3M 2009 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2009 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

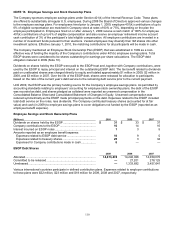

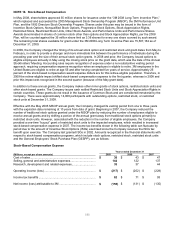

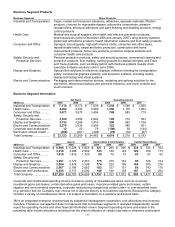

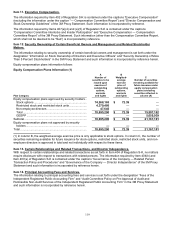

The following table summarizes stock option activity during the twelve months ended December 31:

Stock Option Program

2009 2008 2007

Number of Exercise Number of Exercise Number of Exercise

Options Price* Options Price* Options Price*

Under option — ........................

.

January 1 ..............................

.

75,452,722 $ 71.96 74,613,051 $ 70.50 82,867,903 $ 67.41

Granted:

Annual ...........................

.

6,649,672 53.93 5,239,660 77.22 4,434,583 84.81

Progressive (Reload).....

.

68,189 77.37 78,371 79.53 461,815 87.12

Other..............................

.

4,654 50.85 20,389 79.25 51,730 82.93

Exercised ..........................

.

(6,930,544) 49.83 (3,797,663) 49.38 (12,498,051) 55.34

Canceled ...........................

.

(976,528) 73.50 (701,086) 79.12 (704,929) 77.36

December 31 ........................

.

74,268,165 $ 72.39 75,452,722 $ 71.96 74,613,051 $ 70.50

Options exercisable

December 31 ........................

.

62,414,398 $ 73.73 63,282,408 $ 70.01 58,816,963 $ 66.83

* Weighted average

Outstanding shares under option include grants from previous plans. For options outstanding at December 31, 2009,

the weighted-average remaining contractual life was 58 months and the aggregate intrinsic value was $844 million.

For options exercisable at December 31, 2009, the weighted-average remaining contractual life was 50 months and

the aggregate intrinsic value was $636 million. As of December 31, 2009, there was $68 million of compensation

expense that has yet to be recognized related to non-vested stock option-based awards. This expense is expected to

be recognized over the remaining vesting period with a weighted-average life of 1.7 years.

The total intrinsic values of stock options exercised during 2009, 2008 and 2007, respectively, was $108 million,

$107 million and $373 million. Cash received from options exercised during 2009, 2008 and 2007, respectively, was

$345 million, $188 million and $692 million. The Company’s actual tax benefits realized for the tax deductions related

to the exercise of employee stock options for 2009, 2008 and 2007, respectively, was $38 million, $34 million and

$122 million. Capitalized stock-based compensation amounts were not material for the twelve months ended 2009,

2008, and 2007.

The Company does not have a specific policy to repurchase common shares to mitigate the dilutive impact of

options; however, the Company has historically made adequate discretionary purchases, based on cash availability,

market trends and other factors, to satisfy stock option exercise activity.

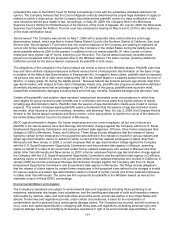

For annual and progressive (reload) options, the weighted average fair value at the date of grant was calculated

using the Black-Scholes option-pricing model and the assumptions that follow.

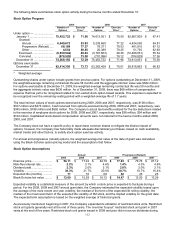

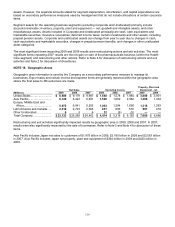

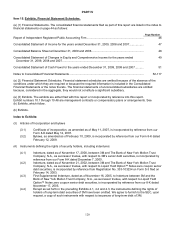

Stock Option Assumptions

Annual Progressive (Reload)

2009 2008 2007 2009 2008 2007

Exercise price.......................... $ 54.11 $ 77.22 $ 84.79 $ 77.83 $ 79.76 $ 87.12

Risk-free interest rate.............. 2.2% 3.1% 4.6% 1.4% 4.3% 4.6%

Dividend yield .......................... 2.3% 2.0% 2.1% 2.0% 2.0% 2.1%

Volatility ................................... 30.3% 21.7% 20.0% 30.7% 18.7% 18.4%

Expected life (months) ............ 71 70 69 32 25 25

Black-Scholes fair value.......... $ 13.00 $ 15.28 $ 18.12 $ 14.47 $ 12.00 $ 13.26

Expected volatility is a statistical measure of the amount by which a stock price is expected to fluctuate during a

period. For the 2009, 2008 and 2007 annual grant date, the Company estimated the expected volatility based upon

the average of the most recent one year volatility, the median of the term of the expected life rolling volatility, the

median of the most recent term of the expected life volatility of 3M stock, and the implied volatility on the grant date.

The expected term assumption is based on the weighted average of historical grants.

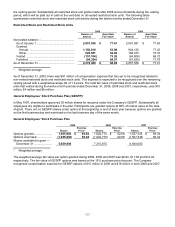

As previously mentioned, beginning in 2007, the Company expanded its utilization of restricted stock units. Restricted

stock unit grants generally vest at the end of three years. The one-time “buyout” restricted stock unit grant in 2007

vests at the end of five years. Restricted stock unit grants issued in 2008 and prior did not accrue dividends during