TCF Bank 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 : TCF Financial Corporation and Subsidiaries

The aggregate amount of loans to non-management

directors of TCF and their related interests was $7.5 million

and $8.5 million at December 31, 2009 and 2008, respec-

tively. During 2009, $804 thousand in new loans were made

and $156 thousand of loans were repaid. All loans to out-

side directors and their related interests were made in the

ordinary course of business on normal credit terms, includ-

ing interest rates and collateral, as those prevailing at the

time for comparable transactions with unrelated persons.

The aggregate amount of loans to executive ofcers of TCF

was $97 thousand and $57 thousand at December 31, 2009

and 2008, respectively. In the opinion of management,

the above mentioned loans to outside directors and their

related interests and executive ofcers do not represent

more than a normal risk of collection.

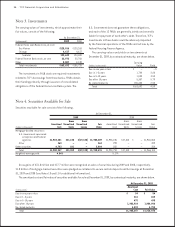

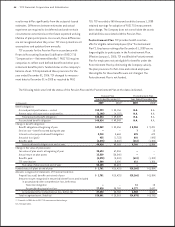

Future minimum lease payments receivable for direct

nancing, sales-type leases and operating leases as of

December 31, 2009 are as follows.

(In thousands) Total

2010 $ 881,616

2011 641,081

2012 425,724

2013 241,865

2014 95,059

Thereafter 27,414

Total $2,312,759

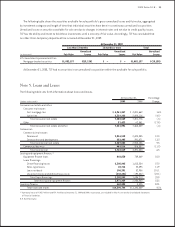

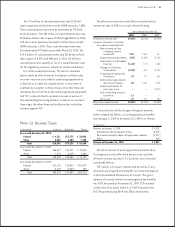

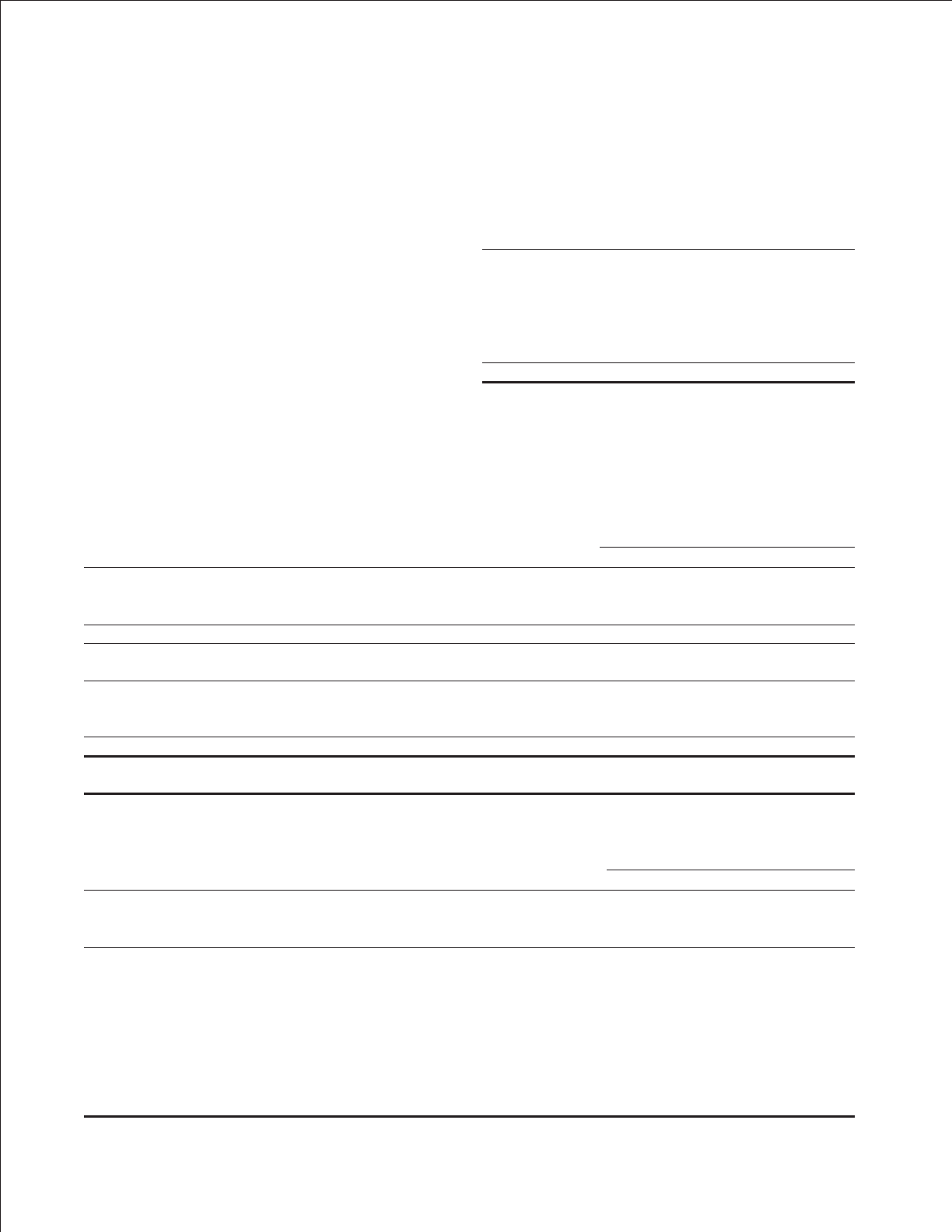

Note 6. Allowance for Loan and Lease Losses

Following is a summary of the allowance for loan and lease losses and other credit loss reserves and selected statistics.

Year Ended December 31,

(Dollars in thousands) 2008 2007

Balance at beginning of year $ 80,942 $ 58,543

Charge-offs (114,800) (52,421)

Recoveries 14,255 17,828

Net charge-offs (100,545) (34,593)

Provision for credit losses 192,045 56,992

Balance at end of year $ 172,442 $ 80,942

Other credit loss reserves:

Reserves netted against portfolio asset balances – –

Reserves for unfunded commitments 1,510 399

Total credit loss reserves $ 173,952 $ 81,341

Net charge-offs as a percentage of average loans and leases .78% .30%

Allowance for loan and lease losses as a percentage of total loans and leases at year-end 1.29 .66

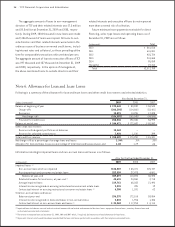

Information relating to impaired loans and non-accrual loans and leases is as follows.

At or For the Year Ended December 31,

(In thousands) 2008 2007

Impaired loans: (1)

Non-accrual loans which are impaired $ 83,471 $25,737

Accruing restructured consumer real estate loans 27,423 4,861

Balance at year-end 110,894 30,598

Related allowance for loan losses, at year-end (2) 24,558 2,718

Average impaired loans 68,283 21,490

Interest income recognized on accruing restructured consumer real estate loans 495 19

Contractual interest on accruing restructured consumer real estate loans (3) 1,331 62

Total non-accrual loans and leases:

Balance at year-end 172,518 59,854

Interest income recognized on loans and leases in non-accrual status 1,956 1,386

Contractual interest on non-accrual loans and leases (3) $ 17,953 $ 8,114

(1) Impaired loans include non-accrual and restructured commercial real estate and commercial business loans, equipment nance loans, inventory nance loans and

restructured consumer real estate loans.

(2) There were no impaired loans at December 31, 2009, 2008 and 2007 which, if required, did not have a related allowance for loan losses.

(3) Represents interest which would have been recorded had the loans and leases performed in accordance with their original contractual terms.