TCF Bank 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

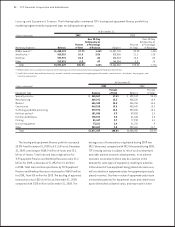

2009 Form 10-K : 37

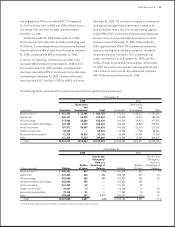

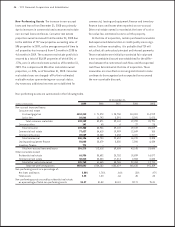

TCF may modify certain loans to

retain customers or to maximize collection of loan balances.

TCF has maintained several programs designed to assist

consumer real estate customers by extending payment

dates or reducing customer’s contractual payments. All loan

modications are made on a case by case basis. However,

under these programs, TCF typically reduces customer’s

contractual payments for a period of 12 to 18 months. Loan

modication programs for consumer real estate borrowers

implemented in the third quarter of 2009 have resulted in

a signicant increase in restructured loans. Primarily these

loans are classied as troubled debt restructurings, referred

to as restructured loans and generally accrue interest

although at lower rates than the original loan.

A large number of modied loans were delinquent at the

time of modication and in most cases these loans were no

longer carried as delinquent following the modication. The

status of these loans at December 31, 2009 is based on the

modied loan terms.

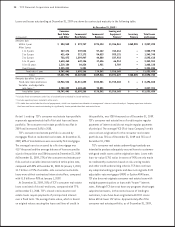

At December 31, 2009, $252.5 million of loans were accruing

and were considered restructured loans, as the borrower

was experiencing nancial difculties and concessions were

granted that would not otherwise have been considered.

Reserves for losses on accruing consumer real estate

restructured loans were $27 million, or 10.7 percent of

the outstanding balance at December 31, 2009. The over

60-day delinquency rate on these restructured loans was

2.48 percent at December 31, 2009.

In addition to

non-performing assets, there were $370.3 million of loans

and leases at December 31, 2009, for which management

has concerns regarding the ability of the borrowers to meet

existing repayment terms, compared with $185.5 million

at December 31, 2008. The increase in potential problem

loans and leases is primarily due to an increase in com-

mercial loans that were downgraded due to the borrower’s

exposure to declining home values. Potential problem

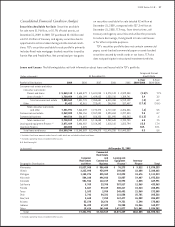

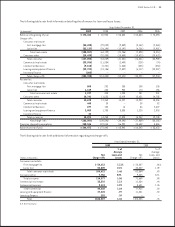

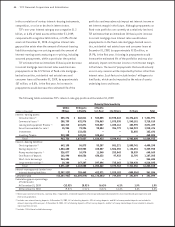

The following table summarizes TCF’s over 60-day delinquent loan and lease portfolio by loan type, excluding non-accrual

loans and leases.

At December 31,

2008

Principal Percentage

(Dollars in thousands) Balances of Portfolio

Consumer real estate

First mortgage lien $53,482 1.11%

Junior lien 13,940 .58

Total consumer real estate 67,422 .93

Consumer other 313 .51

Total consumer 67,735 .93

Commercial real estate 225 .01

Commercial business 605 .12

Total commercial 830 .02

Leasing and equipment nance 10,905 .44

Inventory nance – –

Subtotal (1) 79,470 .60

Delinquencies in acquired portfolios (2) – –

Total $79,470 .60%

(1) Excludes delinquencies and non-accrual loans in acquired portfolios as delinquency and non-accrual migration in these portfolios is not expected to result in losses

exceeding the credit reserves netted against the loan balances.

(2) At December 31, 2009, includes $841.6 million of loans and leases.