TCF Bank 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72 : TCF Financial Corporation and Subsidiaries

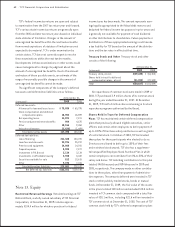

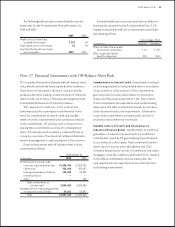

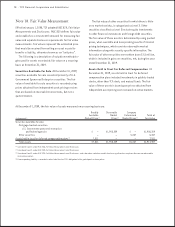

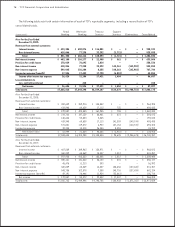

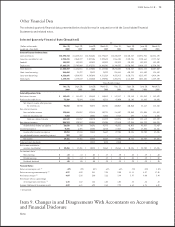

The carrying amounts and fair values of the Company’s remaining nancial instruments are set forth in the following table.

This information represents only a portion of TCF’s balance sheet and not the estimated value of the Company as a whole.

Non-nancial instruments such as the value of TCF’s branches and core deposits, leasing operations and the future revenues from

TCF’s customers are not reected in this disclosure. Therefore, use of this information to assess the value of TCF is limited.

At December 31,

2008

Carrying Estimated

(In thousands) Amount Fair Value

Financial instrument assets:

Cash and due from banks $ 342,380 $ 342,380

Investments 155,725 155,725

Securities available for sale 1,966,104 1,966,104

Loans:

Consumer real estate and other 7,364,340 7,199,684

Commercial real estate 2,984,156 2,860,293

Commercial business 506,887 488,821

Equipment nance loans 789,869 790,970

Inventory nance loans 4,425 4,425

Allowance for loan losses(1) (172,442) –

Total nancial instrument assets $13,941,444 $13,808,402

Financial instrument liabilities:

Checking, savings and money market deposits $ 7,647,069 $ 7,647,069

Certicates of deposit 2,596,283 2,612,874

Short-term borrowings 226,861 226,861

Long-term borrowings 4,433,913 4,964,682

Total nancial instrument liabilities $14,904,126 $15,451,486

Financial instruments with off-balance-sheet risk:(2)

Commitments to extend credit(3) $ 38,730 $ 38,730

Standby letters of credit(4) (105) (105)

Total nancial instruments with

off-balance-sheet risk $ 38,625 $ 38,625

(1) Expected credit losses are included in the estimated fair values.

(2) Positive amounts represent assets, negative amounts represent liabilities.

(3) Carrying amounts are included in other assets.

(4) Carrying amounts are included in accrued expenses and other liabilities.

Company has made estimates of many of these fair values

which are subjective in nature, involve uncertainties and

matters of signicant judgment and therefore cannot be

determined with precision. Changes in assumptions could

signicantly affect the estimated values. Beginning with

the year ended December 31, 2008, the fair value estimates

are determined in accordance with FASC 820.