Supercuts 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

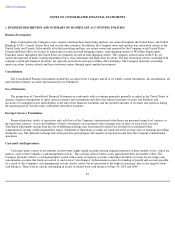

1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Receivables and Allowance for Doubtful Accounts:

The receivable balance on the Company's Consolidated Balance Sheet primarily includes accounts and notes receivable from franchisees.

The balance is presented net of an allowance for expected losses (i.e., doubtful accounts), primarily related to receivables from the Company's

franchisees. The Company monitors the financial condition of its franchisees and records provisions for estimated losses on receivables when it

believes that its franchisees are unable to make their required payments based on factors such as delinquencies and aging trends. The allowance

for doubtful accounts is the Company's best estimate of the amount of probable credit losses related to existing accounts and notes receivable.

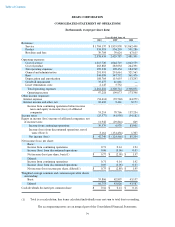

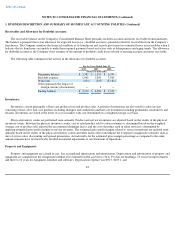

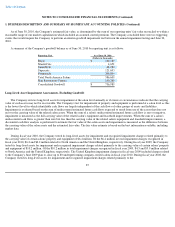

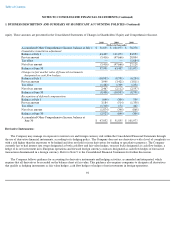

The following table summarizes the activity in the allowance for doubtful accounts:

Inventories:

Inventories consist principally of hair care products for retail product sales. A portion of inventories are also used for salon services

consisting of hair color, hair care products including shampoo and conditioner and hair care treatments including permanents, neutralizers and

relaxers. Inventories are stated at the lower of cost or market, with cost determined on a weighted average cost basis.

Physical inventory counts are performed semi-annually. Product and service inventories are adjusted based on the results of the physical

inventory counts. Between the physical inventory counts, cost of retail product sold to salon customers is determined based on the weighted

average cost of product sold, adjusted for an estimated shrinkage factor, and the cost of product used in salon services is determined by

applying estimated gross profit margins to service revenues. The estimated gross profit margins related to service inventories are updated semi-

annually based on the results of the physical inventory counts and other factors that could impact the Company's margin rate estimates such as

mix of service sales, discounting and special promotions. Actual results for the estimated gross margin percentage as compared to the semi-

annual estimates have not historically resulted in material adjustments to our Statement of Operations.

Property and Equipment:

Property and equipment are carried at cost, less accumulated depreciation and amortization. Depreciation and amortization of property and

equipment are computed on the straight-line method over estimated useful asset lives (30 to 39 years for buildings, 10 years for improvements

and three to 10 years for equipment, furniture and software). Depreciation expense was $92.5, $105.1, and

83

For the Years Ended June 30,

2010 2009 2008

(Dollars in thousands)

Beginning balance

$

2,382

$

1,515

$

6,399

Bad debt expense

1,040

1,089

3,900

Write

-

offs

(252

)

(225

)

(8,784

)

Other (primarily the impact of

foreign currency fluctuations)

—

3

—

Ending balance

$

3,170

$

2,382

$

1,515