TomTom 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76 / NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

OF TOMTOM NV

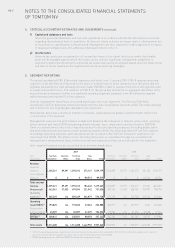

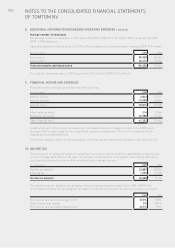

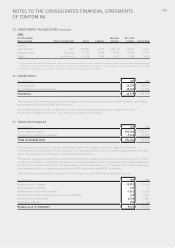

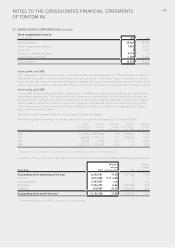

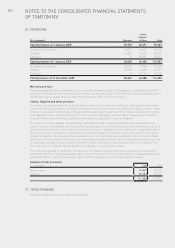

17. TRADE RECEIVABLES (continued)

The following table sets out details of the age of trade accounts receivable that are not overdue, as the payment

terms specified in the terms and conditions established with our customers have not been exceeded, and an

analysis of overdue amounts and related provisions for doubtful trade accounts receivable:

(€ in thousands) 2009 2008

Of which:

Not overdue 281,555 259,093

Overdue <3 months 8,888 39,453

3 to 6 months 5,029 2,178

Over 6 months 7,794 3,209

less provision -9,242 -13,952

Trade receivables (net) 294,024 289,981

Trade accounts receivable include amounts denominated in the following major currencies:

(€ in thousands) 2009 2008

EUR 106,621 135,771

GBP 33,310 39,305

USD 128,213 100,150

Other 25,880 14,755

Trade receivables (net) 294,024 289,981

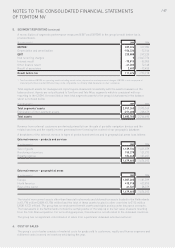

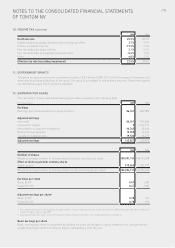

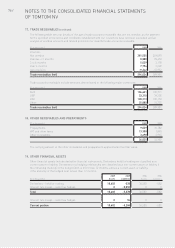

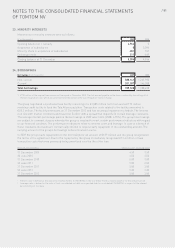

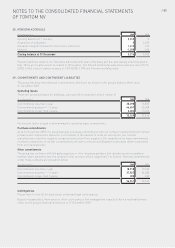

18. OTHER RECEIVABLES AND PREPAYMENTS

(€ in thousands) 2009 2008

Prepayments 9,029 10,182

VAT and other taxes 13,308 1,890

Other receivables 3,698 3,915

26,035 15,987

The carrying amount of the other receivables and prepayments approximates their fair value.

19. OTHER FINANCIAL ASSETS

Other financial assets include derivative financial instruments. Derivatives held for trading are classified as a

current asset or liability. Derivatives in a hedging relationship are classified as a non-current asset or liability if

the remaining maturity of the hedged item is more than 12 months, and as a current asset or liability,

if the maturity of the hedged item is less than 12 months.

2009 2009 2008 2008

(€ in thousands) Assets Liabilities Assets Liabilities

Derivatives – held for trading 10,602 -328 36,583 -582

Interest rate swaps – cash flow hedges 0 -5,050 00

Total 10,602 -5,378 36,583 -582

Interest rate swaps – cash flow hedges 0 94 00

Current portion 10,602 -5,284 36,583 -582