TomTom 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78 / NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

OF TOMTOM NV

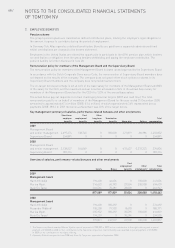

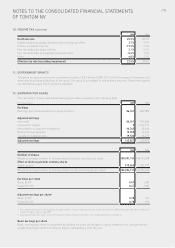

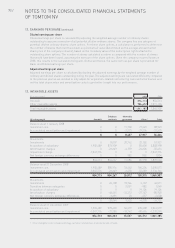

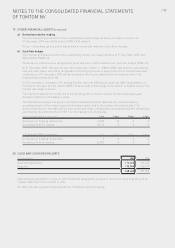

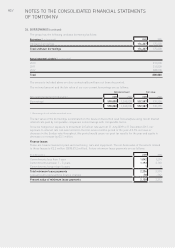

21. SHAREHOLDERS’ EQUITY

2009 2009 2008 2008

(€ in (€ in

No. thousands) No. thousands)

Authorised:

Ordinary shares 600,000,000 120,000 333,000,000 66,600

Preferred shares 300,000,000 60,000 166,500,000 33,300

900,000,000 180,000 499,500,000 99,900

Issued and fully paid:

Ordinary shares 221,718,074 44,344 123,316,000 24,663

All shares have a par value of €0.20 per share (2008: €0.20 per share). For rights, restrictions and other

conditions attached to ordinary and preference shares, reference is made to Corporate Governance section in the

Annual Report.

In 2009, 1,534,787 shares were issued following the exercise of share options by employees (2008: 1,530,689).

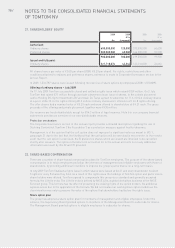

Offering of ordinary shares – July 2009

On 17 July 2009 TomTom successfully closed and settled a rights issue which raised €359 million. On 2 July

TomTom had raised €71 million through a private placement via an issue of shares. In the private placement

Janivo Holding BV, Cyrte Investments BV and Alain De Taeye agreed to subscribe for 11.6 million ordinary shares

at a price of €6.12. In the rights offering 85.3 million ordinary shares were offered in a 5 for 8 rights offering.

The offer shares had a nominal value of €0.20 each and were offered to shareholders at €4.21 each. The gross

proceeds of the offering and private placement together were €430 million.

Our reserves are freely distributable except for €34.3 million of legal reserves. Note 6 in our company financial

statements provides an overview of our non-distributable reserves.

Protection mechanism

The Corporate Governance section of this annual report provides a detailed description regarding the use of

Stichting Continüiteit TomTom (“the Foundation”) as a protection measure against hostile takeovers.

Management is of the opinion that the call option does not represent a significant value as meant in IAS 1,

paragraph 31 due to the fact that the likelihood that the call option will be exercised is very remote. In the remote

event that the call option is exercised, the B preference shares which are issued are intended to be cancelled

shortly after issuance. The option is therefore not accounted for in the annual accounts nor is any additional

information as meant by IAS 32 and 39 provided.

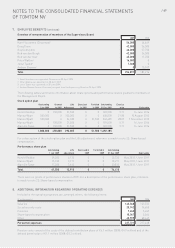

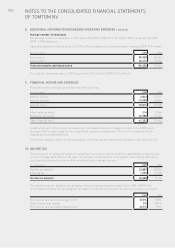

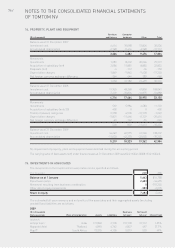

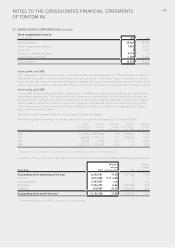

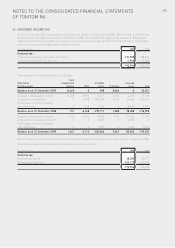

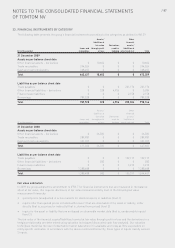

22. SHARE-BASED COMPENSATION

There are a number of share-based compensation plans for TomTom employees. The purpose of the share-based

compensation is to retain employees and align the interests of management and eligible employees with those of

shareholders, by providing additional incentives to improve the group’s performance on a long-term basis.

In July 2009 TomTom finalised a rights issue in which shares were issued at €4.21 and every shareholder received

5 rights for every 8 shares they held. As a result of this rights issue the holdings of TomTom option and performance

share holders were diluted. TomTom agreed to compensate this group via a standard and generally accepted

formula; the Liffe formula. The Liffe formula is defined by NYSE Liffe, a global derivatives business of the NYSE

Euronext group. This formula has the effect of preserving the existing rights of the option holders. No additional

expense arises due to the application of the formula. We did not revalue our existing share option models as the

clear intention was only to preserve the value of the options that shareholders had before the rights issue.

Share option plan

The group has adopted a share option plan for members of management and eligible employees. Under the

scheme, the Supervisory Board granted options to members of the Management Board to subscribe for shares.

The Management Board granted options to eligible employees to subscribe for shares.