TCF Bank 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 : TCF Financial Corporation and Subsidiaries

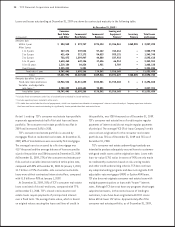

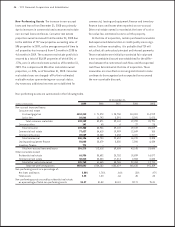

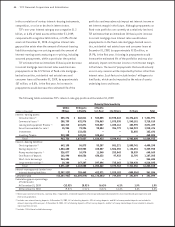

Potential problem loans and leases are summarized as follows.

At December 31,

2008

Principal Percentage

(Dollars in thousands) Balances of Portfolio

Commercial real estate $137,332 4.60%

Commercial business 27,127 5.35

Leasing and equipment nance 20,994 .84

Total $185,453 3.10

loans and leases are primarily classied as substandard for

regulatory purposes and reect the distinct possibility, but

not the probability, that the Company will not be able to

collect all amounts due according to the contractual terms

of the loan or lease agreement. Although these loans and

leases have been identied as potential problem loans and

leases, they may never become delinquent, non-performing

or impaired. At December 31, 2009, approximately 98% of

these loans were less than 60 days past due. Additionally,

these loans and leases are generally secured by commercial

real estate or other assets, thus reducing the potential for

loss should they become non-performing. Potential problem

loans and leases are considered in the determination of the

adequacy of the allowance for loan and lease losses.

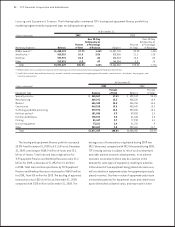

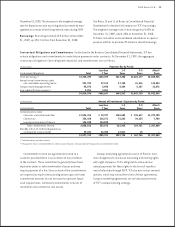

TCF manages its liquidity position

to ensure that the funding needs of depositors and borrowers

are met promptly and in a cost-effective manner. Asset

liquidity arises from the ability to convert assets to cash as

well as from the maturity of assets. Liability liquidity results

from the ability of TCF to maintain a diverse set of funding

sources to promptly meet funding requirements.

Deposits are the primary source of TCF’s funds for use in

lending and for other general business purposes. In addition

to deposits, TCF derives funds from loan and lease repay-

ments and borrowings. Deposit inows and outows are

signicantly inuenced by general interest rates, money

market conditions, competition for funds, customer service

and other factors. TCF’s deposit inows and outows have

been and will continue to be affected by these factors.

Borrowings may be used to compensate for reductions in

normal sources of funds, such as deposit inows at less than

projected levels, net deposit outows or to fund balance

sheet growth. Historically, TCF has borrowed primarily from

the FHLB, from institutional sources under repurchase

agreements and from other sources. At December 31, 2009,

TCF had $2.8 billion in unused secured borrowing capacity

under these funding sources. See “Management’s Discussion

and Analysis of Financial Condition and Results of Operations

– Consolidated Financial Condition Analysis – Borrowings.”

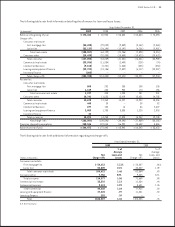

Potential sources of liquidity for TCF include secured

borrowings from FHLB and the Federal Reserve Discount

Window or other unsecured and uncommitted short-term

lines, and issuance of debt and equity securities. TCF Bank’s

ability to pay dividends or make other capital distributions

to TCF is restricted by regulation and may require regula-

tory approval.

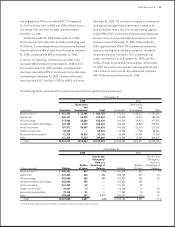

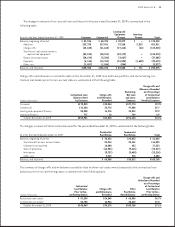

Deposits totaled $11.6 billion at December 31,

2009, up $1.3 billion from December 31, 2008. Checking,

savings and money market deposits are an important source

of low-cost funds and fee income for TCF. Checking, savings

and money market deposits totaled $10.4 billion, up $2.7

billion from December 31, 2008, and comprised 90% of total

deposits at December 31, 2009, compared with 75% of total

deposits at December 31, 2008. The average balance of these

deposits for 2009 was $9.5 billion, an increase of $2 billion

over the $7.5 billion average balance for 2008. Certicates of

deposit totaled $1.2 billion at December 31, 2009, down $1.4

billion from December 31, 2008. TCF had no brokered deposits

at December 31, 2009 or 2008. Non-interest bearing deposits

represented 21% and 22% of total deposits as of December

31, 2009 and 2008, respectively. TCF’s weighted-average

cost for deposits, including non-interest bearing deposits,

was .65% at December 31, 2009, compared with 1.61% at