TCF Bank 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

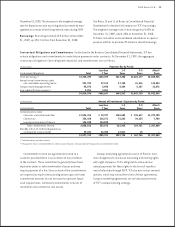

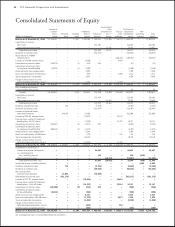

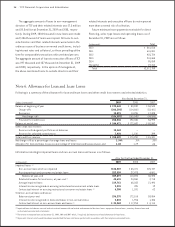

48 : TCF Financial Corporation and Subsidiaries

Consolidated Statements of Equity

Accumulated

Number of Other TCF Financial

Common Additional Comprehensive Treasury Corporation Non-

Shares Preferred Common Paid-in Retained (Loss)/ Stock Stockholders’ controlling Total

(Dollars in thousands) Issued Stock Stock Capital Earnings Income and Other Equity Interests Equity

131,660,749 $ – $1,317 $ 343,744 $ 784,011 $ (34,926) $ (60,772) $ 1,033,374 $ – $ 1,033,374

Comprehensive income:

Net income – – – – 266,808 – – 266,808 – 266,808

Other comprehensive income – – – – – 16,871 – 16,871 – 16,871

Comprehensive income – – – – 266,808 16,871 – 283,679 – 283,679

Dividends on common stock – – – – (124,513) – – (124,513) – (124,513)

Repurchase of 3,910,000

common shares – – – – – – (105,251) (105,251) – (105,251)

Issuance of 198,850 common shares – – – (4,850) – – 4,850 – – –

Cancellation of common shares (140,775) – (1) (615) 569 – – (47) – (47)

Cancellation of common shares

for employee tax withholding (51,275) – (1) (1,409) – – – (1,410) – (1,410)

Amortization of stock compensation – – – 7,430 – – – 7,430 – 7,430

Exercise of stock options, 87,083 shares – – – (992) – – 2,208 1,216 – 1,216

Stock compensation tax benets – – – 4,534 – – – 4,534 – 4,534

Change in shares held in trust for

deferred compensation plans, at cost – – – 6,721 – – (6,721) – – –

131,468,699 $ – $1,315 $ 354,563 $ 926,875 $ (18,055) $(165,686) $ 1,099,012 $ – $ 1,099,012

Pension and postretirement

measurement date change – – – – 65 – – 65 – 65

Subtotal 131,468,699 – 1,315 354,563 926,940 (18,055) (165,686) 1,099,077 – 1,099,077

Comprehensive income:

Net income – – – – 128,958 – – 128,958 – 128,958

Other comprehensive income – – – – – 14,363 – 14,363 – 14,363

Comprehensive income – – – – 128,958 14,363 – 143,321 – 143,321

Dividends on preferred stock – 283 – – (2,540) – – (2,257) – (2,257)

Dividends on common stock – – – – (126,447) – – (126,447) – (126,447)

Issuance of preferred shares

and common warrant – 348,154 – 12,850 – – – 361,004 – 361,004

Issuance of 755,838 common shares – – – (19,573) – – 19,573 – – –

Treasury shares sold to TCF employee

benet plans, 683,787 shares – – – (7,530) – – 17,707 10,177 – 10,177

Cancellation of common shares (223,647) – (3) (4,217) 982 – – (3,238) – (3,238)

Cancellation of common shares

for employee tax withholding (405,674) – (4) (6,474) – – – (6,478) – (6,478)

Amortization of stock compensation – – – 8,344 – – – 8,344 – 8,344

Exercise of stock options, 13,000 shares – – – (173) – – 336 163 – 163

Stock compensation tax benets – – – 10,110 – – – 10,110 – 10,110

Change in shares held in trust for

deferred compensation plans, at cost – – – (17,426) – – 17,426 – – –

130,839,378 $ 348,437 $1,308 $ 330,474 $ 927,893 $ (3,692) $(110,644) $ 1,493,776 $ – $ 1,493,776

Comprehensive income (loss):

Income after income tax expense

Loss attributable to

non-controlling interest

Other comprehensive loss

Comprehensive income (loss)

Investment by non-controlling interest

Dividends on preferred stock

Dividends on common stock

Non-cash deemed

preferred stock dividend

Redemption of preferred stock

Issuance of 719,727 common shares

Treasury shares sold to TCF employee

benet plans, 1,448,640 shares

Cancellation of common shares

Cancellation of common shares

for tax withholding

Amortization of stock compensation

Exercise of stock options, 108,800 shares

Stock compensation tax expense

Change in shares held in trust for

deferred compensation plans, at cost

Cost of issuance of common warrants

See accompanying notes to consolidated nancial statements.