TCF Bank 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

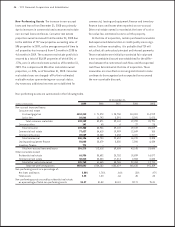

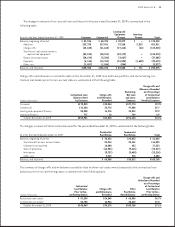

2009 Form 10-K : 39

December 31, 2008. The decrease in the weighted average

rate for deposits was due to pricing decisions made by man-

agement as a result of declining interest rates during 2009.

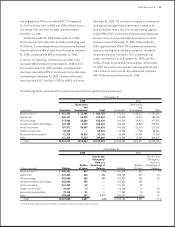

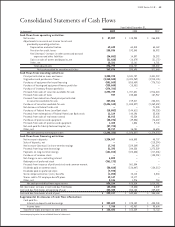

Borrowings totaled $4.8 billion at December

31, 2009, up $94.7 million from December 31, 2008.

See Notes 10 and 11 of Notes to Consolidated Financial

Statements for detailed information on TCF’s borrowings.

The weighted-average rate on borrowings was 4.42% at

December 31, 2009, and 4.48% at December 31, 2008.

TCF does not utilize unconsolidated subsidiaries or special

purpose entities to provide off-balance sheet borrowings.

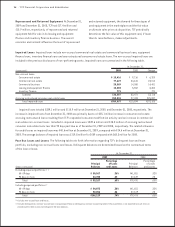

As disclosed in the Notes to Consolidated Financial Statements, TCF has

certain obligations and commitments to make future payments under contracts. At December 31, 2009, the aggregate

contractual obligations (excluding bank deposits) and commitments are as follows.

(In thousands)

Contractual Obligations

Total borrowings (1)

Annual rental commitments under

non-cancelable operating leases

Campus marketing agreements

Visa indemnication expense (2)

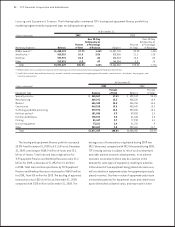

(In thousands)

Commitments

Commitments to lend:

Consumer real estate and other

Commercial

Leasing and equipment nance

Total commitments to lend

Standby letters of credit and guarantees

on industrial revenue bonds

(1) Total borrowings excludes interest.

(2) The payment time is estimated to be less than one year; however, the exact date of the payment can not be determined.

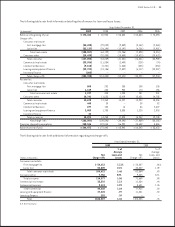

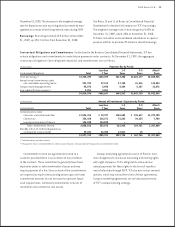

Commitments to lend are agreements to lend to a

customer provided there is no violation of any condition

in the contract. These commitments generally have xed

expiration dates or other termination clauses and may

require payment of a fee. Since certain of the commitments

are expected to expire without being drawn upon, the total

commitment amounts do not necessarily represent future

cash requirements. Collateral predominantly consists of

residential and commercial real estate.

Campus marketing agreements consist of xed or mini-

mum obligations for exclusive marketing and naming rights

with eight campuses. TCF is obligated to make various

annual payments for these rights in the form of royalties

and scholarships through 2029. TCF also has various renewal

options, which may extend the terms of these agreements.

Campus marketing agreements are an important element

of TCF’s campus banking strategy.