TomTom 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72 / NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

OF TOMTOM NV

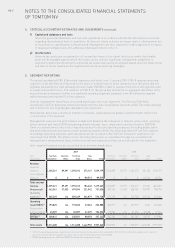

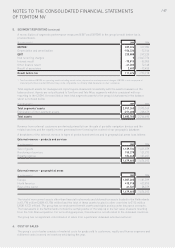

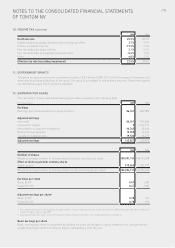

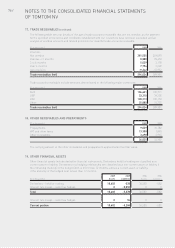

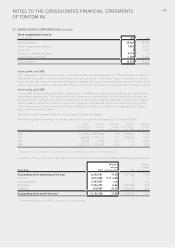

12. EARNINGS PER SHARE (continued)

Diluted earnings per share

Diluted earnings per share is calculated by adjusting the weighted average number of ordinary shares

outstanding to assume conversion of all potential dilutive ordinary shares. The company has one category of

potential dilutive ordinary shares: share options. For these share options, a calculation is performed to determine

the number of shares that could have been acquired at fair value (determined as the average annual market

share price of the company’s shares), based on the monetary value of the subscription rights attached to

outstanding share options. The number of shares calculated as above is compared with the number of shares

that would have been issued, assuming the exercise of the share options. Given the company incurred losses in

2008, this results in the calculation being anti-dilutive and hence, the same net loss per share is presented for

Basic and Diluted earnings per share.

Adjusted earnings per share

Adjusted earnings per share is calculated by dividing the adjusted earnings by the weighted average number of

ordinary and diluted shares outstanding during the year. The adjusted earnings are calculated differently compared

to the previous year as we decided to only adjust for acquisition-related restructuring costs and amortisation and

not the total depreciation and amortisation costs to give better insight into our performance.

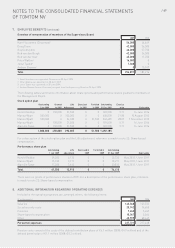

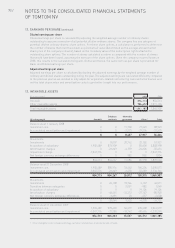

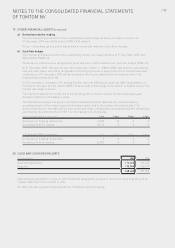

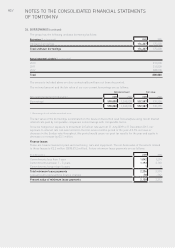

13. INTANGIBLE ASSETS

(€ in thousands) 2009 2008

Goodwill 854,713 854,713

Other intangible assets 986,472 1,011,194

Total intangible assets 1,841,185 1,865,907

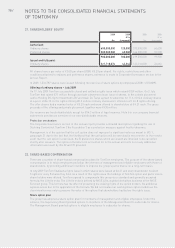

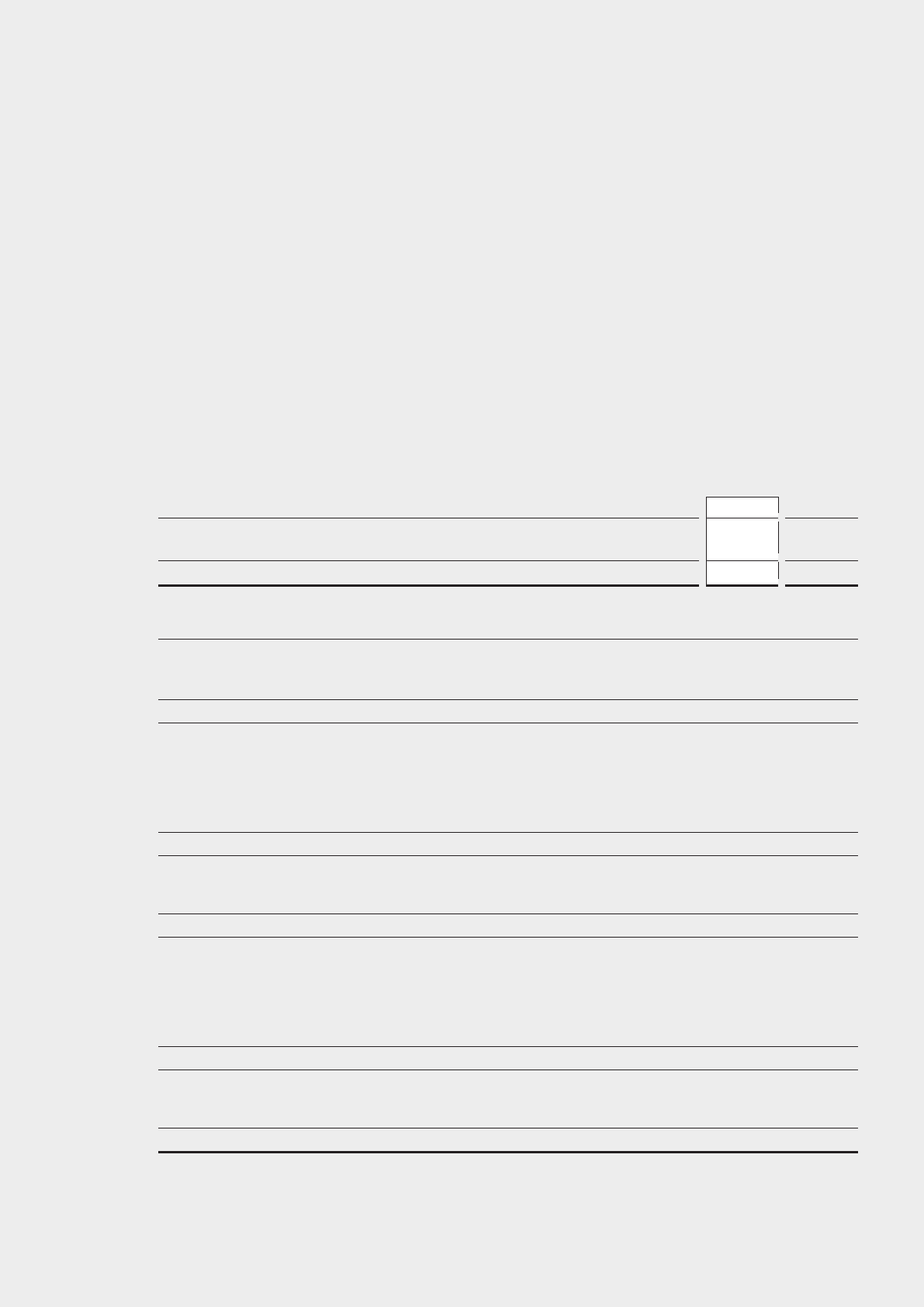

Database Internally

(€ in thousands) Goodwill and tools generated Other1Total

Balance as at 1 January 2008

Investment cost 0011,700 77,223 88,923

Accumulated amortisation and impairment 00-3,273 -29,306 -32,579

008,427 47,917 56,344

Movements

Investments 0 8,007 20,762 23,152 51,921

Acquisition of subsidiary 1,902,489 872,909 0 83,600 2,858,998

Amortisation charges 0 -26,649 -4,159 -24,606 -55,414

Impairment charge -1,047,776 0 0 0 -1,047,776

Net foreign currency exchange differences 0 0 982 852 1,834

854,713 854,267 17,585 82,998 1,809,563

Balance as at 31 December 2008

Investment cost 1,902,489 880,916 32,462 184,204 3,000,071

Accumulated amortisation and impairment -1,047,776 -26,649 -6,450 -53,289 -1,134,164

854,713 854,267 26,012 130,915 1,865,907

Movements

Investments 0 20,108 19,766 3,137 43,011

Transfers between categories 002,051 -982 1,069

Acquisition of subsidiary 00019,126 19,126

Amortisation charges 0 -46,461 -12,312 -27,147 -85,920

Net foreign currency exchange differences 0 -1,691 20 -337 -2,008

0 -28,044 9,525 -6,203 -24,722

Balance as at 31 December 2009

Investment cost 1,902,489 899,603 54,279 205,208 3,061,579

Accumulated amortisation and impairment -1,047,776 -73,380 -18,742 -80,496 -1,220,394

854,713 826,223 35,537 124,712 1,841,185

1 Other intangible assets include technology, customer relationships, brand name and software.