TCF Bank 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009 Form 10-K : 71

The change in the balance sheet carrying values associated

with Company determined market priced nancial assets

carried at fair value during the year ended December 31, 2009

was not signicant.

Effective January 1, 2009, TCF adopted Financial

Accounting Standards Codication (FASC) 820-10-65,

Transition and Open Effective Date Information, which

requires TCF to apply the provisions of FASC 820, Fair Value

Measurements and Disclosures, to non-nancial assets

and liabilities measured on a non-recurring basis.

The following is a description of valuation methodologies

used for assets measured on a non-recurring basis.

Long-lived assets held

for sale include real estate owned and repossessed and

returned equipment. The fair value of real estate owned is

based on independent full appraisals, real estate broker’s

price opinions, or automated valuation methods, less esti-

mated selling costs. Certain properties require assumptions

that are not observable in an active market in the deter-

mination of fair value. The fair value of repossessed and

returned equipment is based on available pricing guides,

auction results or third-party price opinions, less estimated

selling costs. Assets that are acquired through foreclosure,

repossession or return are initially recorded at the lower of

the loan or lease carrying amount or fair value less esti-

mated selling costs at the time of transfer to real estate

owned or repossessed and returned equipment. Long-lived

assets held for sale were written down $15.5 million, which

is included in other non-interest expense, during the year

ended December 31, 2009.

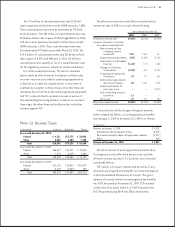

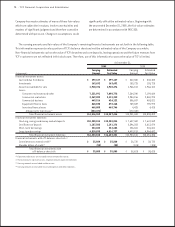

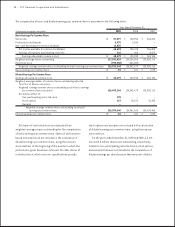

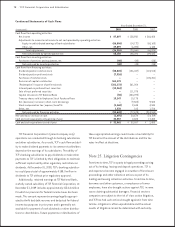

The table below presents the balances of assets measured at fair value on a non-recurring basis at December 31, 2009.

Readily Observable Company

Available Market Determined Total at

(In thousands) Market Prices(1) Prices(2) Market Prices(3) Fair Value

Loans (4) $ – $ – $ 62,794 $ 62,794

Real estate owned (5) – – 71,272 71,272

Repossessed and returned equipment (5) – 14,861 527 15,388

Total $ – $14,861 $134,593 $149,454

(1) Considered Level 1 under FASC 820, Fair Value Measurements and Disclosures.

(2) Considered Level 2 under FASC 820, Fair Value Measurements and Disclosures.

(3) Considered Level 3 under FASC 820, Fair Value Measurements and Disclosures, and is based on valuation models that use signicant assumptions that are not observable

in an active market.

(4) Represents the carrying value of loans for which adjustments are based on the appraisal value of the collateral.

(5) Amounts do not include assets held at cost at December 31, 2009.

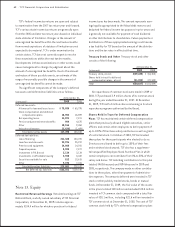

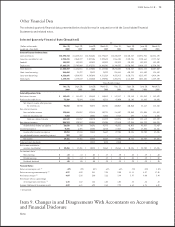

Note 19. Fair Values of Financial Instruments

TCF is required to disclose the estimated fair value of

nancial instruments, both assets and liabilities on and off

the balance sheet, for which it is practicable to estimate fair

value. These fair value estimates are made at December 31,

based on relevant market information and information about

the nancial instruments. Fair value estimates are intended

to represent the price at which an asset could be sold at or

the price for which a liability could be settled for. However,

given there is no active market or observable market

transactions for many of TCF’s nancial instruments, the