Supercuts 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

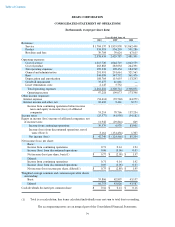

Under the terms of the revolving credit facility amended in July 2009, our ratio of earnings before interest, taxes, depreciation,

amortization and rent expense (EBITDAR) to fixed charges (which includes rent and interest expenses) may not drop below 1.3 on a rolling

four quarter basis. We were in compliance with all covenants and other requirements of our credit agreements and senior notes during fiscal

year 2010 and are currently in fiscal 2011. Additionally, the credit agreements do not include rating triggers or subjective clauses that would

accelerate maturity dates.

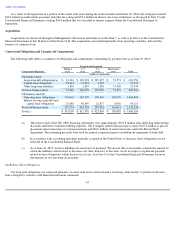

As a part of our salon development program, we continue to negotiate and enter into leases and commitments for the acquisition of

equipment and leasehold improvements related to future salon locations, and continue to enter into transactions to acquire established hair care

salons and businesses.

We do not have any relationships with unconsolidated entities or financial partnerships, such as entities often referred to as structured

finance or special purpose entities, which would have been established for the purpose of facilitating off-balance sheet financial arrangements

or other contractually narrow or limited purposes at June 30, 2010. As such, we are not materially exposed to any financing, liquidity, market

or credit risk that could arise if we had engaged in such relationships.

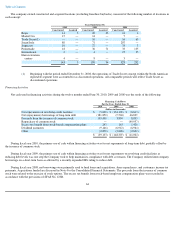

Financing

Financing activities are discussed under "Liquidity and Capital Resources" in this Item 7 and in Note 8 to the Consolidated Financial

Statements in Part II, Item 8. Derivative activities are discussed in Note 9 to the Consolidated Financial Statements in Part II, Item 8 and

Part II, Item 7A, "Quantitative and Qualitative Disclosures about Market Risk."

Management believes that cash generated from operations and amounts available under existing debt facilities will be sufficient to fund its

anticipated capital expenditures, acquisitions and required debt repayments for the foreseeable future. As of June 30, 2010, we have available

an unused committed line of credit amount of $275.4 million under our existing revolving credit facility.

Dividends

We paid dividends of $0.16 per share during fiscal years 2010, 2009 and 2008. On August 25, 2010, the Board of Directors of the

Company declared a $0.04 per share quarterly dividend payable September 22, 2010 to shareholders of record on September 8, 2010.

Share Repurchase Program

In May 2000, the Company's Board of Directors (BOD) approved a stock repurchase program. Originally, the program authorized up to

$50.0 million to be expended for the repurchase of the Company's stock. The BOD elected to increase this maximum to $100.0 million in

August 2003, to $200.0 million on May 3, 2005, and to $300.0 million on April 26, 2007. The timing and amounts of any repurchases will

depend on many factors, including the market price of the common stock and overall market conditions. Historically, the repurchases to date

have been made primarily to eliminate the dilutive effect of shares issued in conjunction with acquisitions, restricted stock grants and stock

option exercises. All repurchased shares become authorized but unissued shares of the Company. This repurchase program has no stated

expiration date. The Company did not repurchase any shares during fiscal year 2010. As of June 30, 2010, 2009, and 2008, a total accumulated

6.8 million shares have been repurchased for $226.5 million. As of June 30, 2010, $73.5 million remains to be spent on share repurchases under

this program.

SAFE HARBOR PROVISIONS UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This annual report, as well as information included in, or incorporated by reference from, future filings by the Company with the

Securities and Exchange Commission and information contained in

69