TomTom 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

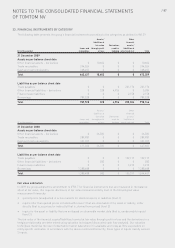

82 / NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

OF TOMTOM NV

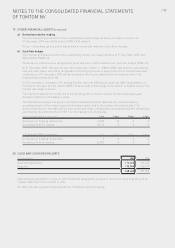

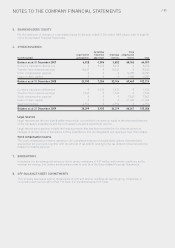

24. BORROWINGS (continued)

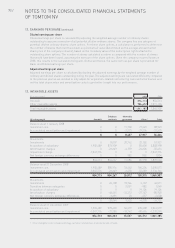

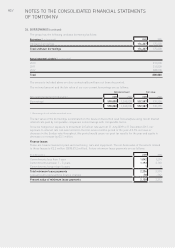

The group has the following undrawn borrowing facilities:

Borrowings (€ in thousands) 2009 2008

Undrawn borrowings 174,227 175,000

Total undrawn borrowings 174,227 175,000

Annual repayment schedule (€ in thousands)

2010 210,000

2011 210,000

2012 388,000

Total 808,000

The amounts included above are due contractually and have not been discounted.

The notional amount and the fair value of our non-current borrowings are as follows:

Notional amount Fair value

Non-current borrowings (€ in thousands) 2009 2008 2009 2008

Borrowings1598,000 1,268,000 552,587 930,355

598,000 1,268,000 552,587 930,355

1 Borrowings do not include amortised costs.

The fair value of the borrowings is estimated on the basis of discounted cash flow analysis using recent market

interest rate paid by comparable companies on borrowings with comparable terms.

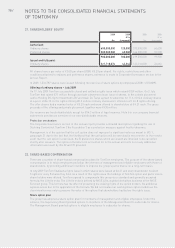

Since we hedged our exposure to movement in Euribor rate as from 31 July 2009 to 31 December 2011, our

exposure to interest rate risk was limited to the first seven months period of the year. A 0.5% increase or

decrease in the Euribor rate throughout this period would cause our post tax results for the year and equity to

decrease or increase by €3.1 million.

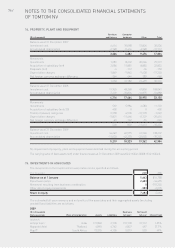

Finance leases

These are finance leases for plant and machinery, cars and equipment. The net book value of the assets related

to these leases is €2.2 million (2008:€3.2 million). Future minimum lease payments are as follows:

(€ in thousands) 2009 2008

Commitments less than 1 year 1,042 1,214

Commitments between 1 – 5 years 1,193 2,160

Commitments longer than 5 years 10

Total minimum lease payments 2,236 3,374

Less amounts representing finance charges -78 -162

Present value of minimum lease payments 2,158 3,212