TomTom 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

/ 83

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

OF TOMTOM NV

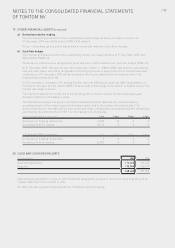

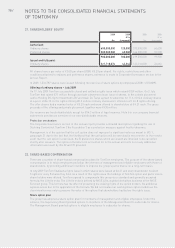

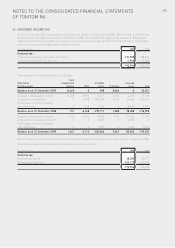

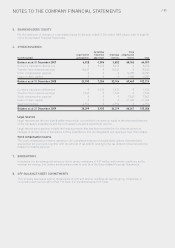

25. DEFERRED INCOME TAX

As at 31 December 2009, the group has a deferred tax liability of €222 million (2008: €229 million). A deferred tax

asset has been recorded amounting to €28 million (2008: €33 million). The deferred tax asset and deferred tax

liability result from timing differences between the tax and accounting treatment of the amortisation of intangible

assets, tax loss carry forwards and certain provisions.

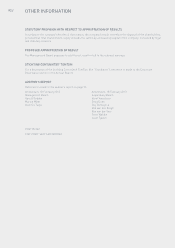

(€ in thousands) 2009 2008

Deferred tax:

To be recovered after more than 12 months -191,958 -188,035

To be recovered within 12 months -1,966 -8,063

-193,924 -196,098

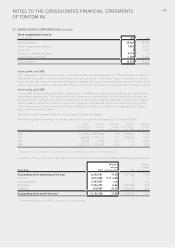

The movement of the deferred tax is as follows:

Stock

Deferred tax compensation Intangible Assessed

(€ in thousands) expense Other assets Provisions losses Total

Balance as at 31 December 2007 14,449 0 898 8,604 0 23,951

Charged / (released) to income -14,258 -8,991 8,471 1,750 -4,270 -17,298

Acquisition of subsidiary 0 2,078 -301,330 -2,466 94,064 -207,654

Net foreign currency exchange

rate differences 0 165 -3,756 0 8,494 4,903

Balance as at 31 December 2008 191 -6,748 -295,717 7,888 98,288 -196,098

Charged / (released) to income 1,456 4,636 10,635 1,959 -19,965 -1,279

Acquisition of subsidiary (note 29) 00-4,877 0 4,877 0

Net foreign currency exchange

rate differences 006,093 0 -2,640 3,453

Balance as at 31 December 2009 1,647 -2,112 -283,866 9,847 80,560 -193,924

Due to the drop in our share price the deferred tax asset related to the stock option plan has been released in 2008.

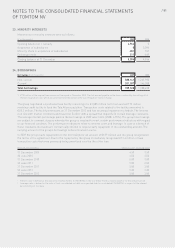

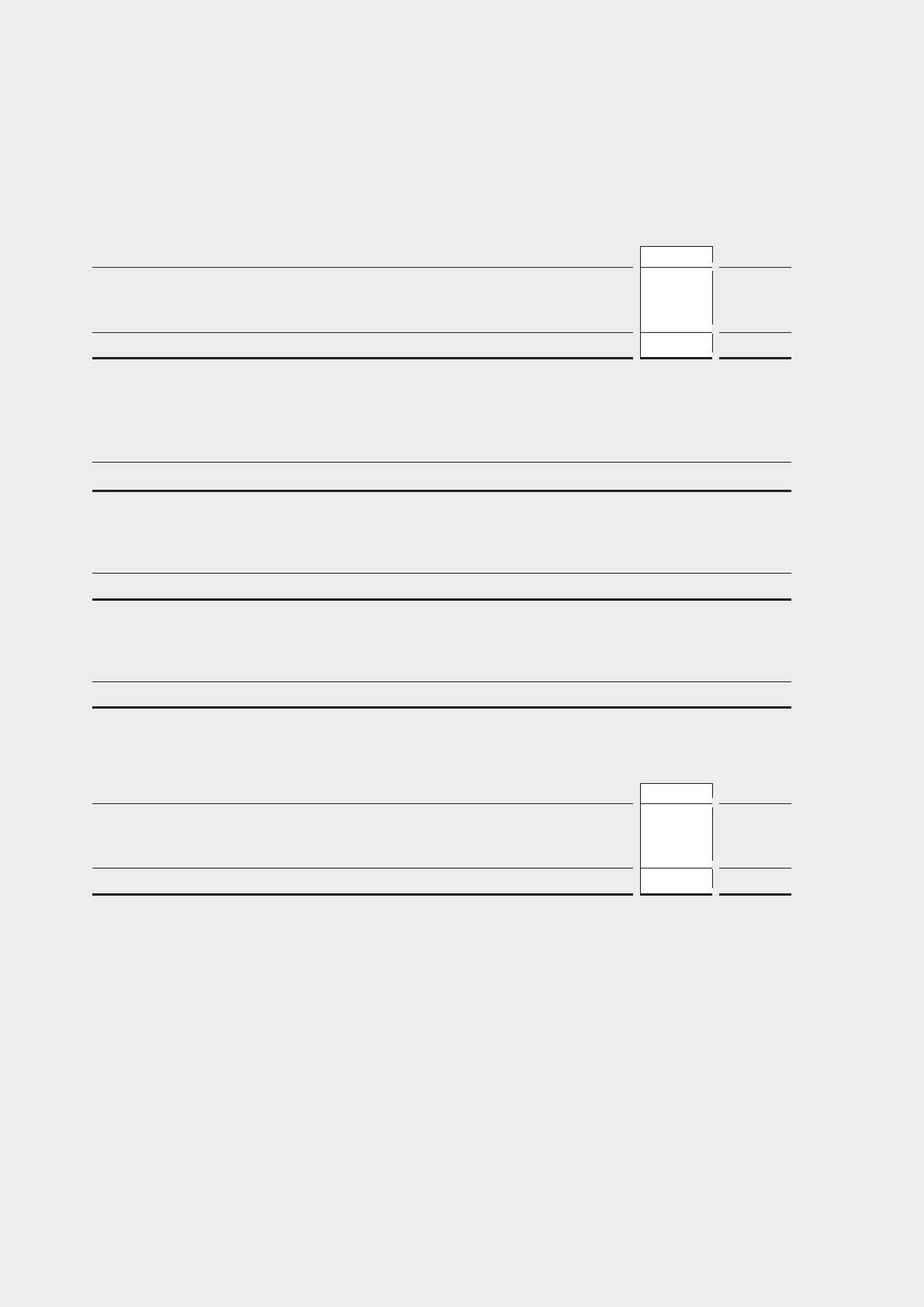

Deferred tax balances are presented in the balance sheet as follows:

(€ in thousands) 2009 2008

Deferred tax:

Deferred tax assets 28,205 32,977

Deferred tax liabilities -222,129 -229,075

-193,924 -196,098