TCF Bank 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 : TCF Financial Corporation and Subsidiaries

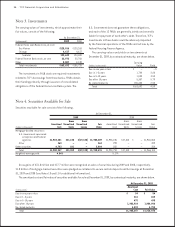

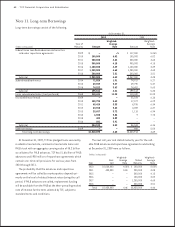

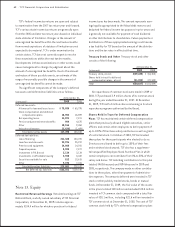

Note 11. Long-term Borrowings

Long-term borrowings consist of the following.

At December 31,

2008

Weighted-

Year of Average

(Dollars in thousands) Maturity Amount Rate

Federal Home Loan Bank advances and securities

sold under repurchase agreements 2009 $ 117,000 5.26%

2010 100,000 6.02

2011 300,000 4.64

2015 900,000 4.18

2016 1,100,000 4.49

2017 1,250,000 4.60

2018 300,000 3.51

Subtotal 4,067,000 4.45

Subordinated bank notes 2014 74,917 5.27

2015 49,790 5.37

2016 74,457 5.63

Subtotal 199,164 5.43

Junior subordinated notes (trust preferred) 2068 110,440 11.20

Discounted lease rentals 2009 25,104 6.38

2010 17,077 6.29

2011 8,976 6.34

2012 4,059 6.47

2013 1,118 6.94

2014 9 7.73

2015 – –

2016 – –

Subtotal 56,343 6.36

Other borrowings 2009 966 5.00

Total long-term borrowings $4,433,913 4.69

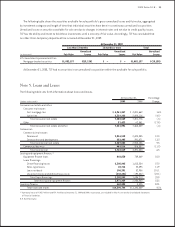

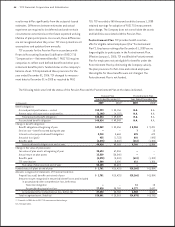

At December 31, 2009, TCF has pledged loans secured by

residential real estate, commercial real estate loans and

FHLB stock with an aggregate carrying value of $5.2 billion

as collateral for FHLB advances. TCF has $1.6 billion of FHLB

advances and $900 million of repurchase agreements which

contain one-time call provisions for various years from

2010 through 2011.

The probability that the advances and repurchase

agreements will be called by counterparties depends pri-

marily on the level of related interest rates during the call

period. If FHLB advances are called, replacement funding

will be available from the FHLB at the then-prevailing market

rate of interest for the term selected by TCF, subject to

standard terms and conditions.

The next call year and stated maturity year for the call-

able FHLB advances and repurchase agreements outstanding

at December 31, 2009 were as follows.

(Dollars in thousands)

Weighted- Weighted-

Next Average Stated Average

Year Call Rate Maturity Rate

2010 $2,050,000 4.58% $ 100,000 6.02%

2011 400,000 3.84 200,000 4.85

2015 – – 500,000 4.15

2016 – – 100,000 4.82

2017 – – 1,250,000 4.60

2018 – – 300,000 3.51

Total $2,450,000 4.46 $2,450,000 4.46