TCF Bank 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 : TCF Financial Corporation and Subsidiaries

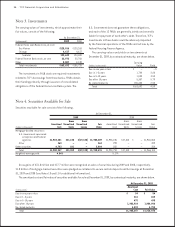

Note 1. Summary of Significant

Accounting Policies

The consolidated nancial

statements include the accounts of TCF Financial Corporation

and its wholly owned subsidiaries. TCF Financial Corporation,

a Delaware corporation, is a nancial holding company

engaged primarily in retail banking and wholesale banking

through its primary subsidiary, TCF Bank. TCF Bank owns

leasing and equipment nance, inventory nance and

REIT subsidiaries. These subsidiaries are consolidated with

TCF Bank and are included in the consolidated nancial

statements of TCF Financial Corporation. All signicant

intercompany accounts and transactions have been

eliminated in consolidation.

Certain reclassications have been made to prior

years’ nancial statements to conform to the current year

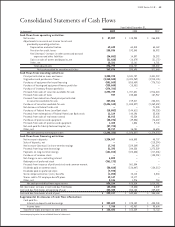

presentation. For Consolidated Statements of Cash Flows

purposes, cash and cash equivalents include cash and due

from banks.

The preparation of nancial statements in conformity

with generally accepted accounting principles requires

management to make estimates and assumptions that

affect the reported amounts of assets and liabilities,

disclosure of contingent assets and liabilities at the date of

the nancial statements and the reported amount of rev-

enues and expenses during the reporting period. These esti-

mates are based on information available to management

at the time the estimates are made. Actual results could

differ from those estimates. Management has evaluated

subsequent events for disclosure or recognition up to the

time of ling these nancial statements with the Securities

and Exchange Commission on February 16, 2010.

Policies Related to Critical Accounting Estimates

Critical

accounting estimates occur in certain accounting policies

and procedures and are particularly susceptible to sig-

nicant change. Policies that contain critical accounting

estimates include the determination of the allowance for

loan and lease losses, lease nancings and income taxes.

Critical accounting policies are discussed with and reviewed

by TCF’s Audit Committee.

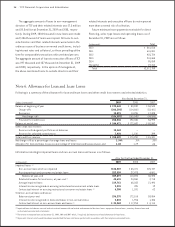

Allowance for Loan and Lease Losses The allowance

for loan and lease losses is maintained at a level believed

by management to be appropriate to provide for probable

loan and lease losses incurred in the portfolio as of the bal-

ance sheet date, including known or anticipated problem

loans and leases, as well as for loans and leases which

are not currently known to require specic allowances.

Management’s judgment as to the amount of the allowance

is a result of ongoing review of larger individual loans and

leases, the overall risk characteristics of the portfolios,

changes in the character or size of the portfolios, geographic

location and prevailing economic conditions. Additionally,

the level of impaired and non-performing assets, historical

net charge-off amounts, delinquencies in the loan and lease

portfolios, values of underlying loan and lease collateral and

other relevant factors are reviewed to determine the amount

of the allowance. Impaired loans include non-accrual and

restructured commercial real estate and commercial busi-

ness loans, equipment nance loans, inventory nance loans

and restructured consumer real estate loans. Loan impair-

ment is generally measured as the present value of the

expected future cash ows discounted at the loan’s initial

effective interest rate. The fair value of the collateral for

fully collateral-dependent loans may be used to determine

loan impairment. Most consumer real estate loans and all

leases are excluded from the denition of an impaired loan

and are evaluated on a pool basis.

Loans and leases are charged off to the extent they are

deemed to be uncollectible. The amount of the allowance

for loan and lease losses is highly dependent upon manage-

ment’s estimates of variables affecting valuation, appraisals

of collateral, evaluations of performance and status, and

the amounts and timing of future cash ows expected to

be received on impaired loans. Such estimates, appraisals,

evaluations and cash ows may be subject to frequent

adjustments due to changing economic prospects of

borrowers, lessees or properties. These estimates are

reviewed periodically and adjustments, if necessary, are

recorded in the provision for credit losses in the periods

in which they become known.

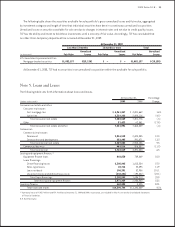

Lease Financing TCF provides various types of lease

nancing that are classied for accounting purposes as

direct nancing, sales-type or operating leases. Leases

Notes to Consolidated Financial Statements