TCF Bank 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009 Form 10-K : 63

is reported separately in a manner similar to treasury stock

(that is, changes in fair value are not recognized) with a

corresponding deferred compensation obligation reected

in additional paid-in capital.

On April 22, 2009, TCF redeemed all of

the 361,172 outstanding shares of its Fixed-Rate Cumulative

Perpetual Preferred Stock, Series A, $.01 Par Value. Upon

redemption, the difference of $12 million between the

preferred stock redemption amount and the recorded

amount was charged to retained earnings as a non-cash

deemed preferred stock dividend. This non-cash deemed

preferred stock dividend had no impact on total equity, but

reduced earnings per diluted common share by 10 cents.

At December 31, 2009, TCF had 3,199,988

warrants outstanding with a strike price of $16.93 per

share. The warrants are publicly traded on the New York

Stock Exchange under the symbol “TCB WS”.

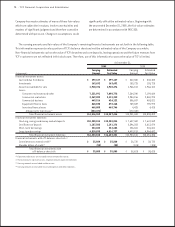

Note 14. Regulatory Capital Requirements

TCF is subject to various regulatory capital requirements

administered by the federal banking agencies. Failure to

meet minimum capital requirements can initiate certain

mandatory, and possible additional discretionary, actions

by the federal banking agencies that could have a material

adverse effect on TCF. In general, TCF Bank may not declare

or pay a dividend to TCF in excess of 100% of its net retained

prots for the current year combined with its retained net

prots for the preceding two calendar years, which was

$158.3 million at December 31, 2009, without prior approval

of the OCC. TCF Bank’s ability to make capital distributions

in the future may require regulatory approval and may be

restricted by its regulatory authorities. TCF Bank’s ability to

make any such distributions will also depend on its earnings

and ability to meet minimum regulatory capital requirements

in effect during future periods. These capital adequacy

standards may be higher in the future than existing minimum

regulatory capital requirements.

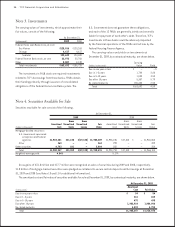

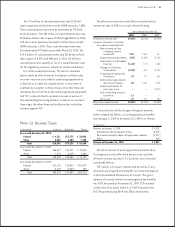

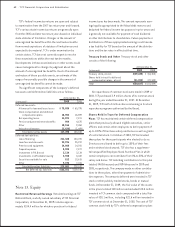

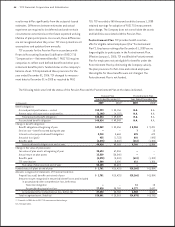

The following table sets forth TCF’s and TCF National Bank’s regulatory tier 1 leverage, tier 1 risk-based and total risk-

based capital levels, and applicable percentages of adjusted assets, together with the stated minimum and well-capitalized

capital ratio requirements.

Minimum Well-Capitalized

Actual Capital Requirement Capital Requirement

(Dollars in thousands) Amount Ratio Amount Ratio Amount Ratio

As of December 31, 2008:

Tier 1 leverage capital

TCF $ 1,461,973 8.97% $ 488,950 3.00% N.A. N.A.

TCF National Bank 1,364,053 8.41 486,552 3.00 $ 810,920 5.00%

Tier 1 risk-based capital

TCF 1,461,973 11.79 496,059 4.00 744,088 6.00

TCF National Bank 1,364,053 11.06 493,388 4.00 740,082 6.00

Total risk-based capital

TCF 1,817,225 14.65 992,117 8.00 1,240,147 10.00

TCF National Bank 1,718,476 13.93 986,776 8.00 1,233,470 10.00

N.A. Not Applicable.

The minimum and well capitalized requirements are determined by the FRB for TCF and by the OCC for TCF National Bank

pursuant to the FDIC Improvement Act of 1991. At December 31, 2009, TCF and TCF National Bank exceeded their regulatory

capital requirements and are considered “well-capitalized”.