3M 2009 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) is designed to

provide a reader of 3M’s financial statements with a narrative from the perspective of management. 3M’s MD&A is

presented in nine sections:

Beginning

page

• Overview 13

• Results of Operations 16

• Performance by Business Segment 20

• Performance by Geographic Area 30

• Critical Accounting Estimates 33

• New Accounting Pronouncements 36

• Financial Condition and Liquidity 36

• Financial Instruments 42

• Forward-Looking Statements 42

OVERVIEW

3M is a diversified global manufacturer, technology innovator and marketer of a wide variety of products. As

discussed in Note 17 to the Consolidated Financial Statements, effective in the first quarter of 2009, 3M made certain

business segment realignments, including both product moves between business segments and reporting changes

related to revised U.S. performance measures. The financial information presented herein reflects the impact of

these changes for all periods presented. 3M manages its operations in six operating business segments: Industrial

and Transportation; Health Care; Consumer and Office; Safety, Security and Protection Services; Display and

Graphics; and Electro and Communications.

3M’s quarterly year-on-year business results got stronger as 2009 progressed, with first nine-month 2009 year-on-

year comparisons significantly negatively impacted by the economic downturn that began impacting 3M in the fourth

quarter of 2008. For total year 2009, while sales declined 8.5 percent and organic volumes declined 9.5 percent,

worldwide industrial production is expected to be down by a similar amount and 3M’s sales performance was in line

with the overall economy. 3M restructured a number of businesses during the year, resulting in 2009 total year

savings of almost $400 million, with estimated additional incremental savings of more than $150 million in 2010. In

addition, 3M amended its policy regarding banked vacation, which added more than $100 million to operating income

in 2009, with a slightly lower benefit expected in 2010. 3M also enacted temporary furloughs where appropriate, froze

merit pay and reduced indirect spending. Finally, in the midst of this economic downturn, 3M invested $1.3 billion in

research, development and related expenses during 2009.

3M has been aggressively restructuring the company since early 2008 and continued this effort through the third

quarter of 2009, with these restructuring actions and exit activities in the aggregate resulting in a reduction of

approximately 6,400 positions. 3M aggressively reduced structural costs across the company, including in the

factories. The focus now is to accelerate growth in the various businesses and to add only those expenses that are

absolutely necessary. 3M announced the reduction of approximately 200 positions in the third quarter of 2009, with

the majority of those occurring in Western Europe and, to a lesser extent, the United States. In the second quarter of

2009, 3M permanently reduced approximately 900 positions spanning many businesses and geographies, and in the

United States another 700 people accepted a voluntary retirement option. 3M expects that a small portion of those

who accepted the voluntary separation will be replaced; thus, on a net basis, 3M estimates an employment level

decline of approximately 1,400 to 1,500 due to these second quarter restructuring actions. In the first quarter of 2009,

3M announced the elimination of approximately 1,200 positions. In addition, 3M announced reductions of

approximately 3,500 positions in 2008, with 2,400 of these reductions announced in the fourth quarter of 2008. The

related net restructuring charges and other special items reduced net income attributable to 3M for year 2009 by

$119 million, or $0.17 per diluted share. Special items reduced net income attributable to 3M for year 2008 by $194

million, or $0.28 per diluted share, with $140 million, or $0.20 per diluted share, in the fourth quarter of 2008. Refer to

the special items discussion at the end of this overview section for more detail.

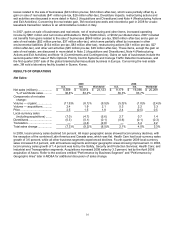

Fourth-quarter 2009 sales totaled $6.1 billion, an increase of 11.1 percent from the fourth quarter of 2008, with all

business segments and major geographic areas showing improvement. Net income attributable to 3M was $935

million, or $1.30 per diluted share. This compares to $536 million, or $0.77 per diluted share, which includes the

impact of restructuring and other special items, in the fourth quarter of 2008.