TCF Bank 2009 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 : TCF Financial Corporation and Subsidiaries

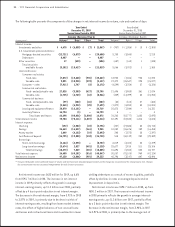

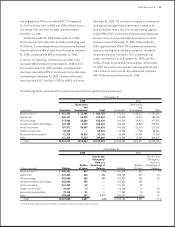

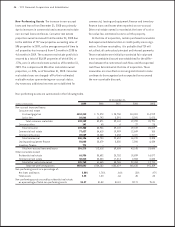

The leasing and equipment nance portfolio increased

23.5% from December 31, 2008 to $3.1 billion at December

31, 2009, consisting of $868.9 million of loans and $2.2

billion of leases. Total loan and lease originations for

TCF Equipment Finance and Winthrop Resources were $1.2

billion for 2009, a decrease of 11.8% from $1.4 billion

in 2008. Total loan and lease purchases by TCF Equipment

Finance and Winthrop Resources increased to $563.9 million

for 2009, from $15 million for 2008. The backlog of approved

transactions was $322.6 million at December 31, 2009,

compared with $328 million at December 31, 2008. The

average size of transactions originated during 2009 was

$82.7 thousand, compared with $92.3 thousand during 2008.

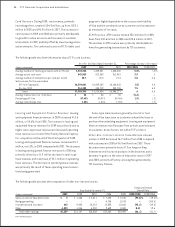

TCF’s leasing activity is subject to risk of cyclical downturns

and other adverse economic developments. In an adverse

economic environment, there may be a decline in the

demand for some types of equipment, resulting in a decline

in the amount of new equipment being placed into service as

well as a decline in equipment values for equipment previously

placed in service. Declines in value of equipment under lease

increase the potential for impairment losses and credit losses

due to diminished collateral value, and may result in lower

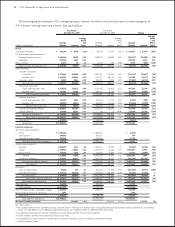

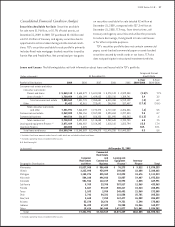

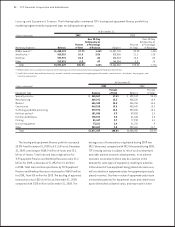

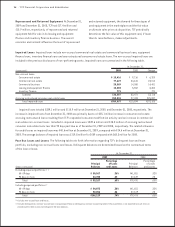

Leasing and Equipment Finance The following tables summarize TCF’s leasing and equipment nance portfolio by

marketing segment and by equipment type, excluding operating leases.

At December 31,

(Dollars in thousands) 2008

Over 30-Day

Delinquency as

Percent a Percentage

Marketing Segment Balance of Total of Balance

Middle market (1) $1,487,749 59.8% 1.45%

Small ticket (2) 525,686 21.1 1.35

Winthrop 328,553 13.2 .08

Other 144,094 5.9 .16

Total $2,486,082 100.0% 1.17%

(1) Middle market consists primarily of loan and lease nancing of construction and manufacturing equipment and specialty vehicles.

(2) Small ticket includes loan and lease nancings to small- and mid-size companies through programs with vendors, manufacturers, distributors, buying groups, and

franchise organizations.

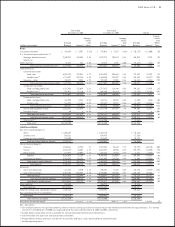

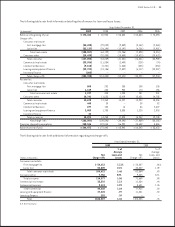

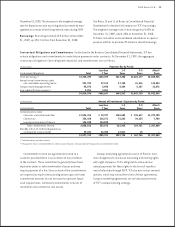

At December 31,

(Dollars in thousands) 2008

Percent

Equipment Type Balance of Total

Specialty vehicles $ 499,519 20.1%

Manufacturing 406,532 16.4

Medical 356,706 14.3

Construction 453,542 18.2

Technology and data processing 259,696 10.4

Golf cart and turf 59,823 2.4

Furniture and xtures 61,443 2.5

Printing 77,939 3.1

Exercise equipment 21,231 .9

Other 289,651 11.7

Total $2,486,082 100.0%