europe.

Worldwide operating income declined in the fourth quarter, including the impact of $18 million in restructuring

charges, which contributed 11.1 percentage points of this 35.7 percent decline.

For total year 2008, Consumer and Office sales grew 2.4 percent. This business has successfully created new

products and designed new programs and planograms with their large U.S. customers in order to mitigate what is a

very tough end-market situation. Sales growth was led by home care and do-it-yourself products. Acquisitions,

primarily the do-it-yourself retail market portion of 3M’s Aearo business, contributed 1.8 percentage points to sales

growth. Operating income declined 3.8 percent and margins were in excess of 19 percent, a strong return

considering the slow U.S. market environment and a synchronized slowdown in growth across most other areas of

the world. Geographically, sales growth was led by Asia Pacific and Latin America. Operating income was negatively

impacted by the $18 million in restructuring charges discussed in the preceding paragraph.

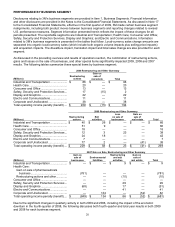

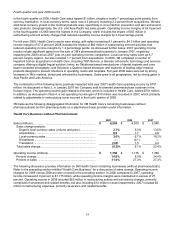

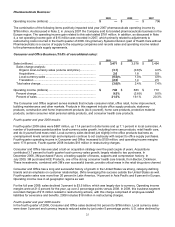

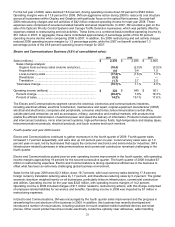

Safety, Security and Protection Services Business (13.8% of consolidated sales):

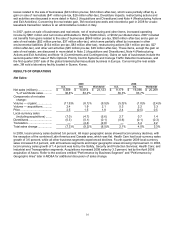

2009 2008 2007

Sales (millions) ............................................................................... $ 3,180 $ 3,450 $ 2,944

Sales change analysis:

Organic local-currency sales (volume and price).................... (5.4) 4.1 3.1

Acquisitions ............................................................................. 2.7 13.0 7.6

Local-currency sales ............................................................... (2.7)% 17.1% 10.7%

Divestitures ............................................................................. (0.9) (1.8) —

Translation .............................................................................. (4.2) 1.9 4.5

Total sales change...................................................................... (7.8)% 17.2% 15.2%

Operating income (millions) ........................................................... $ 745 $ 710 $ 583

Percent change........................................................................... 5.0% 21.7% 8.4%

Percent of sales .......................................................................... 23.4% 20.6% 19.8%

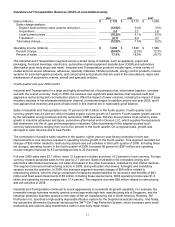

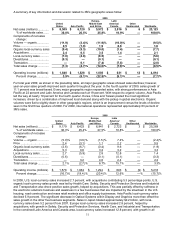

The Safety, Security and Protection Services segment serves a broad range of markets that increase the safety,

security and productivity of workers, facilities and systems. Major product offerings include personal protection

products, safety and security products (including border and civil security solutions), cleaning and protection products

for commercial establishments, track and trace solutions, and roofing granules for asphalt shingles. In the second

quarter of 2008, 3M completed the sale of its HighJump Software business which provided supply chain execution

software solutions. 3M’s Track and Trace Solutions utilize radio frequency identification (RFID) technology to provide

a growing array of solutions — from library patron self-checkout systems to tracking packages.

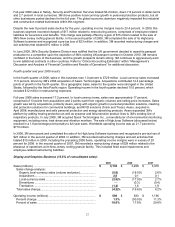

Fourth quarter and year 2009 results:

In Safety, Security and Protection Services, sales grew 13.5 percent in the fourth quarter, or 7.9 percent in local

currency. Foreign exchange impacts added 5.6 percent to fourth quarter sales. Sales growth in the quarter was

largely driven by the personal protection business. In May of 2009, 3M began to see a surge in orders for respirators

approved for use in defending against the H1N1 virus. Since that time, demand has continued to exceed available

supply. 3M recently approved respirator capacity investments in both Singapore and in the United States.

Elsewhere within this segment, local-currency sales growth was slightly positive in the building and commercial

services business, driven by a number of new product introductions, but all other businesses posted lower year-on-

year sales. In particular, 3M saw more than 10 percent local-currency sales declines in its industrial-oriented

corrosion protection products business, and in businesses linked closely to residential construction, such as roofing

granules.

Fourth-quarter operating income increased to $201 million, with operating income margins at 24.3 percent. Fourth

quarter 2008 included $12 million in restructuring expenses.