TCF Bank 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009 Form 10-K : 31

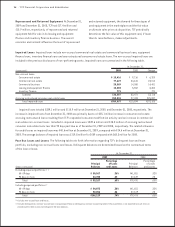

sales-type revenue at the end of the contractual lease term.

See Note 1 of Notes to Consolidated Financial Statements

— Policies Related to Critical Accounting Estimates for

information on lease accounting.

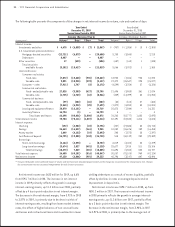

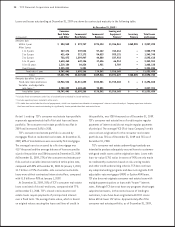

At December 31, 2009 and 2008, $254.9 million and

$56.3 million, respectively, of TCF’s lease portfolio were

discounted on a non-recourse basis with third-party

nancial institutions and, consequently, TCF retains no

credit risk on such amounts. The leasing and equipment

nance portfolio tables above include lease residuals.

Lease residuals represent the estimated fair value of the

leased equipment at the expiration of the initial term of

the transaction and are reviewed on an ongoing basis. Any

downward revisions in estimated fair value are recorded

in the periods in which they become known. At December 31,

2009, lease residuals totaled $106.3 million, or 8.7% of

original equipment value, compared with $52.9 million, or

6.3% of original equipment value, at December 31, 2008.

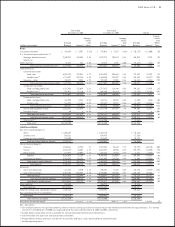

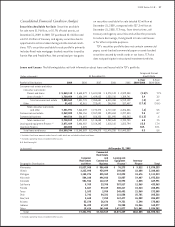

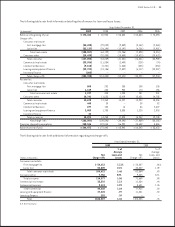

TCF Inventory Finance The following table summarizes

the TCF Inventory Finance portfolio by marketing segment.

(Dollars in thousands)

Equipment Type

Lawn and garden

Electronics and appliances

Total

In the third quarter of 2009, TCF formed a joint venture

with The Toro Company (“Toro”) called Red Iron Acceptance,

LLC (“Red Iron”). Red Iron provides U.S. distributors and

dealers and select Canadian distributors of the Toro and

Exmark brands with reliable, cost-effective sources of

nancing. TCF and Toro will maintain a 55% and 45% own-

ership interest, respectively, in Red Iron. As TCF has

a controlling nancial interest in Red Iron, its nancial

results are consolidated in TCF’s nancial statements.

Toro’s interest is reported as a non-controlling interest

within equity and qualies as tier 1 regulatory capital.

In the fourth quarter of 2009, Red Iron purchased $90.8

million of inventory nance loans from Toro.

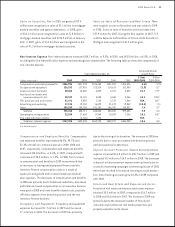

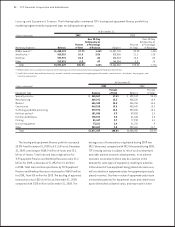

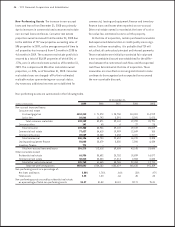

The determina-

tion of the allowance for loan and lease losses is a critical

accounting estimate. TCF’s methodologies for determining

and allocating the allowance for loan and lease losses focus

on ongoing reviews of larger individual loans and leases,

historical net charge-offs, delinquencies in the loan and

lease portfolio, the level of impaired and non-performing

assets, values of underlying loan and lease collateral, the

overall risk characteristics of the portfolios, changes in

character or size of the portfolios, geographic location,

year of origination, prevailing economic conditions and

other relevant factors. The various factors used in the

methodologies are reviewed on a periodic basis.

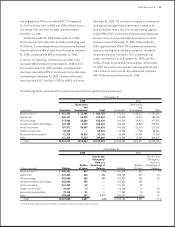

The Company considers the allowance for loan and lease

losses of $244.5 million appropriate to cover losses incurred

in the loan and lease portfolios as of December 31, 2009.

However, no assurance can be given that TCF will not, in any

particular period, sustain loan and lease losses that are

sizable in relation to the amount reserved, or that subse-

quent evaluations of the loan and lease portfolio, in light

of factors then prevailing, including economic conditions,

TCF’s ongoing credit review process or regulatory require-

ments, will not require signicant changes in the balance

of the allowance for loan and lease losses. Among other

factors, a continued economic slowdown, increasing levels

of unemployment and/or a decline in commercial or

residential real estate values in TCF’s markets may have an

adverse impact on the current adequacy of the allowance

for loan and lease losses by increasing credit risk and the

risk of potential loss.

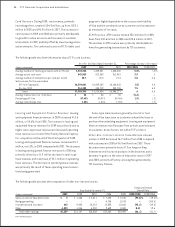

The total allowance for loan and lease losses is gener-

ally available to absorb losses from any segment of the

portfolio. The allocation of TCF’s allowance for loan and

lease losses disclosed in the following table is subject to

change based on the changes in criteria used to evaluate

the allowance and is not necessarily indicative of the trend

of future losses in any particular portfolio.

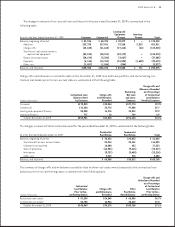

The next several pages include detailed information

regarding TCF’s allowance for loan and lease losses, net

charge-offs, non-performing assets, past due loans and