TomTom 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 / NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

OF TOMTOM NV

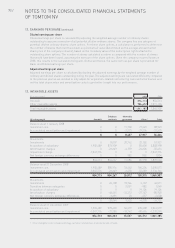

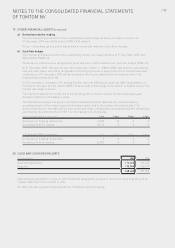

22. SHARE-BASED COMPENSATION (continued)

Performance share plan

In 2007 and 2008 the group introduced performance share plans for employees. Conditional awards of TomTom

shares were made under the share-based incentive plans of 2007 and 2008. In 2008 all employees, except for

Management Board members, were offered the choice of 100% vesting or the original vesting criteria. The

original vesting criteria can result in a vesting ranging from 0-150% of the conditional award. The actual vesting

percentage depends on the total shareholder return of TomTom NV compared to other companies listed in the

AEX index, and the EPS growth of TomTom NV. For the performance shares granted in 2007 and 2008, the

measurement period is three years starting at 1 January 2007 and 1 January 2008 respectively. On 31 December 2009

the liability with regard to the performance share plan is €2.1 million (2008: €0.7 million).

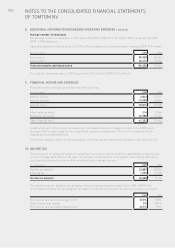

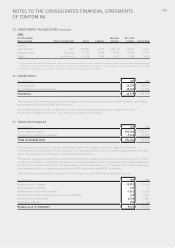

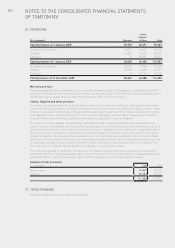

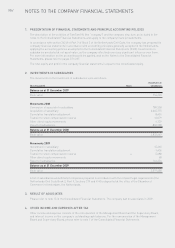

The following table provides more information about the performance shares which were conditionally awarded in

2007 and 2008. There were no awards made in 2009.

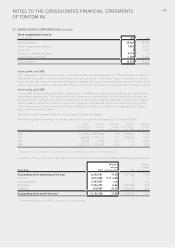

Share plans 2009 2008

Outstanding at the beginning of the year 482,200 185,100

Granted 0347,400

Liffe adjustment 102,669 0

Exercised 00

Forfeited -21,009 -50,300

Outstanding at the end of the year 563,860 482,200

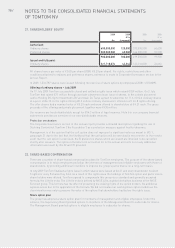

Valuation assumptions

The fair value of the performance shares granted in 2008 was determined by a valuation model. The model

contains several input variables, including the share price at reporting date and an expected leavers’ percentage.

The fair value is calculated at each reporting period.

The fair value of the share options granted in June 2009 was determined by the Binomial tree model. This model

contains the input variables, including the risk-free interest rate, volatility of the underlying share price, exercise

price and share price at the date of grant. The fair value calculated is allocated on a straight-line basis over the

vesting period, based on the group’s estimate of equity instruments that will eventually vest.

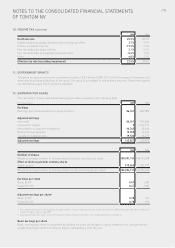

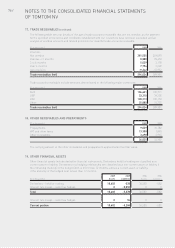

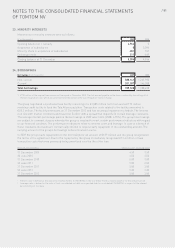

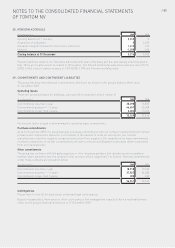

The input into the share option 2009 valuation model is as follows: 2009

Share price at grant date1(euro) 7.26

Weighted average exercise price1(euro) 6.91-7.26

Weighted average expected volatility 55%

Expiration date 16 June 2016

Weighted average risk free rate 3.56%

Expected dividends Zero

1 Prices disclosed are pre-rights issue.

The option valuation models require the input of highly subjective assumptions, including the expected stock price

volatility. Volatility is determined using industry benchmarking for listed peer group companies, as well as the

historic volatility of the TomTom NV stock price. The group’s employee stock options have characteristics

significantly different from those of traded options, and changes in the subjective input assumptions can

materially affect the fair value estimate.