TomTom 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

/ 61

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

OF TOMTOM NV

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Pension costs

The group operates various defined contribution plans and a defined benefit plan for a German subsidiary.

For defined contribution plans, contributions are recognised as employee benefit expenses when they are due.

Prepaid contributions are recognised as an asset to the extent that a cash refund or reduction of future payments

is available.

The assets of the German defined benefit scheme are held separately from those of the group in independently

administered funds. Contributions are charged to the income statement as they become payable, in accordance

with the rules of the scheme. The contributions are included in employee benefit expenses. Full defined benefit

disclosures are not provided given the fact that the plan is not significant.

In Italy, employees are paid a staff leaving indemnity on termination of employment. This is a statutory payment

based on Italian civil law. An amount is accrued each year based on the employees remuneration and previously

revalued accruals. The indemnity has the characteristics of a defined contribution obligation and is an unfunded,

but fully provided liability. The costs of providing benefits under the plans is determined separately for each plan.

Actuarial gains and losses are recognised as either an income or an expense immediately.

Stock compensation expense

The group operates a number of equity-settled share option plans, as well as a cash-settled performance share

plan.

Share option plan

Equity-settled share-based payments are measured at fair value at the date of grant. The fair value determined

at the grant date of the equity-settled share-based payments is expensed on a straight-line basis over the vesting

period, based on the group’s estimate of shares that will eventually vest. Fair value is measured by use of a

binomial tree model. The expected life of the share options used in the model has been adjusted, based on

management’s best estimate, for the effects of non-transferability, exercise restrictions and behavioural

considerations. At each balance sheet date, the entity revises its estimates of the number of options that are

expected to become exercisable. It recognises the impact of the revision of original estimates, if any, in the

income statement, and makes a corresponding adjustment to equity (stock compensation reserve) over the

remaining vesting period. The proceeds received, net of any directly attributable transaction costs, are credited

to share capital (nominal value) and share premium when the options are exercised.

Performance share plan

Cash-settled share-based payments are recognised at the fair value of the liability incurred and are expensed

over the period of the plan. The liability is remeasured at each balance sheet date to its fair value, with all

changes recognised immediately as either a profit or a loss. Fair value is measured using a valuation model

(see note 22).

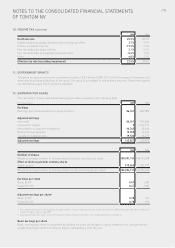

Taxation

Income tax expense represents the sum of the tax currently payable and deferred tax. The group’s income tax

expense is calculated using tax rates that have been enacted or substantively enacted by the balance sheet date.

Deferred taxes are calculated using the liability method. Deferred income taxes reflect the net tax effects of

temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and

the amounts used for income tax purposes. Deferred tax assets and liabilities are measured using the tax rates

expected to apply to taxable income in the years in which those temporary differences are expected to be

recovered or settled, using tax rates (and laws) that have been enacted or substantially enacted by the balance

sheet date. The measurement of deferred tax liabilities and deferred tax assets reflects the tax consequences

that would follow from the manner in which the group expects, at the balance sheet date, to recover or settle the

carrying amount of its assets and liabilities.

Deferred tax assets are recognised when it is probable that sufficient taxable profits will be available against

which the deferred tax assets can be utilised. The carrying amount of deferred tax assets is reviewed at each

balance sheet date and reduced to the extent that it is no longer probable that sufficient taxable profits will be

available to allow all or part of the asset to be recovered.

Current and deferred taxes are recognised as an expense or income in the profit and loss account, except when

they relate to items credited or debited directly to equity. In which case, the tax is also recognised directly in

equity, or where it arises from the initial accounting for a business combination.